Apellis (APLS) Hit By Wider-Than-Expected Q1 Loss, Revenues Top

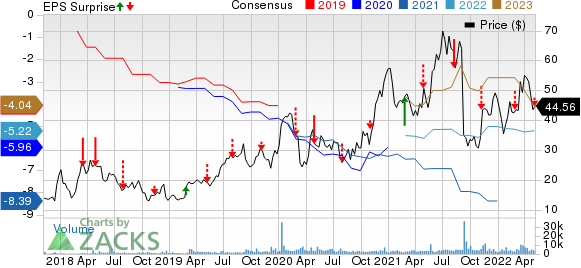

Apellis Pharmaceuticals, Inc. APLS reported first-quarter 2022 loss per share of $1.42, wider than the Zacks Consensus Estimate of a loss of $1.36. The company reported a loss of $2.32 per share in the year-ago quarter.

Total revenues were $14.4 million, beating the Zacks Consensus Estimate of $13 million. Revenues in the reported quarter comprised sales of marketed drug Empaveli (pegcetacoplan), which were $12.1 million, and $2.3 million under the collaboration with Swedish Orphan Biovitrum (Sobi). In the year-ago quarter, the company did not record any revenues.

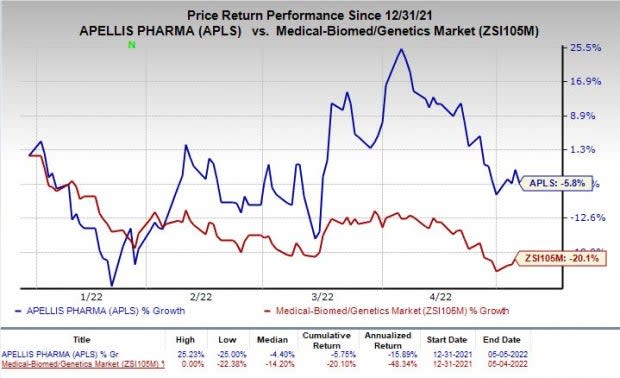

Shares of Apellis were down 3% on May 5, probably due to the above announcement. In the year so far, the stock has declined 5.8% compared with the industry’s decrease of 20.1%.

Image Source: Zacks Investment Research

In May 2021, the FDA approved Empaveli as a monotherapy treatment for adult patients suffering from PNH. A rare blood disorder, PNH is associated with abnormally low hemoglobin levels as the disease destroys red blood cells.

Empaveli is approved for treatment-naïve patients and for those switching from Alexion’s [now part of AstraZeneca AZN] C5 inhibitor therapies for PNH, namely Soliris and Ultomiris (ravulizumab).

AZN closed the acquisition of rare-disease drugmaker, Alexion, for $39 billion last July.

The Alexion buyout strengthened AstraZeneca’s immunology franchise, adding several drugs that can boost its top line.

Quarter in Detail

Research and development expenses were $90.9 million in the first quarter of 2022 compared with $84 million in the year-ago quarter.

General and administrative expenses were $51.2 million in the first quarter of 2022 compared with $40.6 million in the year-ago quarter.

As of Mar 31, 2022, Apellis had cash, cash equivalents and marketable securities worth $965.3 million compared with $700.6 million as of Dec 31, 2021.

Pipeline Update

Last December, the European Commission approved Aspaveli to treat adult patients with PNH who are anemic after treatment with a C5 inhibitor for at least three months. The drug is marketed under the trade name Empaveli in the United States. The nod in the EU should boost sales in 2022 and beyond.

Apart from PNH, Apellis is developing pegcetacoplan with Sobi for other rare diseases.

Pegcetacoplan is being evaluated in two phase III studies, namely, DERBY and OAKS, for treating patients with geographic atrophy or GA. Apellis plans to submit a new drug application or NDA to the FDA for intravitreal pegcetacoplan to treat GA in the second quarter of 2022.

A marketing authorization application for pegcetacoplan to treat GA is expected to be filed in the second half of 2022 to the European Medicines Agency.

The phase II MERIDIAN study is evaluating systemic pegcetacoplan for treating amyotrophic lateral sclerosis or ALS. Apellis completed enrollment in the study in the first quarter of 2022. Top-line data from the same is expected in mid-2023. A potential label expansion of the drug for any of the above indications will boost the company’s top line.

Apellis plans to initiate a phase III study evaluating systemic pegcetacoplan to treat immune complex membranoproliferative glomerulonephritis/C3 glomerulopathy in the second quarter of 2022.

Meanwhile, Sobi plans to begin a phase III study evaluating systemic pegcetacoplan to treat cold agglutinin disease in the second quarter of 2022. Earlier this year, Sobi enrolled the first patient in a phase II study evaluating the safety and efficacy of systemic pegcetacoplan to treat patients with hematopoietic stem cell transplantation-associated thrombotic microangiopathy.

Apellis Pharmaceuticals, Inc. Price, Consensus and EPS Surprise

Apellis Pharmaceuticals, Inc. price-consensus-eps-surprise-chart | Apellis Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

Apellis currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are Vertex Pharmaceuticals Incorporated VRTX and Applied Therapeutics, Inc. APLT, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Vertex’s earnings estimates have been revised 0.3% upward for 2022 and 0.1% upward for 2023 over the past 60 days. The VRTX stock has rallied 21.3% year to date.

Earnings of Vertex have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

Applied Therapeutics’ loss per share estimates have improved 34.1% for 2022 and 20.2% for 2023 over the past 60 days.

Earnings of Applied Therapeutics surpassed estimates in two of the trailing four quarters, met the same once and missed the same on the other occasion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report

Applied Therapeutics Inc. (APLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance