AMD Q2 Preview: Estimates Indicate Serious Growth

Semiconductor stocks have been stellar investments over the last five years, as illustrated in the chart below that shows the performance of SOXX, the iShares Semiconductor ETF, compared to the S&P 500.

Image Source: Zacks Investment Research

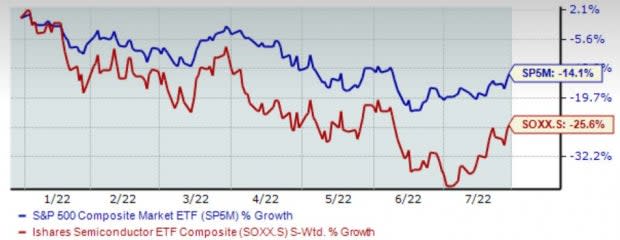

However, year-to-date, it’s been a tough stretch for the industry.

Image Source: Zacks Investment Research

A titan in the semiconductor space, Advanced Micro Devices AMD, is slated to release quarterly results on Tuesday, August 2nd, after market close.

Advanced Micro Devices’ extensive product portfolio includes microprocessors, graphics processors, motherboard chipsets, and personal computers. The company is currently a Zacks Rank #3 (Hold) with an overall VGM Score of a B.

Let’s see how the semiconductor titan stacks up heading into the print.

Share Performance & Valuation

It’s no secret that AMD shares have tumbled in 2022, losing more than a third of their value and extensively underperforming the S&P 500.

Image Source: Zacks Investment Research

However, AMD shares have tacked on a remarkable 23% over the last month, crushing the S&P 500’s performance. The bulls have finally returned after hiding all-year long.

Image Source: Zacks Investment Research

In addition, Advanced Micro Devices’ forward earnings multiple has retraced all the way down to 22.9X, a fraction of highs of 107.2X in 2020. Shares trade at a 25% premium relative to the general market.

AMD has a Style Score of a C for Value.

Quarterly Estimates

Quarterly estimates reflect strong growth.

Analysts have been bullish over the last 60 days, with two positive estimate revisions hitting the tape. For the quarter to be reported, the Zacks Consensus EPS Estimate resides at $1.03, penciling in a robust 63% uptick in quarterly earnings year-over-year.

Image Source: Zacks Investment Research

Furthermore, the top-line is in exceptional health as well. Projected revenue of $6.5 billion displays a sizable 70% uptick in sales compared to $3.9 billion in the year-ago quarter.

AMD sports a Style Score of an A for Growth.

Quarterly Performance & Market Reactions

The company has repeatedly topped earnings estimates, chaining together eight consecutive bottom-line beats. Just in its latest quarter, AMD recorded an impressive 24% EPS beat.

Pivoting to the top-line, quarterly sales results have been just as stellar, with AMD exceeding top-line estimates over the last eight quarters. The chart below illustrates the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Additionally, as of late, the market has reacted well to quarterly releases; over its last four earnings reports, shares have moved upwards three times following the report, all by at least 6%.

Putting Everything Together

AMD shares have soared over the last month, a reflection of buyers finally stepping up to the plate after being nowhere to be seen all year long. In addition, AMD shares now trade at much lower valuation levels but still represent a premium to the S&P 500.

AMD has been on a blazing hot earnings streak, exceeding both top and bottom-line estimates in eight consecutive quarters. Quarterly estimates for the semiconductor titan reflect sizable growth, as well.

As of late, shares have primarily moved upwards following quarterly releases, all by sizable percentages. All in all, it looks to be a strong quarter for the company.

Heading into the print, Advanced Micro Devices AMD carries an Earnings ESP Score of 1.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance