If You're Retired, Consider Buying These 2 High-Yield Stocks

Income generation becomes even more important in your portfolio once you're retired. The big goal, of course, is to supplement your Social Security while outdistancing the ravages of inflation. Finding investments that achieve this can be hard, but don't give up hope. Magellan Midstream Partners, L.P. (NYSE: MMP) and ONEOK, Inc. (NYSE: OKE) are two high-yield stocks you should consider buying today. Here's why.

Conservative growth

Magellan Midstream Partners is a large midstream oil partnership that owns pipeline and storage assets. Roughly 85% of its revenue is driven by fees, which means it's getting paid for the use of its assets. The price of the oil and other commodities that Magellan handles aren't the driving force -- demand is. So the partnership's business tends to be pretty stable.

Image source: Getty Images.

For example, while oil majors were struggling to maintain their dividends or were forced to cut them during the oil downturn that started in mid-2014, Magellan increased its distribution each quarter through the worst of the downturn. It has now upped the disbursement for 62 consecutive quarters at an annualized rate of 12%, four times the historical rate of inflation growth.

Magellan is targeting 8% distribution growth over the next few years, still nearly three times inflation growth. To reach that figure it has plans to spend $800 million on growth projects in 2018 and another $350 million in 2019. It's examining an additional $500 million worth of capital projects that it could add to the mix, as well. This spending includes projects like a pipeline expansion in Texas, building a new marine terminal in Pasadena, and augmenting an existing terminal at its Galena Park facility.

Many of these projects are being built with customers already signed up, ensuring they will add to the top and bottom lines. When a customer isn't waiting in the wings, the spending only takes place if Magellan believes demand warrants the investment (increasing the size of an existing pipeline, for example) or if the spending will add value to its business (like increasing the number of tankers a port facility can service simultaneously). Magellan has invested $5 billion in growth projects and, to a smaller extent, acquisitions over the past decade, with an impressive track record of success.

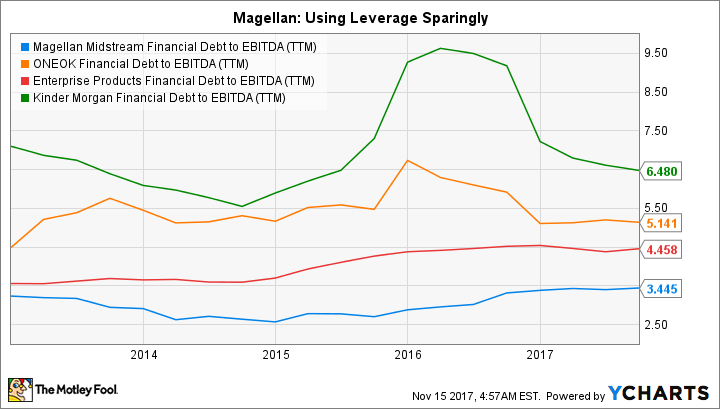

MMP Financial Debt to EBITDA (TTM). Data by YCharts.

Perhaps that best part here is that Magellan is among the most conservatively run pipeline companies. Debt to EBITDA, for example, is roughly 3.5 times. That's toward the low end of the industry. So Magellan provides a healthy 5.5% yield, a strong history of rewarding investors with distribution growth, a pipeline of expansion projects, and relatively low risk. There's a lot to like about this story.

Another way to play

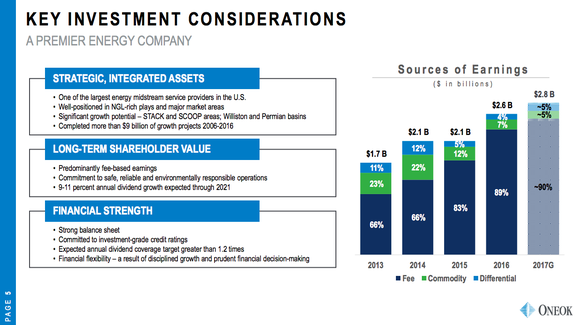

The only problem with Magellan is that its partnership structure doesn't play well with tax-advantaged retirement accounts like IRAs. That is why you might want to look at ONEOK, which yields around 5.8%. This midstream player gets roughly 90% of its revenue from the fees it charges for the use of its pipelines, storage, and processing assets.

The big news recently was ONEOK's decision to acquire its associated limited partnership. That move should help to reduce the company's cost of capital in the future, making it easier to expand the business. It'll probably be a year or so before the dust settles from this deal, but it should be a long-term positive.

The one problem here is the company's leverage. Debt to EBITDA is a little over five times. That's not horrible, but it is higher than management would like. So it's going to work toward trimming that into the four times range, which is down near Magellan. But it isn't planning on sacrificing dividend growth to get there.

A quick overview of ONEOK. Image source: ONEOK, Inc.

ONEOK's dividend has climbed every year for 15 years and counting. The goal over the next few years is to increase the dividend around 10% a year. That said, there are going to be a lot of moving parts, so you'll want to keep a close eye on how well management achieves its targets.

For example, ONEOK has four growth projects expected to come on line over the next year or so in and around Oklahoma's Stack region, worth about $350 million combined. And it has more projects in the works, too. While it's paying for and managing those investments, it's also going to be trimming leverage -- likely with a mix of debt reduction and EBITDA growth. Management will need to be picky about the projects it takes on and how it finances them if it hopes to also up the dividend by double-digit rates. That's a tall order. But so far, it looks like it's off to a good start. ONEOK is probably a little riskier than Magellan. However, it appears to be heading in a good direction.

Two great midstream plays

If you're looking for a decent yield and distribution growth to help power you through retirement, then Magellan and ONEOK are two midstream players you should consider buying. One is a good fit for a tax-advantaged retirement account while the other would play nicely in a regular taxable brokerage account. But either will give you a 5% yield backed by a long history of rewarding investors. It's time for a deep dive if you are retired and looking to supplement your Social Security checks.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends ONEOK. The Motley Fool recommends Magellan Midstream Partners. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance