Amazon (AMZN) Q4 Earnings Crush Estimates, Revenues Up Y/Y

Amazon.com AMZN reported fourth-quarter 2019 earnings of $6.47 per share, beating the Zacks Consensus Estimate by 62.6%. Further, the figure surged 7.1% from the year-ago quarter.

Net sales of $87.437 billion comfortably surpassed the Zacks Consensus Estimate of $85.996 billion and came well above management’s guided range of $80 billion and $86.5 billion. Further, the figure improved 21% on a year-over-year basis.

North America revenues (61.4% of sales) improved 22% from the year-ago quarter to $53.67 billion. International revenues (27.2% of sales) climbed 14.3% year over year to $23.81 billion. Amazon Web Services (AWS) revenues (11.4% of sales) surged 34% year over year to $9.95 billion.

Year-over-year top-line growth was primarily driven by solid momentum across Prime on account of strong performance of Prime ultra-fast delivery services and expanding Prime Video original content. Further, the company’s record-breaking holiday sales drove the top line.

Additionally, strengthening AWS services and smart home products offerings contributed to the fourth-quarter results.

Following the better-than-expected fourth-quarter results, shares of the company have surged 11.4% in the pre-market trading.

Further, Amazon has returned 15.1% over a year, outperforming the industry’s rally of 13.6%.

We believe Amazon’s expanding global presence remains a major positive. Its focus toward strengthening presence in countries like India, Brazil and Canada among others that hold immense growth opportunities are likely to instill investor optimism.

Additionally, growing Prime and AWS momentum, strengthening Alexa skills and expanding smart devices portfolio are likely to drive the company’s business growth in the near term.

Momentum Across Prime, Fashion & Music Streaming

Amazon Prime gained solid traction during the reported quarter on the back of strengthening fast delivery services, customer-oriented benefits and original content. We note that number of people joining Prime was the highest so far in the fourth quarter.

The company’s paid Prime members base now stands above the mark of 150 million. This can be attributed to international expansion. Amazon witnessed fastest growth in paid membership in Brazil where it was launched last September.

AmazonFresh service, which enables Prime members to receive delivery of daily essential goods and grocery items at an ultrafast speed, was made free for Prime members. The company removed the monthly fee of the $14.99 from the service during the reported quarter.

The company made free two-hour grocery delivery services from Amazon Fresh and Whole Foods Market available in more than 2,000 U.S. cities. Courtesy of this, Amazon witnessed doubling of grocery delivery orders from both in the reported quarter.

Additionally, the company experienced quadrupling number of items delivered via Prime free one-day and same-day delivery compared to year-ago quarter.

Further, the company benefited from robust original series and movies. Watch hours of Amazon’s original movies and TV shows on Prime Video doubled compared to year-ago quarter.

Furthermore, Prime Video streamed The Kacey Musgraves Christmas Special, The Expanse, The Report, The Aeronauts, third season of The Marvelous Mrs.Maisel, second season of Jack Ryan and the final season of The Man in the High Castle during the fourth quarter.

Additionally, Amazon Originals received 88 nominations and won 26 honors at major awards shows. Further, it received eight Golden Globe Award nominations and Fleabag won the Best Television Series award.

Further, the company’s growing momentum in music streaming space remained positive. Notably, worldwide user base of Amazon Music now stands above 55 million, owing to its strengthening international presence.

Furthermore, the company ramped up initiatives in the fashion world by launching Amazon Fashion’s first holiday catalogue. Additionally, Amazon Fashion and Amazon Home teamed up with Refinery29 to set up a holiday pop-up shop in New York City. All these endeavors remain noteworthy.

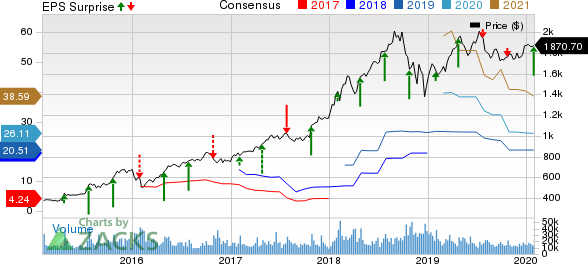

Amazon.com, Inc. Price, Consensus and EPS Surprise

Amazon.com, Inc. price-consensus-eps-surprise-chart | Amazon.com, Inc. Quote

Expanding AWS Portfolio: A Key Catalyst

AWS that witnessed significant improvement in the top line growth, continued to gain momentum across customers during the fourth quarter owing to expanding services portfolio.

The company made AWS Outposts — fully managed and configurable compute and storage racks, generally available to customers. Further, it announced AWS Wavelength — to offer low latency to customers. Notably, the new service is a combination of AWS compute and storage services, and cutting edge 5G networks.

Furthermore, it announced several other services like — AWS Fargate for Amazon Elastic Kubernetes Service, AWS Data Exchange and Amazon Managed (Apache) Cassandra Service, to name a few, during the reported quarter.

The company also introduced six new Amazon SageMaker capabilities and new analytics capabilities among others.

Additionally, Amazon announced a new type of AWS infrastructure deployment — AWS Local Zones. Notably, the first was launched in Los Angeles in the fourth quarter.

We note that all these strong endeavors helped Amazon to win a number of customers during the reported quarter including ProSiebenSat.1 Media, Western Union, Klarna, Old Mutual Limited, Seattle Seahawks, FINRA CAT, Cerner, Best Western Hotels & Resorts and BP.

Alexa & Smart Devices Gaining Traction

Amazon continued to enhance the skills and features of Alexa during the reported quarter. Features like medication reminders, prescription refills and utility bills payment were added to Alexa capabilities, which in turn enriched user experience.

Further, the company also partnered with Buzzfeed and added thousands of Buzzfeed Tasty’s famous quick-play social videos to Echo Show.

Additionally, Amazon made content from Spotify Free, Spotify Podcasts, Apple Podcasts, SiriusXM’s On Demand library and Tubi TV accessible on Alexa.

Advancing Alexa features with increasing number of devices compatible with Alexa remains a key positive.

Apart from Alexa, the company banked on Fire TV, which has now more than 40 million active users globally. The company launched the latest version of its Fire HD 10 tablet in the fourth quarter. Further, it expanded Fire TV Edition Smart TV offerings by introducing Fire TV Edition Smart TV in India in partnership with Onida.

Additionally, it rolled out Fire HD 10 Kids Edition, which strengthened its portfolio of smart devices for kids. It also introduced Kindle Kids Edition and Echo Glow.

Further, the company strengthened presence in the global home security space by launching Ring Alarm in the U.K. Also, it rolled out all-new Indoor Cam and Stick Up Cam in several countries like Canada, New Zealand, France, Germany, Italy, Australia, the U.K. and Spain.

Quarter Details

Product sales (57.8% of sales) increased 13.1% year over year to $50.542 billion. Service sales (42.2% of sales) surged 33.3% from the year-ago quarter to $36.895 billion.

Operating expenses were $83.558 billion, up 21.8% from the year-ago quarter. As percentage of revenues, the figure expanded 80 bps on a year-over-year basis to 95.6%.

Cost of sales, fulfillment, marketing, technology & content and general & administrative improved 20.5%, 21.6%, 25.7%, 27% and 26.4%, respectively, on a year-over-year basis.

Other operating expenses were down 24.4% from the year-ago quarter.

Operating income increased 2.5% from the year-ago quarter to $3.9 billion. However, operating margin contracted 80 bps from the year-ago quarter to 4.4%.

Operating income for AWS came in $2.6 billion, up 18% year over year. However, the same for North America declined 15.6% from the prior-year quarter to $1.9 billion.

Further, International segment reported a loss of $617 million, narrower from the year-ago quarter’s loss of $642 million.

Guidance

For first-quarter 2020, Amazon expects net sales between $69 billion and $73 billion. The figure is anticipated to grow in the range of 16-22% on a year-over-year basis. The Zacks Consensus Estimate for net sales is pegged at $71.34 billion.

Management projects a favorable foreign exchange impact of approximately 5 bps.

Operating income is expected between $3 billion and $4.2 billion compared with $4.4 billion in first-quarter 2019.

Zacks Rank & Stocks to Consider

Currently, Amazon carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Retail-Wholesale sector are Zumiez Inc. ZUMZ, Boot Barn Holdings, Inc. BOOT and Booking Holdings Inc. BKNG. While Zumiez sports a Zacks Rank #1 (Strong Buy), Boot Barn and Booking Holdings carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Zumiez, Boot Barn and Booking Holdings is currently pegged at 12%, 17% and 13.2%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Zumiez Inc. (ZUMZ) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance