Altice (ATUS) Q4 Earnings Miss Estimates, Revenues Rise Y/Y

Altice USA, Inc. ATUS reported unimpressive fourth-quarter 2019 results, wherein the bottom line and the top line missed the respective Zacks Consensus Estimate. However, the company is seeing strength in broadband as it continues to reap the benefits of ongoing investments in network, including FTTH and DOCSIS 3.1 upgrades.

Net Income

Net income for the December quarter was $0.3 million compared with $213.1 million in the prior-year quarter. The decline can be attributed to lower operating income, lower net gain on derivative contracts, and higher loss on extinguishment of debt and write-off of deferred financing costs. For 2019, net income was $138.9 million or 21 cents per share compared with $18.8 million or 3 cents per share in 2018. Adjusted earnings per share came in at 10 cents, which missed the Zacks Consensus Estimate by 10 cents.

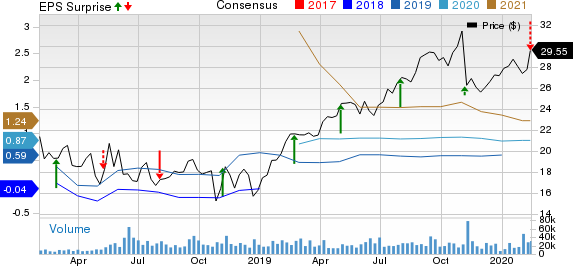

Altice USA, Inc. Price, Consensus and EPS Surprise

Altice USA, Inc. price-consensus-eps-surprise-chart | Altice USA, Inc. Quote

Revenues

Fourth-quarter aggregate revenues grew 0.8% year over year to $2,474.5 million. This reflects Residential revenue growth of 0.1% (including Broadband growth of 11.1%), Business Services revenue growth of 4.1%, and News and Advertising revenue decline of 9%. The top line lagged the consensus estimate of $2,505 million. For 2019, revenues increased 2% year over year to $9,760.9 million.

Quarterly Residential revenues were $1,941.2 million, up 0.1% year over year. This reflects decline in customer relationships sequentially due to temporary promotional roll-offs and disruption from the completed BSS/OSS integration. Revenue per customer relationship was slightly down year over year at $142.65.

Revenues from Business Services were $362.4 million, up 4.1% year over year with growth in Enterprise and Carrier of 1.2%, and SMB of 5.9%. News and Advertising revenues totaled $148.6 million, down 9%, as growth driven by a4 and Cheddar was more than offset by the political cycle in the second half of 2019, which is expected to reverse in 2020.

Other Quarterly Details

Operating income declined significantly to $427.3 million from $528.7 million in the year-ago quarter mainly due to higher programming and direct costs, other operating expenses, and restructuring expenses. Adjusted EBITDA was $1,085 million compared with $1,106.1 million in the prior-year quarter.

Cash Flow & Liquidity

Operating free cash flow in 2019 was down 3.3% year over year to $2,910.1 million, mainly reflecting higher investment in key growth initiatives such as FTTH and mobile. Free cash flow in 2019 was $1,198.8 million compared with $1,354.7 million in 2018, impacted by the timing of working capital outflow, partly offset by lower interest costs. As of Dec 31, 2019, the company’s consolidated net debt was $22,146 million.

2020 Outlook

Altice expects acceleration in momentum in 2020, including benefits from Altice Mobile and an integrated targeted advertising platform driving its News and Advertising business during a political upcycle. Altice provided its revenue guidance for 2020. It expects revenue growth (excluding Mobile) of 2-2.5% year over year. The company anticipates capital expenditures between $1.3 billion and $1.4 billion. It projects year-end leverage target 4.5x-5.0x net debt/adjusted EBITDA.

Zacks Rank & Stocks to Consider

Altice currently has a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader industry are Alteryx, Inc. AYX, Atlassian Corporation Plc TEAM and Splunk Inc. SPLK. While Alteryx and Atlassian sport a Zacks Rank #1 (Strong Buy), Splunk carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alteryx surpassed earnings estimates in the trailing four quarters, the beat being 129.2%, on average.

Atlassian topped earnings estimates in the trailing four quarters, the surprise being 23.9%, on average.

Splunk surpassed earnings estimates in the trailing four quarters, the beat being 74.3%, on average.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Splunk Inc. (SPLK) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

Altice USA, Inc. (ATUS) : Free Stock Analysis Report

Alteryx, Inc. (AYX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance