Arm reveals record $2.8bn revenues after snubbing London float

British chip designer Arm has revealed record annual revenues of $2.8bn (£2.2bn) as the Cambridge company gears up for a US public listing after snubbing the London Stock Exchange.

The microchip designer, whose technology is used as the blueprint for semiconductors in billions of smartphones, said sales grew 5.7pc in the year to March as it confidentially filed to go public.

Under its Japanese owner SoftBank, which took the former FTSE 100 company private in 2016, Arm is hoping for a $60bn debut on the US Nasdaq stock exchange.

Arm’s revenues, which come from licensing its technology to chip makers, were boosted by demand for 5G network gear and sales of high-end smartphones.

Profits in dollar terms were largely flat, SoftBank said in its annual results.

The Japanese investor is eyeing a lucrative share sale for Arm in the second half of the year, which has been pushed back due to turbulent public markets.

Yoshimistu Gotu, SoftBank’s finance chief, said: “All in all, Arm has been performing a lot better than expected… I can say our preparation for the IPO is going smoothly.”

Meanwhile, SoftBank revealed it had fallen to a record $32bn loss at its technology investment division in the year to March, as valuations plunged in both public and private companies.

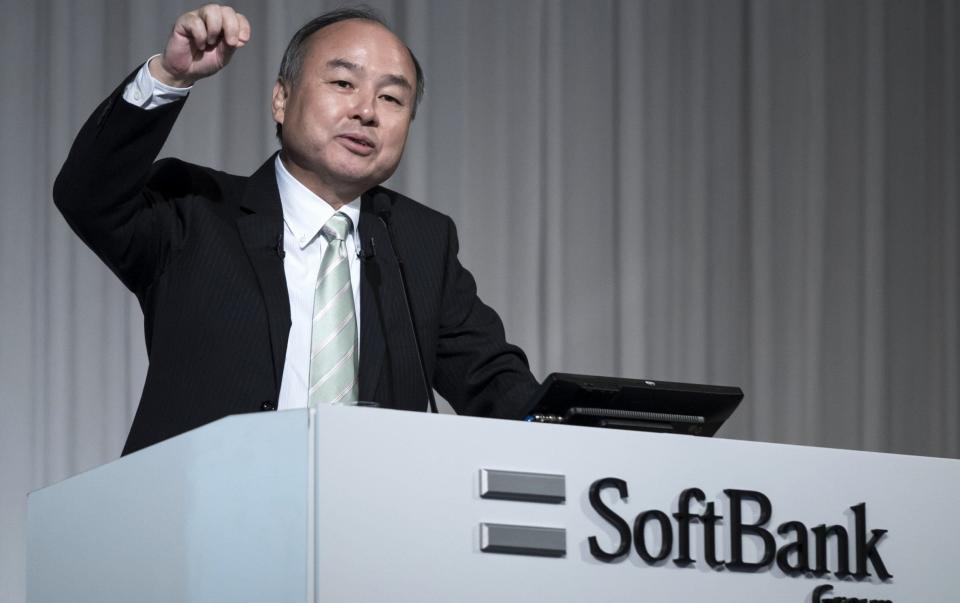

The technology giant, founded by enigmatic billionaire Masayoshi Son, plunged more than $100bn into venture investments across the world.

These bets have since unwound as stock prices collapsed.

In its annual results for the year ending in March, SoftBank said it had made gains on some investments, such its stake in Uber, which it has sold in its entirety.

This was offset by falling valuations at companies such as Doordash, however.

Overall, SoftBank reported an annual loss of $7.1bn as it made up some of its investment losses with a huge stock sale in Chinese e-commerce giant Alibaba, a company that Mr Son backed in 1999.

SoftBank snubbed London for an initial public offering of Arm despite months of courting by British government officials.

Executives at Arm met with Prime Minister Rishi Sunak as he tried to sway them to include the City in the company’s megadeal.

The Japanese company had always favoured a public offering in the US, where it is likely to achieve a higher valuation for its prized asset.

Meanwhile, Arm has considered altering the licensing conditions for its chip designs as a means of boosting revenues, charging handset makers fees based on the value of the device.

The Cambridge headquartered company is also locked in a bitter legal dispute with one of its biggest customers.

Arm has accused US company Qualcomm, which supplies some of the world’s biggest smartphone makers, of breaching its licensing conditions.

Qualcomm has denied the allegations.

SoftBank has picked bankers at institutions including Goldman Sachs, JP Morgan, Barclays and Mizuho to lead the initial public offering of Arm.

Yahoo Finance

Yahoo Finance