Altria (MO) on Growth Track, Unveils 2028 Enterprise Goals

Altria Group Inc. MO unveiled its new 2028 Enterprise Goals, which includes corporate financial metrics and U.S. smoke-free portfolio goals. The company provided an update on its product development efforts for the smoke-free category. In addition, the company reaffirmed its 2023 guidance.

Let’s delve deeper.

2028 Enterprise Goals on Promise

Under its corporate goals, the company expects to deliver mid-single digits adjusted earnings per share (EPS) growth on a compounded annual basis through 2028. The company’s newly-unveiled dividend goal targets annual mid-single digits dividend growth. Management expects its debt-to-earnings before interest, taxes, depreciation and amortization ratio to be roughly 2.0x. The company expects to maintain its total adjusted OCI margin of at least 60% every year through 2028.

Also, management set two new goals for its U.S. smoke-free portfolio, which includes smoke-free volume and smoke-free revenues. In this regard, the company expects to grow U.S. smoke-free volumes by at least 35% compared with the 2022 base. Management envisions to nearly double its U.S. smoke-free net revenues to $5 billion relative to the 2022 base of $2.6 billion.

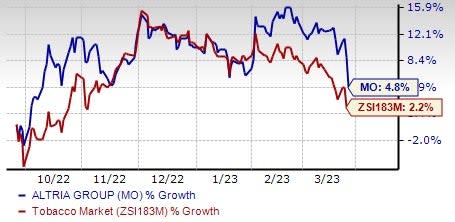

Image Source: Zacks Investment Research

Product Development on Track

The company is on track with building an impressive portfolio of smoke-free products. In this regard, management unveiled a heated tobacco capsule product — SWIC and an oral tobacco innovation — on! PLUS. In the long run, Altria aspires to compete in the international innovative smoke-free and non-nicotine categories.

Reaffirms 2023 Guidance

Management recently reaffirmed its 2023 guidance. The company still envisions 2023 adjusted EPS in the range of $4.98-$5.13, suggesting growth of 3-6% from the $4.84 recorded in 2022. The company continues assessing external environmental factors like increased inflation, higher interest rates, global supply-chain hurdles, and ATC dynamics such as purchasing patterns, the adoption of smoke-free products and disposable income.

The bottom line also considers planned investments associated with costs to improve the digital consumer engagement system, enhanced smoke-free product research, development and regulatory preparation expenses and marketplace activities to support the company’s smoke-free products. The view also considers reduced expected net periodic benefit income.

Shares of this Zacks Rank #3 (Hold) company have gained 4.8% in the past six months compared with the industry’s growth of 2.2%.

Solid Staple Bets

Some more top-ranked stocks are Post Holding POST, General Mills GIS and The Hershey Company HSY.

Post Holdings, which is a consumer-packaged goods company, sports a Zacks Rank #1 (Strong Buy) at present. Post Holdings has a trailing four-quarter earnings surprise of 34.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for POST’s current financial-year sales and earnings suggests growth of 2.5% and 119.6%, respectively, from the year-ago reported numbers.

Hershey, the leader in chocolate and non-chocolate confectionery, currently sports a Zacks Rank #1. HSY has a trailing four-quarter earnings surprise of 11.3%, on average

The Zacks Consensus Estimate for Hershey’s current financial-year sales and earnings suggests growth of 7.7% and 9.9%, respectively, from the year-ago reported numbers.

General Mills, a branded consumer foods company, currently carries a Zacks Rank #2 (Buy). GIS has a trailing four-quarter earnings surprise of 8.7%, on average.

The Zacks Consensus Estimate for General Mills’ current fiscal-year sales and earnings suggests growth of 5.1% and 6.1%, respectively, from the corresponding year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Altria Group, Inc. (MO) : Free Stock Analysis Report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance