Asian Markets Mixed; Mnuchin Praises China for Supporting Yuan

Investing.com - Asian markets were mixed in morning trade on Wednesday as U.S. Treasury Secretary Steven Mnuchin praised China for supporting the yuan just a week after President Donald Trump accused China of manipulating its currency.

"Their currency is more of a controlled currency than other markets that are free access," Mnuchin said in an interview with CNBC on Tuesday. "But if they go in and support their currency, that is not currency manipulation."

"If they [China] let their currency weaken, either for structural reasons or for actual manipulation, that is something that is manipulation," he added.

His comments came a week after Trump said China is manipulating yuan to make up for having to pay tariffs on imports imposed by the U.S.

The Shanghai Composite and the SZSE Component opened 0.4% and 0.6% lower by 9:40PM ET (01:40 GMT). Hong Kong’s Hang Seng Index was unchanged at 28352.5.

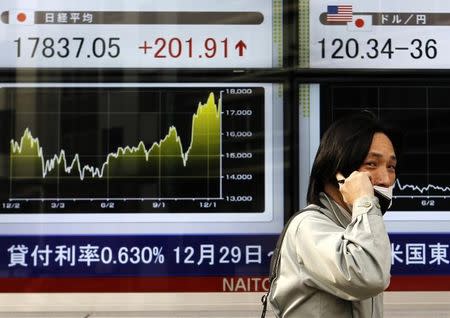

Meanwhile, Japan’s Nikkei 225 gained 0.5%. Data from Japan Exchange Group revealed that foreigners have sold a net 3.9 trillion yen ($34.7 billion) in Japanese stocks so far this year, on course to be the largest annual selloff since 1987. The benchmark Topix index is down 5% this year and is one of the worst performances among developed markets, Bloomberg reported.

“The markets are reflecting very low interest rates supporting asset prices and undoubtedly in some parts very good profits,” William Low, head of global equities at Nikko Asset Management Europe, said in an interview with Bloomberg. Investors “are beginning to question where sustainable growth is going to be coming from rather than having excessive expectations on cyclical growth,” he added.

Down under, Australia’s S&P/ASX 200 edged 0.1% higher, while South Korea’s KOSPI was also up 0.1%.

Related Articles

Asian shares, dollar becalmed awaiting trade news

Exclusive: Mexico-U.S. deal includes Mexican auto export cap - sources

Argentina re-ignites labor deal to spur investment in Vaca Muerta

Yahoo Finance

Yahoo Finance