AMC Chief Braces for Questions on Dividend and Debt

AMC Entertainment CEO Adam Aron has given his shareholders more skin in the game. Aron has paved the way for retail investors to ask questions during the Q2 2021 earnings webcast, which will be a first for the company. The popular CEO has already begun to vet some of the questions, saying that they are “really smart” and calling the ideas that have been presented fascinating.

August 9 is our next quarterly earnings call. Will be webcast so you can listen. For the first time ever, we will take questions from individual investors on the call. Here’s

the link: https://t.co/YSGBIlkFKU Really smart questions in so far, and fascincinating suggestions too.— Adam Aron (@CEOAdam) August 1, 2021

Individual Investors Want to Know

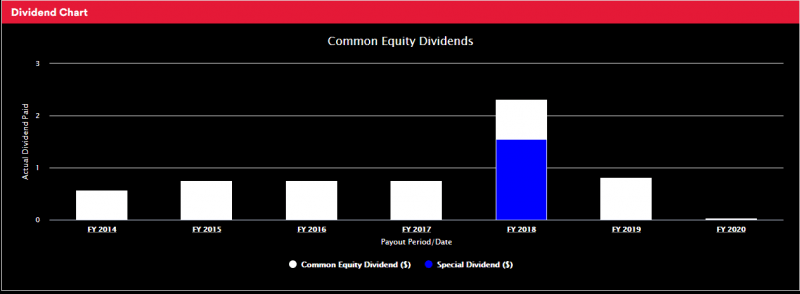

Nearly 4,200 questions have poured into the Say app from retail investors so far. Among the most popular questions is whether AMC will resume rewarding shareholders with a dividend, which it stopped doing at the start of the pandemic year. The question has received more than 32K upvotes and the most “shares” of any question. In February 2020, AMC announced a dividend of USD 0.03 per share and hasn’t paid a dividend since then. That compared to a distribution of USD 0.20 per share in early 2019.

Another popular question is whether a potential AMC/GameStop partnership could be in the works. This shareholder is looking for “theatre experiences via local and national gaming competitions.”

AMC and GameStop are two of the early meme stocks and have gained popularity among retail investors this year. Investors in both stocks have taken it on the chin in recent months as shares have been under pressure. AMC is down a steep 10% today ahead of the company’s earnings call on Aug. 9.

Something else that is on the minds of AMC investors is COVID, especially given the emergence of the delta variant. One investor suggests that the company consider going back in time to offering drive-in movie theaters, and at the very least they want to know how AMC would respond to another lockdown.

Debt Load

AMC is saddled with a heavy debt load on its balance sheet. Investors want to know how the movie chain will slash its debt without selling new shares. The company recently attempted to raise capital by issuing 25 million new shares but reversed course on the heels of investor backlash.

As of the end of Q1, AMC’s long-term debt stood at USD 5.5 billion. The company has said it plans to pare down its debt with the cash that it has raised. But it won’t be by selling new shares, at least not before 2022.

Another company that is welcoming questions from shareholders is cryptocurrency exchange Coinbase, whose earnings call is planned for Aug. 10.

This article was originally posted on FX Empire

More From FXEMPIRE:

Ethereum, Litecoin, and Ripple’s XRP – Daily Tech Analysis – August 5th, 2021

Natural Gas Price Prediction – Prices Break Out on Warm Weather Forecast

Gold Price Prediction – Gold Prices Whipsaw Following ADP and ISM

European Equities: Economic Data and Corporate Earnings in Focus

Natural Gas Price Forecast – Natural Gas Exploded to the Upside

Yahoo Finance

Yahoo Finance