Annaly (NLY) Q4 Earnings Beat Estimates, Stock Down 6.3%

Annaly Capital Management, Inc. NLY reported fourth-quarter earnings available for distribution (EAD) per average share of 89 cents, which surpassed the Zacks Consensus Estimate of 86 cents. The figure declined from $1.14 in the year-ago quarter.

The company’s shares have lost 6.3% since the announcement of results last week. A challenging operating backdrop amid higher interest rates is a major near-term headwind for NLY.

NLY registered a year-over-year decline in book value per share (BVPS) and margin, while the average yield on interest-earning assets improved.

In 2022, EAD per average share was $4.23, down 9% year over year.

Inside the Headlines

Net interest income (NII) was $135.1 million in the reported quarter, missing the Zacks Consensus Estimate of $347 million. The figure plunged 62.3% year over year.

In 2022, NII declined 15.3% to $1.47 billion.

At the fourth-quarter end, Annaly had $80.6 billion of total assets, with $72.9 billion invested in the Agency portfolio. At the end of the quarter, unencumbered assets were $6.3 billion.

In the reported quarter, the average yield on interest-earning assets (excluding premium amortization adjustment or PAA) was 3.82%, up from the prior-year quarter’s 2.63%. The average economic costs of interest-bearing liabilities were 2.11%, increasing from 0.75%.

Net interest spread (excluding PAA) of 1.71% in the fourth quarter fell from 1.88% in the prior-year quarter. Also, the net interest margin (excluding PAA) was 1.90% compared with 2.03% in fourth-quarter 2021.

Annaly’s BVPS was $20.79 as of Dec 31, 2022, down from $31.88 in the prior-year quarter. At the end of the reported quarter, Annaly’s economic capital ratio was 13.4%, declining from 14.4% in the prior-year quarter.

In the fourth quarter, the weighted average actual constant prepayment rate was 7.5%, sequentially down from 9.8%.

Economic leverage was 6.3X as of Dec 31, 2022, down from 7.1X (sequentially) but up from 5.7X in the prior-year quarter. Annaly generated an annualized EAD return on average equity (excluding PAA) of 16.19% in the fourth quarter, up from the prior-year quarter’s 13.10%.

Annaly currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

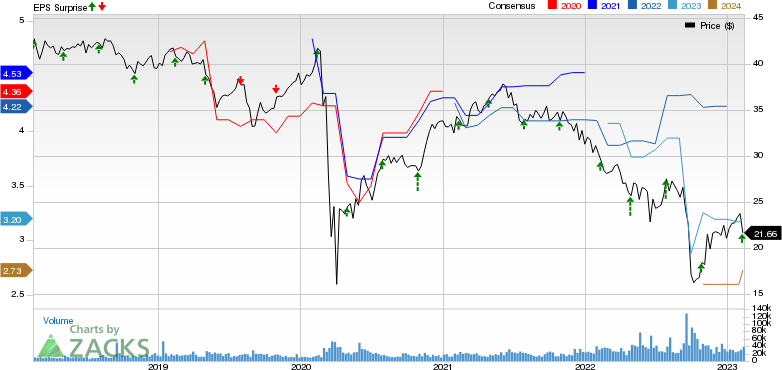

Annaly Capital Management Inc Price, Consensus and EPS Surprise

Annaly Capital Management Inc price-consensus-eps-surprise-chart | Annaly Capital Management Inc Quote

Competitive Landscape

AGNC Investment Corp.’s AGNC fourth-quarter 2022 net spread and dollar roll income per common share (excluding estimated "catch-up" premium amortization costs) of 74 cents per share beat the Zacks Consensus Estimate of 67 cents. The bottom line declined from 75 cents in the prior-year quarter. Our estimate for the same was pegged at 57 cents.

AGNC’s adjusted net interest and dollar roll income (excluding catch-up premium amortization) was $451 million, rising from the quarter-ago number of $440 million.

We now look forward to the earnings releases of Starwood Property Trust STWD. STWD is scheduled to report results on Mar 1.

Starwood Property carries a Zacks Rank #4 (Sell) at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AGNC Investment Corp. (AGNC) : Free Stock Analysis Report

STARWOOD PROPERTY TRUST, INC. (STWD) : Free Stock Analysis Report

Annaly Capital Management Inc (NLY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance