AMERISAFE (AMSF) Q4 Earnings Beat, Hikes Dividend by 10%

AMERISAFE, Inc. AMSF reported fourth-quarter 2022 adjusted earnings of 84 cents per share, which outpaced the Zacks Consensus Estimate by 29.2% and our estimate of 62 cents per share. It broke even in the prior-year quarter.

Operating revenues remained flat year over year at $74 million. The top line beat the consensus mark by a whisker and was higher than our estimate of $72.1 million.

The quarterly results gained momentum on the back of a significant increase in net investment income, solid underwriting results and a declining expense level. However, the positives were partially offset by reduced premiums.

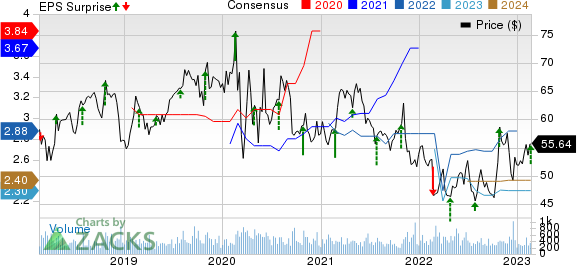

AMERISAFE, Inc. Price, Consensus and EPS Surprise

AMERISAFE, Inc. price-consensus-eps-surprise-chart | AMERISAFE, Inc. Quote

Q4 Performance

Net premiums earned by AMERISAFE amounted to $66.1 million, which slipped 2.5% year over year in the fourth quarter. The figure fell short of the Zacks Consensus Estimate of $67 million but came higher than our estimate of $65.8 million.

Net investment income of $7.6 million advanced 25.8% year over year on the back of growing yields on fixed-income securities. The figure beat the consensus mark of $6.6 million and our estimate of $6.2 million.

Fees and other income climbed 43.2% year over year to $0.1 million in the quarter under review and matched the Zacks Consensus Estimate as well as our estimate.

AMERISAFE reported a pre-tax underwriting profit of $11.9 million. An underwriting loss of $8.7 million was reported in the prior-year quarter.

Total expenses declined 29.2% year over year to $54.1 million in the fourth quarter, attributable to lower loss and loss adjustment expenses incurred coupled with reduced policyholder dividend costs. The reported figure also fell shy our estimate of $57.7 million.

The net combined ratio of 82% improved 3,090 basis points (bps) year over year. The figure was lower than the consensus mark of 87% and our estimate of 87.7%.

Financial Update (as of Dec 31, 2022)

AMERISAFE exited the fourth quarter with cash and cash equivalents of $61.5 million, which decreased 13.1% from the 2021-end level.

Total assets of $1,269.3 million tumbled 9.5% from the figure in 2021 end.

Shareholders' equity fell 20.5% from the 2021-end level to $317.4 million.

Book value per share tumbled 19.6% year over year to $16.57 in the fourth quarter.

Return on average equity improved 2,090 bps year over year to 24.1% in the quarter under review.

Dividend Hike Announced

Concurrent with announcing quarterly results, management sanctioned a 9.7% hike in the quarterly dividend. The increased dividend amounting to 34 cents per share will be paid out on Mar 24, 2023, to its shareholders of record as of Mar 10, 2023.

Full-Year Update

AMERISAFE’s adjusted earnings of $3.07 per share improved 8.9% year over year in 2022.

Net premiums earned dipped 1.6% year over year to $271.7 million. Net investment income of $27.2 million rose 7% year over year.

AMSF reported a pre-tax underwriting profit of $44.7 million in 2022, which advanced 13.2% from the 2021 figure. Net combined ratio of 83.6% improved 210 bps year over year.

Zacks Rank

AMERISAFE currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Performances of Other Insurers

Of the insurance industry players that have reported fourth-quarter results so far, CNO Financial Group, Inc. CNO, Arch Capital Group Ltd. ACGL and W.R. Berkley Corporation WRB beat the respective Zacks Consensus Estimate for earnings.

CNO Financial reported fourth-quarter 2022 adjusted earnings per share of 56 cents, which matched the Zacks Consensus Estimate. However, the bottom line dropped 36% year over year. Total revenues declined 9.4% year over year to $973.6 million in the quarter under review. The top line beat the consensus mark by 6.7%. CNO’s insurance policy income of $626 million dipped 1% year over year. Annuity collected premiums of $431 million rose 8% year over year.

Arch Capital’s fourth-quarter 2022 operating income of $2.14 per share beat the Zacks Consensus Estimate by 59.7%. The bottom line increased 68.5% year over year. Operating revenues of $2,950 million rose 35.1% year over year, beating the Zacks Consensus Estimate by about 10.3%. Net premiums written by ACGL climbed 49.2% year over year to $3,034 million. Net investment income skyrocketed 100.2% year over year to $181 million.

W.R. Berkley reported a fourth-quarter 2022 operating income of $1.16 per share, which beat the Zacks Consensus Estimate of $1.07 by 8.4%. The bottom line improved 12.4% year over year. Net premiums written were a record $2.4 billion, up 6.7% year over year. Operating revenues of WRB came in at $2.9 billion, up 14.4% year over year, on the back of higher net premiums earned as well as higher net investment income. The top line beat the consensus estimate by 0.6% Net investment income surged 40.2% to a record $231.3 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNO Financial Group, Inc. (CNO) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

AMERISAFE, Inc. (AMSF) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance