For the first time since the recession, America's biggest companies are getting smaller

In January, the US economy added 227,000 jobs, more than expected by economists.

But underneath the surface of this strong headline number, we saw wage growth disappoint, rising far less than forecast. The unemployment rate also rose, though this was because of an increase in labor force participation.

And so on balance, it was a bit of a mixed report.

Aside from soft earnings, however, elsewhere in the labor market we’re seeing another trend that casts some doubt on just how strong the hiring environment is, as employment at big US companies is slowing for the first time since the recession.

In a post out this weekend, we noted that while currency moves remain the most talked about topic on S&P 500 earnings calls, over half of companies reporting so far have mentioned politics or the US election.

This, to our minds, indicates that among executives at big US companies there is, despite the idea that the Trump administration is and will remain stridently pro-business, considerable uncertainty about how the administration’s policies unfold.

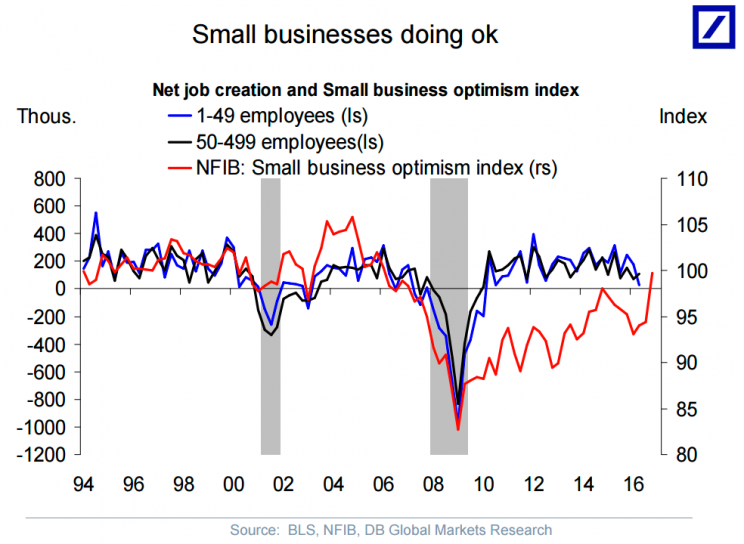

Now, S&P 500 companies account for less than 20% of total US employment. And this would suggest that perhaps a more important indicator for judging the strength of the US labor market — and economy more generally — is the NFIB’s small business optimism index, which surged to its highest level since before the financial crisis after the election.

And so on the one hand, we have small businesses indicating that not only are things okay in the US economy now but stand to improve.

On the other hand, the biggest companies in the country seem unnerved by something.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance