Here's how these retailers could turn things around this week

Retailers shuttering stores, slowing foot traffic in brick-and-mortar locations, and e-commerce players like Amazon and Wayfair gaining market share ... Sound familiar? This has been the narrative for much of the industry, following a disappointing start to 2017.

Department store operators Macy's , Dillard's , Kohl's , Nordstrom and J.C. Penney each reported first-quarter results last week that sparked a selloff in the sector. The S&P 500 Retail ETF (XRT) ended the week in red territory, marking its worst 5-day performance since March.

Now, Wall Street is preparing for an onslaught of more retailers' earnings to come — but it's a different mix of companies reporting, some of which could turn this discouraging narrative around.

"The problem plaguing [department stores], and much of the industry, has been the inability to grow the top line in the wake of declining foot traffic," Ken Perkins of Retail Metrics wrote in a report. But that foot traffic hasn't left the retail industry entirely just yet — it's merely shifting to other types of stores.

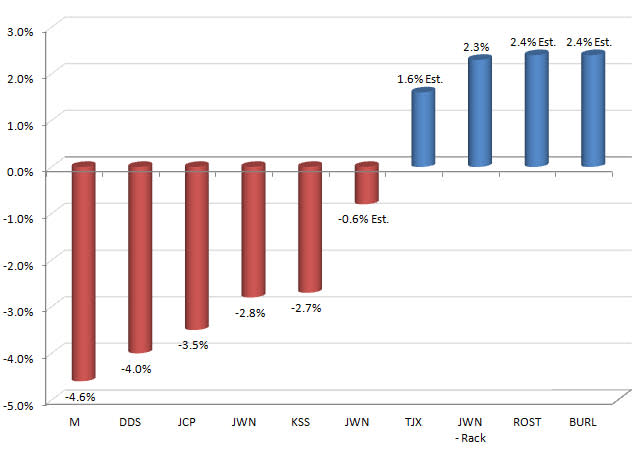

"Department stores continue to lose market share to online competition and off-price retailers, which sell designer clothing for less," Thomson Reuters' Jharonne Martis wrote in an update to investors last week.

Off-price champion TJX Companies — the parent of TJ Maxx, Marshalls and HomeGoods' discount stores — is scheduled to report earnings after the bell on Tuesday.

Department stores vs off-price retailers same-store sales (estimates/actuals for Q1 2017)

Source: Thomson Reuters

"Meanwhile, off-price retailers are expected to post healthy earnings growth rates" for the first quarter, Martis continued. Further, "Home Depot is on top with a 4.0% [same-store sales], and strongest earnings growth rate estimate of 11.8%."

Home Depot will kick off the week, reporting its first-quarter earnings before the bell on Tuesday. The home improvement retailer historically benefits from shoppers investing in their homes, as the overall economy improves and residential real estate values climb.

Just earlier this year, Home Depot reported fourth-quarter sales and earnings that topped the Street's expectations, implying the housing recovery still has legs.

Then, big-box retailers Target and Wal-Mart will report earnings before the bell on Wednesday and Thursday, respectively.

Much of the latest talk around these companies has been optimistic, as they test new initiatives like free shipping for online orders, beef up their grocery departments, and acquire smaller players in the space (for example, Wal-Mart bought Jet.com).

"We have started seeing improvement in store standards, including in-stocks, general tidiness and the front end register experience as well as price investment," Jefferies analyst Daniel Binder wrote of Target in a note to investors last week.

Binder said Target has set its expectations — especially for same-store sales — to a "conservative level," so shares of the stock could see a bump this week if the company is able to top that and report healthier foot traffic than was anticipated.

The same can be said for its competitor, Wal-Mart.

"Based on our national field checks we believe sales momentum continued in Q1 driven by better store execution, price investments and continued improvement in the ecommerce," Binder wrote about the "Everyday Low Price" retailer.

Wal-Mart has put more resources toward its food/consumables and apparel divisions lately, while the company also hopes to maintain wide margins between its competitively low prices and those of its peers, Binder said.

Those big names aside, Dick's Sporting Goods , Victoria's Secret parent L Brands , Foot Locker , Urban Outfitters , Ross Sores and more, are preparing to update analysts and investors with their latest financials this week — offering better insight into where consumers have been spending their money to start the year.

The Commerce Department announced last week that Americans actually stepped up their spending in April, as retail sales rebounded from two sluggish months.

The increase suggests consumers could spur faster growth throughout the April to June period, and adds to the argument that the struggles of large department chains merely reflect changes in consumer buying patterns rather than broader economic weakness.

Same-store sales estimates for retailers reporting this week

Source: Thomson Reuters

Home Depot, Target, Wal-Mart and TJX were all trading in green Monday morning. Target is the only company out of these four that hasn't performed positively for the year-to-date period, with its shares down around 22 percent.

Yahoo Finance

Yahoo Finance