Sears just surprised Wall Street with a narrower-than-expected loss; shares jump

Sears reported a narrower-than-expected first-quarter loss on Thursday, sending shares of the stock climbing in premarket trading.

But revenue and same-store sales continued to decline at a double-digit pace, as Sears and Kmart stores suffered weak foot traffic and tough price competition.

Sears also announced Thursday that it's boosting its cost-cutting efforts to $1.25 billion, from a prior target of $1 billion, and reviewing its fleet of stores while it tries to regain its financial footing.

Here's what the company reported vs. what the Street was expecting:

Earnings per share: an adjusted loss of $2.15 vs. an expected loss of $3.05, according to two Thomson Reuters analysts who continue to cover the company

Revenue: $4.3 billion vs. a Thomson Reuters forecast for $4.05 billion

Same-store sales: an 11.9 percent decline vs. a FactSet estimate for a decline of 12 percent

Shares of Sears' stock were climbing by as much as 25 percent, up nearly $2, at one point Thursday morning.

Sears posted its first quarterly profit in almost two years, with net income attributable to Sears' shareholders that was $244 million, or $2.28 per share, compared with a loss of $471 million, or $4.41 per share, a year earlier.

The company's profit was boosted by the sale of its Craftsman brand to Stanley Black & Decker , which happened in March, for an upfront payment of $525 million.

Adjusted for these types of significant items, Sears lost $230 million, or $2.15 per share, compared to a loss of $199 million, or $1.86 per share, one year ago. A survey of two analysts by Thomson Reuters had forecast an adjusted loss of $3.05 a share.

Meanwhile, Sears' total sales declined a whopping 20.3 percent, to $4.30 billion, coming in slightly higher than what analysts were anticipating.

Revenue was hurt by lower demand for groceries, household items, pharmacy and apparel at Kmart stores, and fewer sales of home appliances at Sears, the retailer said. Sears also saw weakness in its apparel and lawn and garden categories.

Sears' U.S. stores saw their same-store sales drop 12.4 percent, while at Kmart stores they fell 11.2 percent during the first quarter. Overall, Sears comparable sales fell 11.9 percent — a narrower decline that what Wall Street was expecting.

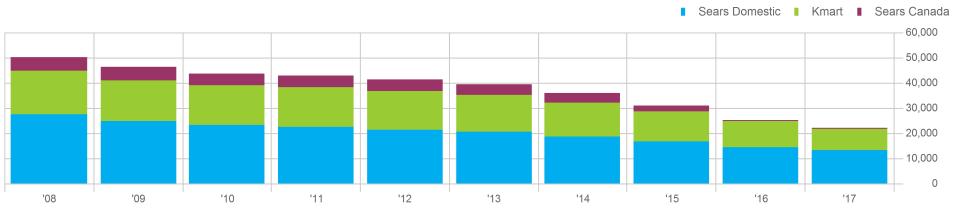

Sears Holdings annual sales for 2008-2017

Source: FactSet; 2008-2016 actual; 2017 estimate (in millions)

"While this was certainly a challenging quarter for our Company, it was also one that clearly demonstrated our commitment to return Sears Holdings to solid financial footing," CEO Eddie Lampert said in a statement. "We recognize that we need to accelerate our efforts to improve our operational performance and are moving decisively with our $1.25 billion restructuring program."

Sears said it has rung up $700 million in cost savings to-date.

This was accomplished by closing 150 non-profitable Sears stores, which the company announced earlier this year. Sears has also started closing 92 under-performing pharmacy operations in some Kmart stores, and 50 Sears Auto Center locations, the company said.

"We continue to evaluate ways to improve our financial position by unlocking value from our asset base, including our Kenmore and DieHard Brands, as well as our Home Services and Auto Centers businesses," Sears Chief Financial Officer Rob Riecker said in a statement.

"We will continue to closely evaluate the stores where a clear path to return to profitability is not in sight. We are determined to take necessary actions to improve the performance of Sears Holdings and will leverage our lease optionality to reconfigure our stores and reduce capital obligations."

Sears' financial position

Earlier this week, Sears inked a deal to extend a portion of a $500 million secured loan facility and annuitize $515 million of its pension obligations. The retailer said it's now targeting a reduction in its outstanding debt and pension obligations of $1.5 billion this fiscal year.

Sears ended the first quarter with $264 million in cash and cash equivalents, compared with $286 million in the fourth quarter.

Short-term borrowings totaled $551 million at the end of the first quarter of 2017, consisting of $536 million of revolver borrowings and $15 million of commercial paper outstanding, Sears said. The retailer had no short-term borrowings on hand last quarter.

As of April 29, Sears said it's used $1 billion of its $1.5 billion revolving credit facility due in 2020, with $70 million still available for use.

Total long-term debt — including current portion of long-term debt and capital lease obligations — totaled $3.7 billion in the latest period, down from $4.2 billion in the fourth quarter. Sears also reported total liquidity of $3.7 billion in the first quarter, something the company has been working to improve.

Meanwhile, Sears hasn't reported positive cash flow from operations since 2010.

Sears' deteriorating financial conditions forced it to disclose in a filing with the Securities and Exchange Commission in March that there was "substantial doubt" about its ability to "continue as a going concern."

The statement spooked investors and reignited fears that a bankruptcy was imminent. Sears countered by saying it remained focused on trying to improve its business, and stated the language was simply its effort to adhere to regulatory standards.

Sears has been shuttering stores, selling off assets like its Craftsman brand and borrowing money from CEO Eddie Lampert — what's seen as a last-ditch effort to survive. Cash injections from Lampert's hedge fund, ESL Investments, and his heavy ownership of Sears' unsecured debt helped convince some investors that the company would avoid filing Chapter 11 this year.

But the bankruptcy chatter continues, and Lampert, who's often more reserved, has been increasingly vocal and defensive of late.

"I feel like we're ahead of J.C. Penney , we're ahead of Macy's , we're ahead of Target , in some aspects of where the world is going," Lampert said in a recent interview with the Chicago Tribune.

Lampert has also called out Sears' vendors directly, saying the retailer "has nothing to be embarrassed about" with those partnerships. Despite Lampert's efforts, vendors have told Reuters they are doubling down on defensive measures — such as reducing shipments and asking for better payment terms — to protect against the risk of nonpayment as Sears warns about its finances.

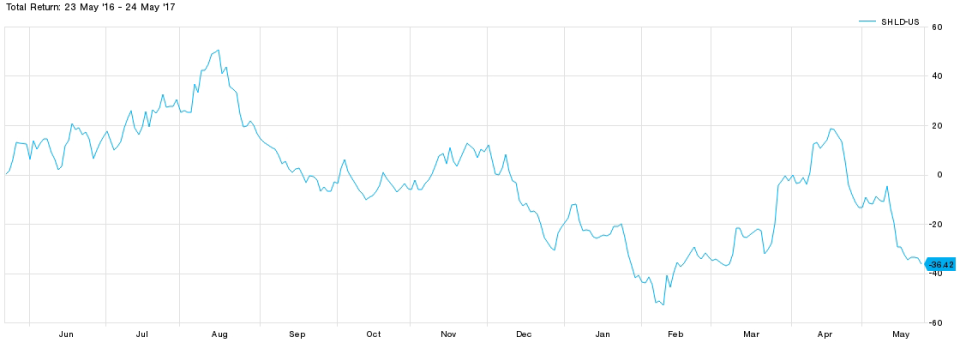

As of Wednesday's close, Sears stock has fallen more than 19 percent for the year-to-date period and is down about 40 percent over the past 12 months.

SHLD 12-month performance

Source: FactSet

Yahoo Finance

Yahoo Finance