Allogene's (ALLO) Q1 Loss Widens Y/Y, Pipeline Progresses

Allogene Therapeutics, Inc. ALLO incurred loss of 50 cents per share in first-quarter 2020, wider than the year-ago quarter’s loss of 32 cents. The Zacks Consensus Estimate was pegged at a loss of 57 cents.

With no marketed products, the company did not record any revenues during the quarter.

Shares of Allogene have gained 15.7% so far this year compared with the industry’s increase of 3.6%.

Quarter in Detail

Research & development (R&D) expenses were $42 million, up 79.6% from the year-ago quarter. The significant increase was presumably due to higher clinical activities.

General and administrative (G&A) expenses increased 19.8% year over year to $8 million.

The company had $553 million in cash, cash equivalents and investments as of Mar 31, 2020 compared with $588.9 million as of Dec 31, 2019.

2020 Guidance Maintained

Allogene maintained its guidance for 2020 provided on the fourth-quarter earnings call. The company expects full-year loss to be in the range of $260-$280 million, which will include stock-based compensation expense of $70 million to $75 million.

Pipeline Update

Allogene has four pipeline candidates in early-stage of development, including three CAR T cell product candidates — UCART19, ALLO-501 and ALLO-715 — and a monoclonal antibody (mAB), ALLO-647.

The company expects to report initial data from the phase I study evaluating ALLO-501 in patients with relapsed/refractory (r/r) large B-cell lymphoma (“LBCL”) and r/r follicular lymphoma (“FL”), by June-end.

Allogene plans to initiate enrollment in an abbreviated phase I study, which will evaluate next generation anti-CD19 AlloCAR T, ALLO-501A, in patients with r/r LBCL or transformed FL in the second quarter. Please note that ALLO-501A is the second-generation version of ALLO-501.

The company plans to initiate a phase I study to evaluate ALLO-715 in combination with SpringWorks’ investigational gamma secretase inhibitor (GSI), nirogacestat, for treating R/R MM in the second half of 2020.

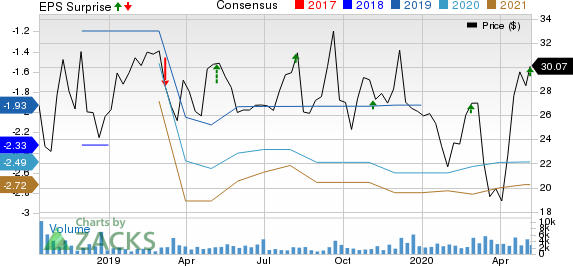

Allogene Therapeutics Inc Price, Consensus and EPS Surprise

Allogene Therapeutics Inc price-consensus-eps-surprise-chart | Allogene Therapeutics Inc Quote

Zacks Rank & Other Stocks to Consider

Allogene currently has a Zacks Rank #2 (Buy).

A couple of other top-ranked biotech stocks include Seattle Genetics Inc SGEN, Epizyme Inc EPZM and Immunomedics, Inc. IMMU, all carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Seattle Genetics’ loss per share estimates have narrowed from $3.23 to $3.10 for 2020 and from $1.41 to 81 cents for 2021 in the past 30 days. The company’s average four-quarter positive earnings surprise is 16.15%. The company’s stock has surged 44.1% so far this year.

Epizyme’s loss per share estimates have narrowed from $2.82 to $2.42 for 2020 and from $2.10 to $2.07 for 2021 in the past 30 days. The company’s average four-quarter positive earnings surprise is 10.33%.

Immunomedics’ loss per share estimates have narrowed from $1.65 to $1.60 for 2020 and from $1.03 to 87 cents for 2021 in the past 30 days. The company’s stock has surged 52.2% so far this year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Immunomedics Inc (IMMU) : Free Stock Analysis Report

Seattle Genetics Inc (SGEN) : Free Stock Analysis Report

Epizyme Inc (EPZM) : Free Stock Analysis Report

Allogene Therapeutics Inc (ALLO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance