Anthem (ANTM) Q2 Earnings Surpass Estimates, Improve Y/Y

Anthem Inc. ANTM delivered second-quarter 2020 earnings of $9.20 per share, which beat the Zacks Consensus Estimate by 4.9% on the back of Medicaid and Medicare businesses. Moreover, the bottom line jumped 98.3% year over year.

However, Anthem’s operating revenues of $29.2 billion missed the Zacks Consensus Estimate by 0.9%. But the top line was up 15.9% year over year, aided by pharmacy product revenues in relation to the launch of IngenioRx. The increase was further led by higher premium revenues from growth in Medicaid and Medicare and the return of the health insurance tax in 2020.

Quarterly Operational Update

Medical enrollment inched up 3.9% year over year to 42.5 million members, backed by growth in Medicaid, National and Medicare businesses.

Anthem’s benefit expense ratio of 77.9% contracted 880 basis points (bps) from the prior-year quarter, driven by the return of the health insurance tax in 2020 and the deferral of healthcare utilization amid COVID-19 pandemic.

SG&A expense ratio of 13.9% expanded 90 bps from the year-ago quarter due to the return of the health insurance tax in 2020 and an increased spend on growth initiatives.

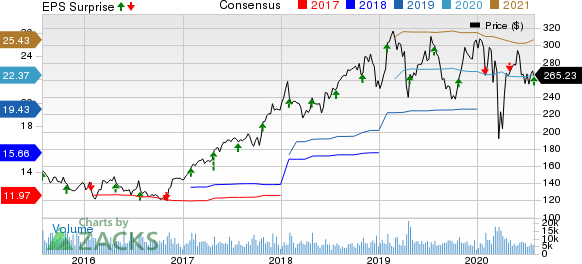

Anthem, Inc. Price, Consensus and EPS Surprise

Anthem, Inc. price-consensus-eps-surprise-chart | Anthem, Inc. Quote

Strong Segmental Results

Commercial & Specialty Business

Operating revenues of $8.8 billion in the second quarter were down 6.7% year over year.

Operating gain totaled $1.4 billion, up 39.6% year over year on the back of reduced healthcare benefit utilization during the COVID-19 pandemic.

Operating margin was 15.6%, expanding 520 bps year over year.

Government Business

Operating revenues were $17.2 billion, up 11% from the prior-year quarter.

Operating gain was $1.6 billion, up 237.1% year over year on the back of reduced healthcare benefit utilization during the COVID-19 pandemic.

Operating margin was 9.4%, up 630 bps year over year.

Other

The Other segment’s operating gain of $66 million came against the year-earlier quarterly loss of $30 million on the back of growth in the Diversified Business Group.

Financial Update

As of Jun 30, 2020, Anthem’s cash and cash equivalents totaled $6 billion, up 22.1% from the level at 2019 end.

As of Jun 30, 2020, its long-term debt less current portion increased 11.7% to $19.8 billion from the level at 2019 end.

Cash provided by operating activities at the end of the second quarter was $8 billion, up 161.7% year over year.

Capital Deployment

After considering the company’s solvency level, share buyback activity was resumed in late June.

During the second quarter, Anthem bought back shares worth $55 million.

As of Jun 30, 2020, the company had shares worth $3.2 billion remaining under its share buyback authorization.

Moreover, the company paid out a quarterly dividend of 95 cents per share, adding up to a distribution of cash worth $242 million.

The company announced a dividend of 95 cents per share on Jul 28, 2020 for the third quarter, payable Sep 25 to its shareholders of record as of Sep 10, 2020.

Guidance for 2020

Based on solid second-quarter results, Anthem updated its guidance for 2020. GAAP net income is expected to be greater than $20.91 per share including approximately $1.39 per share of net unfavorable items. The company’s adjusted net income is now expected to be higher than $22.30 per share excluding these items.

The company withdrew all other previously issued guidance for the current-year financial metrics due to the unprecedented uncertainty around the COVID-19 pandemic and its impact.

Zacks Rank

Anthem currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the medical sector players that have reported second-quarter results so far, earnings of UnitedHealth Group Incorporated UNH, HCA Healthcare, Inc. HCA and Universal Health Services, Inc. UHS beat the Zacks Consensus Estimate.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained an impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance