Andreas Halvorsen's Strategic Acquisition in BioMarin Pharmaceutical Inc

Overview of the Recent Transaction

On September 20, 2024, Viking Global Investors, under the leadership of Andreas Halvorsen (Trades, Portfolio), made a significant addition to its portfolio by acquiring 9,753,293 shares of BioMarin Pharmaceutical Inc (NASDAQ:BMRN). This transaction, executed at a price of $70.69 per share, represents a 0.73% impact on Vikings portfolio, increasing their position in the company to 5.10%. This move not only underscores Vikings confidence in BioMarin but also reflects a strategic enhancement of its holdings in the healthcare sector.

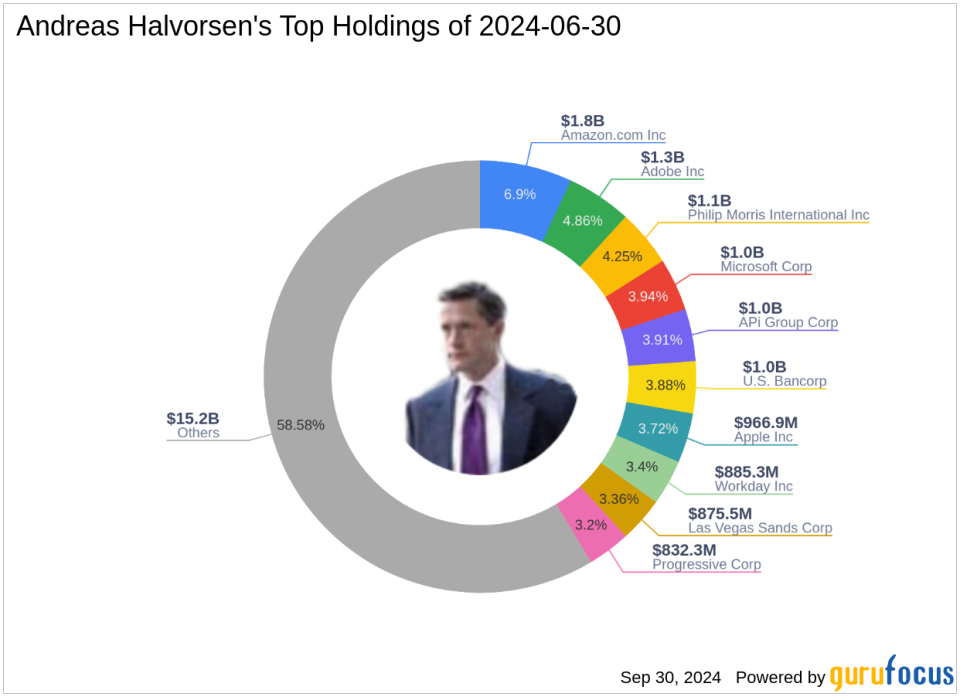

Profile of Andreas Halvorsen (Trades, Portfolio) and Viking Global Investors

Andreas Halvorsen (Trades, Portfolio), a founding partner of Viking Global Investors LP, has established the firm as a powerhouse in equity investment across global markets since its inception in 1999. With a profound commitment to a research-intensive, long-term investment approach, Viking Global leverages fundamental analysis to identify promising investment opportunities. The firms decentralized research structure allows it to tap into diverse ideas while maintaining rigorous risk management protocols. Vikings top holdings include major names like Adobe Inc (NASDAQ:ADBE) and Amazon.com Inc (NASDAQ:AMZN), emphasizing its strong inclination towards technology and healthcare sectors.

Introduction to BioMarin Pharmaceutical Inc

Founded in 1997 and headquartered in the USA, BioMarin Pharmaceutical Inc specializes in innovative therapies for rare diseases. Its product portfolio includes several high-impact treatments such as Voxzogo and Roctavian, addressing conditions like achondroplasia and hemophilia A, respectively. BioMarin stands out in the biotechnology industry for its focused approach on life-altering genetic diseases, making it a key player in the sector.

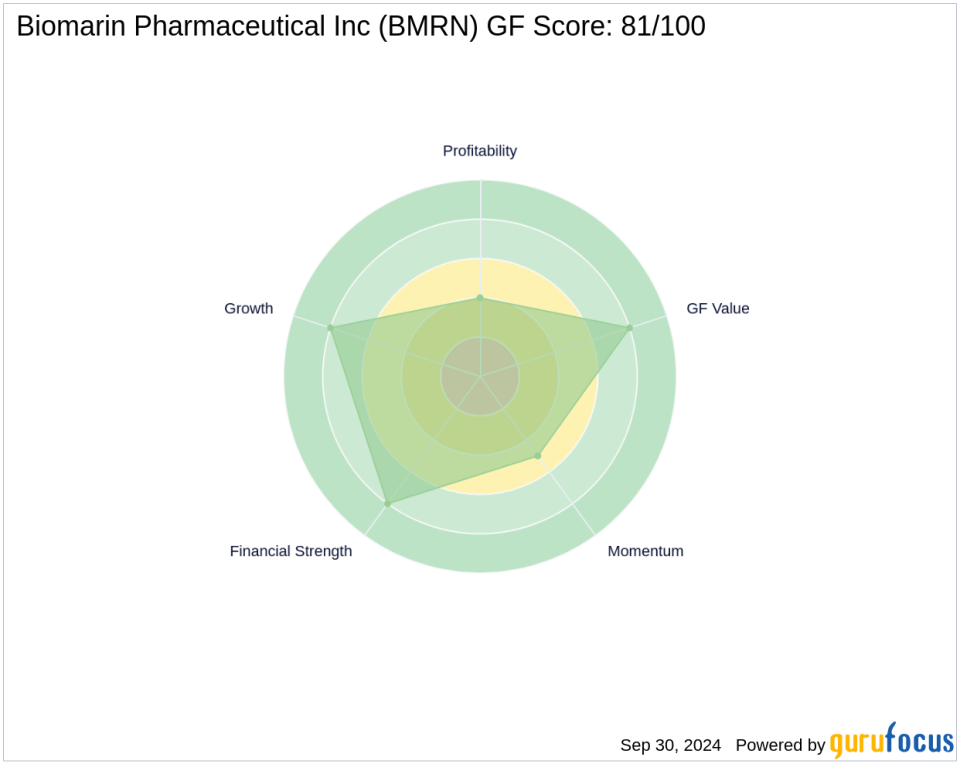

Financial and Market Analysis of BioMarin

As of the latest data, BioMarin boasts a market capitalization of $13.38 billion with a current stock price of $70.29. Despite a PE ratio of 52.85 indicating profitability, the stock is considered significantly undervalued with a GF Value of $108.64, suggesting a potential upside. The GF Score of 81 indicates good potential for outperformance, supported by strong scores in financial strength, growth, and GF Value ranks.

Significance of the Trade

This acquisition significantly bolsters Viking Globals position in BioMarin, reflecting a strategic bet on the biotechnology sectors growth prospects. The addition of BioMarin shares has increased the healthcare representation in Vikings portfolio to a notable extent, aligning with its investment philosophy of focusing on companies with robust business models and potential for sustained growth.

Comparative Context and Market Analysis

Dodge & Cox remains the largest institutional investor in BioMarin, highlighting the stocks appeal among leading investment firms. Other notable investors include George Soros (Trades, Portfolio) and Ken Fisher (Trades, Portfolio), indicating a strong guru interest in BioMarins business model and market potential. The biotechnology sector continues to face challenges but offers substantial opportunities for firms that can innovate and effectively bring new therapies to market.

Future Outlook and Implications

The strategic acquisition by Viking Global Investors suggests a positive outlook on BioMarins future performance. Investors and market watchers will likely keep a close eye on BioMarins ongoing developments and its impact on Vikings portfolio. This move could signal broader confidence in the biotechnology sector, particularly in companies that are positioned to lead in rare disease treatment innovations.

For value investors, this transaction highlights the importance of considering growth prospects and market positioning when selecting biotechnology stocks for long-term gains.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.