Amgen (AMGN) Beats Q2 Earnings Estimates, to Buy Chemocentryx

Amgen AMGN reported second-quarter 2022 earnings of $4.65 per share, which beat the Zacks Consensus Estimate of $4.40. In the year-ago quarter, earnings were $1.77 per share. Lower operating expenses and share count boosted earnings in the quarter.

Total revenues of $6.59 billion beat the Zacks Consensus Estimate of $6.54 billion. Total revenues rose 1% year over year, driven by growth in product sales, which offset the impact of lower Other revenues.

Total product revenues rose 3% from the year-ago quarter to $6.28 billion (U.S.: $4.45 billion; ex-U.S.: $1.84 billion). Higher volumes were offset by lower selling prices of several drugs and currency headwinds. Volumes rose 10% in the quarter, offset by a 6% lower net selling price. Foreign exchange movement hurt sales by 2% in the quarter.

Other revenues were $313 million in the quarter, down 24% year over year, primarily due to lower COVID-19 antibody manufacturing collaboration revenues compared to last year’s second quarter.

Performance of Key Drugs

Prolia revenues came in at $922 million, up 13% from the year-ago quarter, as new and repeat patient volumes improved.

Evenity recorded sales of $191 million in the quarter, up 46% year over year driven by strong volume growth.

Xgeva delivered revenues of $533 million, up 9% from the year-ago quarter due to favorable changes to estimated sales deductions and higher prices, which offset the impact of flat volumes.

Kyprolis recorded sales of $317 million, up 13% year over year.

Repatha generated revenues of $325 million, up 14% year over year, as higher volume was partially offset by lower prices. Increased rebates to support broad Medicare Part D and commercial patient access in the United States led to lower prices in the quarter.

Vectibix revenues came in at $207 million, down 13% year over year due to a difficult comparison with the year-ago quarter revenues, which had benefited from the favorable timing of shipments to Japanese partner, Takeda. Vectibix sales increased 4% year over year in the United States.

Nplate sales rose 16% to $284 million. Blincyto sales increased 29% from the year-ago period to $1389 million.

Aimovig recorded sales of $92 million in the quarter, up 12% year over year as the benefit from higher net selling price was partially offset by lower volumes.

Sales of Otezla were $594 million in the quarter, up 11% driven by higher volumes and favorable changes to estimated sales deductions, which offset the impact of lower selling prices.

Amgen’s newly approved drug, Lumakras (sotorasib), recorded sales of $77 million in the quarter compared with $62 million in the previous quarter. Lumakras has now been approved in over 40 countries and Amgen is actively launching in 25 markets.

Newly approved asthma drug, Tezspire (tezepelumab) recorded sales of $29 million in the quarter compared with $7 million in the previous quarter. Tezspire was approved in the United States in December 2021 and the entire sales came from this country.

In biosimilars, sales of Kanjinti (Amgen’s biosimilar of Roche’s [RHHBY] Herceptin) were $85 million, down 46% year over year due to lower volumes and pricing as a result of increased competition.

Sales of Mvasi (biosimilar of Roche’s Avastin) were $243 million in the quarter, down 17% year over year due to declines in net selling price on increased competition that was partially offset by higher volume growth. Sales of Kanjinti and Mvasi are expected to continue to decline in the remaining quarters of 2022.

Amjevita (biosimilar of AbbVie’s Humira) sales were $116 million in the quarter, up 8% year over year, driven by volume growth, which was partially offset by currency headwinds and lower net selling price due to increased competitive pressure.

Total sales of mature drugs like Parsabiv, Neupogen, Aranesp, Epogen and Neulasta declined 15% in the quarter due to an array of branded and generic competitors. Enbrel revenues of $1.05 billion declined 8% year over year due to lower volumes and price.

Operating Margins Rise

The adjusted operating margin rose 26.8 percentage points to 53.1% in the quarter due to lower operating costs. Adjusted operating expenses declined 34% to $3.26 billion due to lower acquired IPR&D costs. Acquired IPR&D expenses were zero in the quarter, compared with $1.5 billion in the year-ago quarter. The company wrote-off $1.5 billion in acquired IPR&D in the second quarter of 2021 associated with the acquisition of Five Prime Therapeutics.

SG&A spending declined 2% to $1.31 billion. R&D expenses declined 2% year over year to $1.02 billion.

Excluding the impact of the Five Prime IPR&D charge, second-quarter adjusted operating costs declined 5% year over year.

2022 Outlook

Amgen tightened its previously issued revenue guidance while maintaining its adjusted earnings guidance range. Revenues are expected in the range of $25.5 billion to $26.4 billion versus prior expectations of $25.4 billion to $26.5 billion. Earnings are expected in the range of $17.00 per share to $18.00 per share.

Amgen expects other revenues to be in the range of $1.4 billion to $1.7 billion in 2022 (previously $1.4 billion to $1.7 billion).

Adjusted cost of sales as a percent of product sales is expected to be 15.5% to 16.5% in 2022. Adjusted R&D costs are expected to decrease in the range of 4% to 6% year over year in 2022. SG&A spend is expected to be flat to slightly down year over year as a percentage of product sales (previously flat). Total operating expenses are expected to decline year over year at a low double-digit rate. Operating expenses are expected to increase in the second half of the year versus the first half. Amgen expects operating margin as a percentage of product sales to be roughly 50% in 2022.

Currency headwinds are expected to hurt adjusted earnings by approximately 25 cents in the second half of 2022.

The adjusted tax rate is expected to be in the range of 14.0% to 15.0% (previously 13.5%-14.5%) while capital expenditures are expected to be approximately $950 million (maintained). The company expects to buy back shares in the range of $6.0 billion to $7.0 billion in 2022.

Proposed Acquisition of ChemoCentryx

Before market hours, Amgen announced a definitive agreement to acquire ChemoCentryx CCXI for $52 per share in cash, which amounts to a total enterprise value of approximately $3.7 billion.

The acquisition will add the latter’s newly approved drug, Tavneos (avacopan) to Amgen’s inflammation and nephrology portfolio. Tavneos was approved for treating antineutrophil cytoplasmic antibody (ANCA) associated vasculitis, a serious systemic autoimmune disease, in October last year. Tavneos recorded sales of $5.4 million in the first quarter of 2021, its first full quarter since launch. Tavneos is also approved in the European Union and Japan. ChemoCentryx is also developing avacopan for other indications like complement 3 glomerulopathy and hidradenitis suppurativa. In addition, ChemoCentryx also has three early-stage drug candidates in its portfolio.

The acquisition has been unanimously approved by the board of directors of both companies and is expected to close in the fourth quarter of 2022, subject to shareholders’ approval and other regulatory approvals.

Our Take

Amgen’s second-quarter results were decent as it beat estimates for both earnings and sales. Drugs like Repatha, Otezla, Prolia and Evenity, all delivered double-digit sales growth in the quarter. However, pricing pressure and increased competition continued to hurt sales of some drugs as well as biosimilar products. Two of Amgen’s newest drugs Lumakras and Tezspire, are off to an encouraging start. The acquisition of ChemoCentryx, if successfully closed, will add another newly launched innovative product to Amgen’s portfolio.

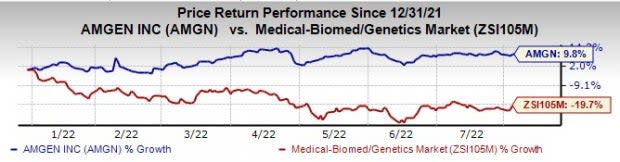

Amgen’s stock fell slightly in after-hours trading on Aug 4. Amgen’s stock has risen 9.8% this year so far against a decrease of 19.7% for theindustry.

Image Source: Zacks Investment Research

Zacks Rank and Stock to Consider

Amgen currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Amgen Inc. Price, Consensus and EPS Surprise

Amgen Inc. price-consensus-eps-surprise-chart | Amgen Inc. Quote

A better-ranked stock in the same sector is BioNTech BNTX with a Zacks Rank #2 (Buy) at present.

BioNTech’s stock is down 30% this year so far. Earnings estimates for 2022 have gone up from $33.18 per share to $34.28 per share while that for 2023 has increased from $14.28 per share to $20.17 per share over the past 30 days.

Earnings of BioNTech beat estimates in all the last four quarters, the average surprise being 56.87%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

ChemoCentryx, Inc. (CCXI) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance