Analysts expect Disney to top Comcast's $65 billion bid for Fox

Comcast’s $65 billion bid for 21st Century Fox (FOX) is the largest all-cash offer in history, but analysts overwhelmingly are expecting the Walt Disney Co. to top it.

Equity analysts and market watchers say that Disney has room to increase its bid and given chief executive Bob Iger’s proclivity for dealmaking they expect the company to do just that.

“We believe Disney (DIS) has the flexibility to sweeten its current deal with cash,” UBS analyst John C. Hodulik said in a note with the bank’s equity team to clients. “Disney does have a stronger balance sheet and higher stock valuation than Comcast.”

Comcast (CMCSA) holds more debt or leverage on its balance sheet than Disney, the analysts note, even though Comcast currently trades at five times its earnings before interest, tax, depreciation and amortization (EBITDA), the analysts note, which they call a historic and absolute low.

(EBITDA can be used to analyze and compare profitability among companies and industries as it eliminates the effects of financing and accounting decisions.)

A deal with either Comcast or Disney would involve the buyer taking over Fox’s cable networks, its international holdings, regional sports networks like Fox Sports Southwest and its film studio. The Fox News and national sports networks, which have been called the Murdoch family’s “crown jewels,” would be spun off and remain under the family’s control.

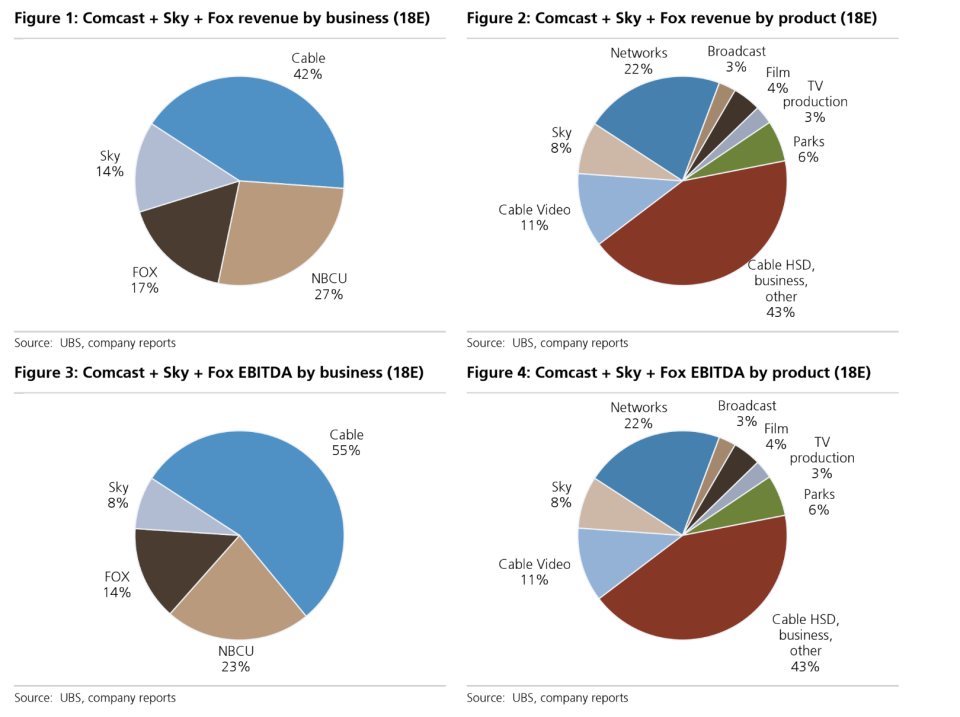

At stake is a deal that would create a global content and distribution company, with leading platforms in the U.S., Europe and India. With Fox’s assets, the UBS analysts estimate Comcast would generate around 55% of its pro forma EBITDA from U.S. cable, followed by 37% from media and 8% from Sky. It would also significantly increase Comcast’s international exposure.

Bloomberg Opinion columnist Tara LaChapelle says both the Murdochs and Disney “clearly want the merger to take place and seem committed.” Disney has a five-day window during which it has the right to match Comcast’s offer.

“I suspect it will add some cash to its offer mix if that’s what it will take to win a shareholder vote come July,” LaChapelle said in an opinion piece. “Disney is already six months into this deal and to some degree, both sides have already been talking about it as if it’s in the bag.”

Oppenheimer analysts Timothy Horan and Tom Shaughnessy similarly expect a rejoinder from Disney, they said in a note titled “Comcast Makes Formal Fox Offer—Disney Likely to Top the Bid of Last Remaining Major Content Company.”

Both potential acquirers are seeing increases in their share prices. Disney’s stock was up 2.4% in pre-market futures trading Friday, having gained 4.2% from its market close on Monday to its close on Thursday. Comcast’s stock jumped 4.2% in futures trading Friday, having gained 5.6% between its Monday and Thursday close.

While the company may not want to see Fox’s assets slip through its fingers, Disney outbidding the cable giant could be a good thing, argues Moody’s lead analyst Neil Begley. He rates Comcast’s current $65 billion bid as credit negative.

“The total pro forma debt for the combined companies would be approximately $170 billion of total debt, the world’s second-most indebted company (excluding financial institutions and government-related entities) after pro forma AT&T-Time Warner once it closes,” Begley said in a statement. “Assuming about $40 billion of EBITDA after synergies, pro forma leverage would be about 4.25 times, which represents a material change in financial risk tolerance for Comcast‘s AAA longterm debt ratings.”

—

Dion Rabouin is a markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.

Yahoo Finance

Yahoo Finance