What's in the Offing for Citizens (CFG) in Q2 Earnings?

Citizens Financial Group CFG is scheduled to report second-quarter 2018 results on Jul 20, before the market opens. The company is expected to witness year-over-year growth in revenues and earnings.

In the last reported quarter, the Providence, RI-based bank displayed organic growth. Continued rise in revenues, loan growth and lower provisions were the key highlights. Also, the company recorded rise in deposits and improved credit quality. However, the results were partially offset by elevated expenses.

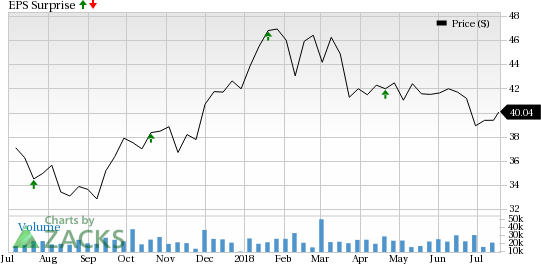

Notably, Citizens Financial boasts an impressive surprise history. It surpassed earnings estimates in each of the trailing four quarters with an average beat of 5.4%.

Citizens Financial Group, Inc. Price and EPS Surprise

Citizens Financial Group, Inc. Price and EPS Surprise | Citizens Financial Group, Inc. Quote

However, the company’s price performance has not been very impressive. Its shares have lost 3.9% in the past three months against slight growth recorded by the industry.

Will the price performance improve post second-quarter earnings release? Let’s check which factors are expected to impact Citizens Financial’s second-quarter earnings.

Factors That Might Drive Q2 Results

Net Interest Income (NII) to Exhibit Growth: The second quarter was decent in terms of commercial and industrial, and consumer loan growth, which is expected to lend support to NII.

Driven by loan growth, earning assets are likely to rise too. The Zacks Consensus Estimate for average interest earning assets of $140.6 billion for the second quarter indicates a 2.2% rise year over year.

Further, despite flattening of the yield curve during the quarter, margins are likely to have expanded due to the rising interest rates, further boosting NII. The consensus estimate of $1.12 billion for NII reflects 8.9% year-over-year growth.

Fee Income Might Increase: The trend of earning solid advisory and underwriting fees for debt and equity issuance is unlikely to have remained in the second quarter as rising rates will have limited corporates’ involvement in these activities. The consensus estimate for Citizens Financial’s capital market fees of $40 million indicates a 16.7% decline.

Also, with the rising interest rates, mortgage refinancing activities and fresh originations have been slowing down. Therefore, no major help is expected from this segment. The Zacks Consensus Estimate for Citizens Financial’s mortgage banking revenues is $28.6 million, down 4.6% year over year.

The trend of consumer spending was strong during the quarter, which is likely to provide some support to its top line. The consensus estimate for card fees of $61 million indicates a 3.4% increase.

Further, the Zacks Consensus Estimate for foreign exchange and interest rate products fees is $28.7 million, reflecting year-over-year growth of 10.3%. Also, trust and investment services fees is expected to rise 6% year over year to $41.3 million.

With improvement in most of the components of fee income, total non-interest income is expected to rise. The Zacks Consensus Estimate for non-interest income is $389 million, indicating 5.1% rise on a year-over-year basis.

Controlled Expenses: Citizens Financial’s expenses are expected to continue declining due to its TOP IV efficiency initiative. Also, its self-funding revenue initiatives might help in lowering the efficiency ratio. Moreover, management expects non-interest expenses to remain stable sequentially.

Credit Quality Might Improve: Citizens Financial’s credit quality is expected to have improved during the quarter backed by an improving economy. Per the consensus estimate, non-performing loans and leases are likely to decline 14.5% year over year to $876 million.

Earnings Whispers

According to our quantitative model, we cannot conclusively predict an earnings beat for Citizens Financial in the upcoming results. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #3 (Hold) or better for this to happen, which is not the case here as elaborated below.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: Earnings ESP for Citizens Financial is 0.00%.

Zacks Rank: The stock currently carries a Zacks Rank #2 (Buy).

Notably, the Zacks Consensus Estimate for earnings for the to-be-reported quarter is 86 cents, which reflects year-over-year improvement of 36.5%. Further, the consensus estimate for sales of $1.51 billion indicates 8% growth from the prior-year quarter.

Stocks That Warrant a Look

Here are some stocks worth considering, as they have the right combination of elements to post an earnings beat this quarter.

The Blackstone Group L.P. BX is slated to release results on Jul 19. It has an Earnings ESP of +3.70% and carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

SunTrust Banks, Inc. STI is scheduled to release results on Jul 20. It has an Earnings ESP of +0.31% and carries a Zacks Rank of 2.

KeyCorp KEY has an Earnings ESP of +0.40% and carries a Zacks Rank of 3. The company is slated to release results on Jul 19.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SunTrust Banks, Inc. (STI) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

The Blackstone Group L.P. (BX) : Free Stock Analysis Report

Citizens Financial Group, Inc. (CFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance