Armstrong World (AWI) Q2 Earnings Miss, Sales Beat Estimate

Armstrong World Industries, Inc. AWI reported mixed results for second-quarter 2022. The bottom line missed the Zacks Consensus Estimate but increased year over year. Net sales topped the consensus mark and improved on a year-over-year basis.

Shares of the company inched up 0.98% on Jul 26.

Vic Grizzle, president and CEO of Armstrong, said, “While market-driven challenges remain, namely higher inflation and the lengthening of the commercial project completion cycle, we are optimistic about the second half of 2022. Our teams are squarely focused on executing our growth initiatives and delivering double-digit top- and bottom-line growth for the full year.”

Earnings & Revenue Discussion

Armstrong World reported adjusted earnings of $1.29 per share, missing the Zacks Consensus Estimate of $1.38 by 6.5%. The bottom line rose 11.2% from $1.16 per share reported in the year-ago quarter, backed by solid pricing to surpass higher-than-expected inflation and strong growth in the Architectural Specialties segment.

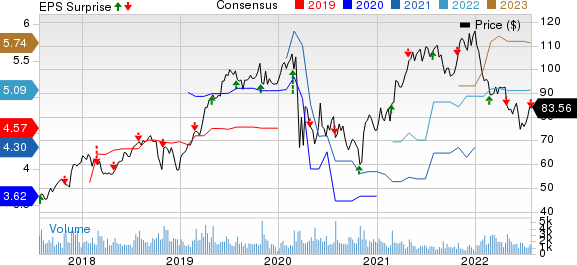

Armstrong World Industries, Inc. Price, Consensus and EPS Surprise

Armstrong World Industries, Inc. price-consensus-eps-surprise-chart | Armstrong World Industries, Inc. Quote

Net sales of $321 million topped the consensus mark of $288 million by 2.6% and increased 14.6% year over year. A strong contribution of $24 million within Mineral Fiber Average Unit Value (“AUV”) and increased net sales of $15 million in Architectural Specialties drove the top line.

Segmental Performance

Mineral Fiber segment’s sales increased 12.7% on a year-over-year basis to $234.5 million. It is mainly attributable to a favorable AUV of $24 million and sales volumes of $2 million.

Operating income fell 1% from the prior-year quarter’s levels to $71.4 million. Adjusted EBITDA also declined 1.5% from the prior-year quarter’s levels to $89 million, thanks to increased manufacturing costs (primarily raw material and energy costs), lower sales volumes, higher selling expenses and lower equity earnings.

Net sales in the Architectural Specialties segment rose 20.3% year over year to $86.5 million, owing to increased custom project sales, benefits from recent acquisitions and positive impacts from price increases.

The segment reported an operating income of $1.1 million, significantly down from $7.4 million in the prior year. Adjusted EBITDA came in at $13 million, up 34.8% from the prior-year quarter’s levels.

Operational Update

During the quarter, the company’s adjusted operating income of $81 million rose 9.5% from the prior-year quarter’s levels. The upside was primarily driven by favorable AUV performance, a reduction in intangible asset amortization and positive impacts from the increase in sales volumes. This was partially offset by an increase in manufacturing costs, primarily due to higher raw material and energy costs, an increase in selling expenses, a decrease in equity earnings from WAVE and an increase in incentive compensation expenses.

Adjusted EBITDA also rose 2% from the prior-year quarter’s figure to $102 million.

Financials

As of Jun 30, 2022, Armstrong World had cash and cash equivalents of $79.3 million compared with $98.1 million at the 2021-end. Net cash provided by operations was $63.1 million during the first six months of 2022 compared with $81.9 million in the prior-year period.

In the second quarter, the company’s free cash flow (adjusted basis) came in at $45 million, down from $64 million in the year-ago period.

2022 Guidance Updated

AWI anticipates net sales of $1,225-$1,245 million compared with $1,215-$1,255 million expected earlier. This reflects an 11-13% increase from a year ago. The company lowered its adjusted EBITDA projection to $410-$420 million, suggesting a rise of 10-13% year over year.

AWI expects adjusted earnings per share in the range of $4.36-$5.10 versus $5-$5.20 projected earlier, indicating 17-19% growth from 2021. Adjusted free cash flow is anticipated in the range of $215-$235 million (suggesting a 13-24% increase from the prior year’s levels).

Owing to the inflationary pressure, AWI slightly reduced the 2022 guidance. Yet, it expects margin performance to improve in the second half of the year, backed by the Mineral Fiber price increase, effective July 1.

Zacks Rank & Some Recent Construction Releases

Armstrong World currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

D.R. Horton, Inc.’s DHI third-quarter fiscal 2022 earnings beat the Zacks Consensus Estimate, but revenues missed the same.

DHI also lowered its revenue guidance for the full year, given the expected completion dates of homes under construction and current market conditions.

UFP Industries, Inc. UFPI reported stellar second-quarter 2022 results.

Both UFPI’s earnings and net sales beat the Zacks Consensus Estimate and increased on a year-over-year basis.

Acuity Brands, Inc. AYI reported solid third-quarter fiscal 2022 results. The top and the bottom line surpassed the Zacks Consensus Estimate and improved from the prior-year quarter’s levels.

The upside in AYI’s quarterly result was backed by higher sales from both of its segments along with price increases and product and productivity improvement.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UFP Industries, Inc. (UFPI) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance