Arena Pharmaceuticals (ARNA) Q1 Loss Narrower Than Expected

Arena Pharmaceuticals, Inc. ARNA incurred loss of $2.00 per share in the first quarter of 2020, narrower than the Zacks Consensus Estimate of a loss of $2.26. The company had recorded earnings of $12.11 in the year-ago quarter.

Arena’s total revenues of $0.3 million, solely from royalty revenues, in the reported quarter missed the Zacks Consensus Estimate of $0.7 million. The company had recorded revenues of $801.1 million in the first quarter of 2019 due to recognition of $800.0 million upfront payment fromUnited Therapeutics UTHR related to out-licensing of its pipeline candidate, ralinepag.

Shares of Arena have increased 9.8% so far this year compared with the industry’s 3.8% rise.

Research & development (R&D) expenses escalated 73% from the prior-year level to $78.5 million, primarily driven by progress of its pipeline candidates to the next phase of clinical development, including phase III development program of etrasimod.

General and administrative expenses surged 59.5% from the year-ago figure to $26.4 million, mainly driven by higher personnel expenses.

Pipeline Update

Arena’s pipeline currently consists of two key candidates, namely etrasimod (autoimmune diseases) and olorinab (pain and fibrotic diseases). It also has one early-stage candidate, ADP418.

The company stated that while it faced slowdown in clinical study operations due to COVID-19, the ongoing clinical programs remain on track.

Etrasimod is presently in late-stage development for ulcerative colitis. Arena is evaluating the candidate in the pivotal phase III ELEVATE UC 52 study as a treatment for moderately-to-severely active ulcerative colitis ("UC").

The study is part of the ELEVATE UC registrational program, which comprises two pivotal studies to evaluate etrasimod in UC patients. The company has plans to initiate ELEVATE UC 12, a 12-week induction study, in the second half of 2020.

Notably, etrasimod has the potential to be developed for additional indications beyond ulcerative colitis. The company is evaluating the candidate in the phase IIb ADVISE study for treating atopic dermatitis. In December 2019, the company initiated phase IIb/III CULTIVATE study to evaluate etrasimod in patients with Crohn's disease.

A phase II CAPTIVATE study is evaluating another candidate, olonarib, as a treatment for abdominal pain associated with irritable bowel syndrome.

The company initiated a phase I study on its pipeline candidate, APD418, during the quarter following the acceptance of an investigational new drug application by the FDA in January. The study is evaluating the candidate for acute heart failure.

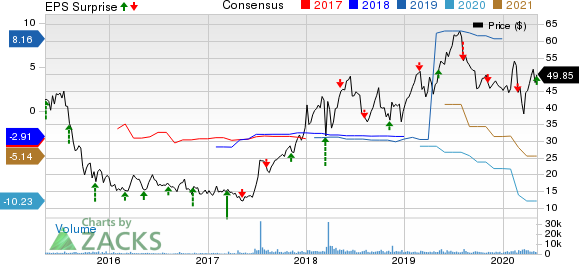

Arena Pharmaceuticals Inc Price, Consensus and EPS Surprise

Arena Pharmaceuticals Inc price-consensus-eps-surprise-chart | Arena Pharmaceuticals Inc Quote

Zacks Rank & Stocks to Consider

Arena currently has a Zacks Rank #3 (Hold).

A couple of better-ranked biotech stocks include Seattle Genetics Inc. SGEN and Immunomedics, Inc. IMMU, both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Seattle Genetics’ loss per share estimates have narrowed from $3.23 to $3.10 for 2020 and from $1.41 to 81 cents for 2021 in the past 30 days. The company’s average four-quarter positive earnings surprise is 16.15%. The company’s stock has surged 42.9% so far this year.

Immunomedics’ loss per share estimates have narrowed from $1.65 to $1.60 for 2020 and from $1.03 to 87 cents for 2021 in the past 30 days. The company’s stock has surged 52.6% so far this year.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Therapeutics Corporation (UTHR) : Free Stock Analysis Report

Immunomedics Inc (IMMU) : Free Stock Analysis Report

Arena Pharmaceuticals Inc (ARNA) : Free Stock Analysis Report

Seattle Genetics Inc (SGEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance