Here's Why You Should Invest in Veeva (VEEV) Stock Right Now

Veeva Systems Inc. VEEV is currently one of the top performing stocks in the MedTech space. A solid second quarter and focus on cloud-based services currently favor the stock.

Shares Up

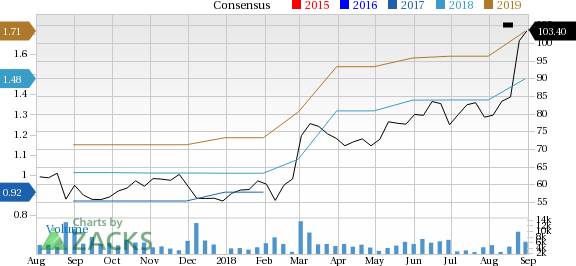

Over the past year, shares of Veeva have rallied 73.8% outperforming the industry’s rise of 41.9%.

This Zacks Rank #1 (Strong Buy) stock currently has a Growth Score of A. This reflects possibilities of outperformance over the long haul. Our research shows that stocks, with a Growth Score of A or B, when combined with a Zacks Rank #1 or 2 (Buy), are better picks than most.

Which Way Are Estimates Treading?

For the current quarter, the Zacks Consensus Estimate for earnings per share is pegged 38 cents, reflecting year-over-year growth of 52%. The same for revenues stands at $216.2 million, showing a growth of 59.1% year over year.

Veeva Systems Inc. Price and Consensus

Veeva Systems Inc. Price and Consensus | Veeva Systems Inc. Quote

Let’s delve deeper.

Factors That Make It an Attractive Pick

Fundamental Growth Story

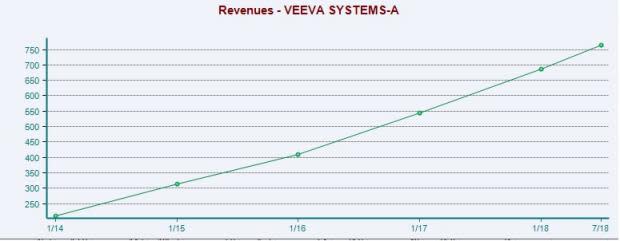

Since 2014, Veeva’s revenues have seen a CAGR of 34.4% to $686 million.

The company’s earnings have seen a CAGR of 42% to 61 cents over the same time frame.

Solid Q2 Show

In the recently reported fiscal second quarter of 2019, Veeva put up a solid show.

Total revenues came in at $209.6 million, outpacing estimates. Per management, theimprovement in revenues can be attributed to continued strong demand within Veeva Vault R&D (research and development).Core business units, subscription service revenues and professional service revenues also contributed significantly to the upside.

Management is optimistic about the segment’s performance in the fiscal third quarter of 2019 as well.

Veeva Nitro & Sunrise UI

The healthcare industry is gradually realizing the benefits of cloud-based applications.

Earlier this year, Veeva rolled out Nitro, a next-generation commercial data warehouse for the life sciences industry.Built on Amazon Redshift, the platform offers an industry-specific database that merges key data sources of companies in the HCIT (Healthcare IT) industry. (Read More: Veeva Rolls Out Nitro to Unify Healthcare Industry Data)

Per management, in the fiscal second quarter, Veeva had its first customer signed.

Additionally, in the quarter, Veeva made another significant advancement in the CRM (Customer Relationship Management) space. The company unveiled a major user interface, Sunrise UI.

Per management, Sunrise has an adaptive and multi-device design. It provides consistent experience across laptops, tablets and smartphones. Majority of Veeva’s CRM users on iPad are already using Sunrise and have provided positive feedback.

We expect such trends to continue favoring the company.

Other Key Picks

Some other top-ranked stocks in the broader medical space are Intuitive Surgical ISRG, Integer Holdings Corporation ITGR and Masimo Corporation MASI.

Intuitive Surgical’s expected long-term earnings growth rate is 14.7%. The stock carries a Zacks Rank #2.

Integer Holdings has an expected growth rate of 12.6% for the next year. The stock flaunts a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Masimo’s long-term earnings growth rate is projected at 14.8%. The stock carries a Zacks Rank #2.

5 Companies Verge on Apple-Like Run

Did you miss Apple's 9X stock explosion after they launched their iPhone in 2007? Now 2018 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs. A bonus Zacks Special Report names this breakthrough and the 5 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains.

Click to see them right now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance