Arrow (ARW) Adds CommVault's Metallic DMaaS to ArrowSphere

Arrow Electronics ARW recently announced that it has added CommVault Systems’ CVLT Metallic Data Management-as-a-Service (“DMaaS”) Backup and Recovery solutions to its cloud management portfolio — ArrowSphere.

CommVault’s Metallic is comprehensive data protection coverage across on-premise, cloud and Software-as-a-Service (“SaaS”) workloads. It provides enterprise-grade, industry-leading solutions with real time insights into at-risk datasets, abnormal behaviors, and suspicious events. Additionally, it offers flexible recovery with granular search, point-in-time, and out-of-place restore options.

With the addition of Metallic, which highlights further extension of the long-standing relationship between Arrow and CommVault, ArrowSphere will be able to accelerate cloud migration among its customers.

Arrow’s ArrowSphere helps channel partners manage, differentiate and scale their cloud businesses. The channel partners can access streamlined quoting and ordering, automated provisioning, and comprehensive billing integration.

ArrowSphere’s marketplace comprises leading hyperscale providers, public and private Infrastructure-as-a-Service, Platform-as-a-Service, Hardware-as-a-Service, SaaS, and cloud software services. With the latest move, Tinton Falls-based CommVault’s Metallic also joins this growing list of ArrowSphere products.

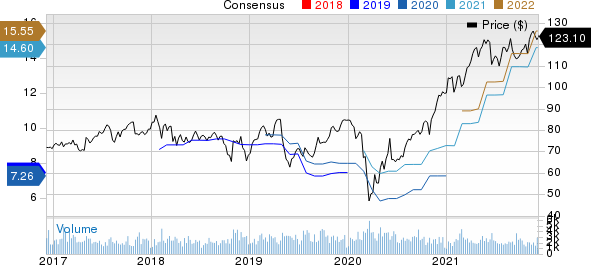

Arrow Electronics, Inc. Price and Consensus

Arrow Electronics, Inc. price-consensus-chart | Arrow Electronics, Inc. Quote

Zacks Rank & Stocks to Consider

Arrow currently sports a Zacks Rank #1 (Strong Buy), while CommVault carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader technology sector are Advanced Micro Devices AMD and Qualcomm QCOM, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Advanced Micro Devices’ fourth-quarter 2021 earnings has been revised upward by 7 cents to 75 cents per share over the past 60 days. For 2021, earnings estimates have moved north by 1 cent to $2.64 per share in the last 60 days.

Advanced Micro Devices’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 14%. Shares of AMD have rallied 51.6% in the YTD period.

The consensus mark for Qualcomm’s first-quarter fiscal 2022 earnings has been raised to $3.01 per share from $2.78 in the past 30 days. For fiscal 2022, earnings estimates have been revised upward by 8.6% to $10.49 per share in the past 30 days.

Qualcomm’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 11.2%. Shares of QCOM have gained 15.2% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Arrow Electronics, Inc. (ARW) : Free Stock Analysis Report

CommVault Systems, Inc. (CVLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance