Here's Why You Should Hold on to Praxair (PX) Stock for Now

Praxair, Inc. PX is poised to gain from strong backlog, new order wins, and recovery in the energy and industrial end markets. However, sluggish economic conditions in Brazil, currency headwinds and inflation remain headwinds.

This Zacks Rank #3 (Hold) company has an estimated long-term earnings growth rate of 11.5%.

Below, we briefly discuss the company’s potential growth drivers and possible headwinds.

Factors Favoring Praxair

Northbound Estimates

Investors should consider the positive trends on the estimate revision front. Analysts have been raising their estimates for Praxair lately, resulting in a favorable earnings picture.

Over the past 30 days, the Zacks Consensus Estimate for the current year moved up around 0.4%.

Positive Earnings Surprise History

Praxair outpaced the Zacks Consensus Estimate in each out of the trailing four quarters, with an average beat of 3.46%.

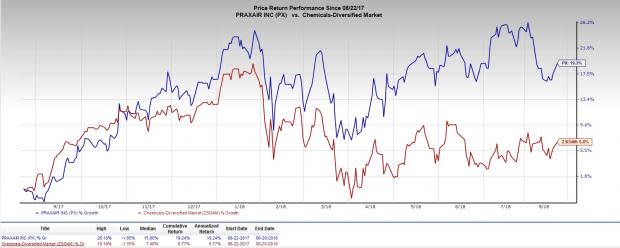

Price Performance

Over the past year, Praxair has outperformed the industry with respect to price performance. The stock has gained around 19%, while the industry recorded growth of around 7% during the same time frame.

Higher Inventory Turnover Ratio

Over the trailing 12 months, the inventory turnover ratio for Praxair has been 11.1% compared with the industry’s level of 4.1%. A higher inventory turnover than the industry average implies that inventory is sold at a faster rate, suggesting inventory management effectiveness.

Growth Drivers in Place

Praxair posted solid backlog growth in second-quarter 2018. The company won three new onsite projects and started work on China National Offshore Oil Corporation project during the reported quarter. It expects to win new on-site business opportunities, especially in the U.S. Gulf Coast. Additionally, Praxair has more than 30 small on-site project wins, totaling $80 million in investment, which will likely begin in 2019.

The company will also gain from growth in end markets, including chemicals, aerospace and manufacturing, on the back of large project start-ups and higher levels of demand. Thus, the prospects for industrial gases remain bright.

Headwinds for Praxair

Praxair’s performance in the South American segment continues to lag the rest of the world due to sluggish economic conditions in Brazil. The scenario in the nation is expected to remain challenging for the foreseeable future, mainly due to the strengthening of the U.S. economy, along with global trade concerns and political uncertainty, which will continue through second-half 2018. Further, the company expects to experience translational currency headwinds of 2-4% during the second half as the U.S. dollar continues to strengthen from higher interest rates and a stronger economy.

Bottom Line

Investors might want to hold on to the stock, at present, as it has ample prospects of outperforming peers in the near future.

Stocks to Consider

Some better-ranked stocks in the same sector are Celanese Corporation CE, Huntsman Corporation HUN and Air Products and Chemicals, Inc. APD. While Celanese and Huntsman sport a Zacks Rank #1 (Strong Buy), Air Products carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Celanese has a long-term earnings growth rate of 10%. The stock has rallied 19% in a year’s time.

Huntsman has a long-term earnings growth rate of 8.5%. Its shares have gained 22% in the past year.

Air Products has a long-term earnings growth rate of 16.2%. The company’s shares have been up 14% over the past year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Praxair, Inc. (PX) : Free Stock Analysis Report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

Huntsman Corporation (HUN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance