Allison (ALSN) Soars 30% in 6 Months: More Upside Left?

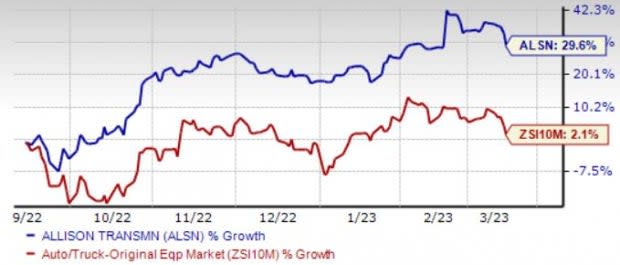

Allison Transmission ALSN has been reaping the benefits of its strategic buyouts, strong demand across all end markets and frequent product launches. This prominent designer and manufacturer of propulsion solutions for commercial and defense vehicles also has a well-defined capital allocation policy in place and is committed to boosting shareholders’ value. We like the company’s efforts to innovate and adapt to the changing dynamics of the automotive industry. The electric solutions provided by the firm position it well for strong revenue and earnings growth, going forward. Shares of Allison have risen 29.6% in the past six months, outperforming the industry’s growth of 2.1%.

Image Source: Zacks Investment Research

Is Allison primed for more share price appreciation from the current level? Let’s take a closer look at the firm’s fundamental growth drivers, near-term headwinds and valuation picture.

Factors to Drive Growth

Acquisitions are Enhancing Portfolio: Allison’s strategic buyouts are expected to bolster long-term growth. Acquisitions of Walker Die and C&R Tool & Engineering have enhanced the quality of its on-highway transmissions. The buyouts of Vantage Power and AxleTech’s EV systems division have accelerated Allison’s electrification strategy, expanding its system and integration level capabilities in alternative propulsion. The buyout of the Off-Highway transmission portfolio of AVTEC positions Allison for growth opportunities in the India Off-Highway market and will aid in further expansion in the Asia Middle East markets.

Focus on Advanced Technology & Product Development: FracTran, the firm’s next-generation hydraulic fracturing transmission, is bolstering Allison’s global off-highway end markets. TerraTran, an innovative propulsion solution purpose-built for the global construction and mining markets, is also set to buoy Allison’s prospects. Allison’s efforts toward innovation through 3414 Regional Haul Series (RHS) fully automatic transmission and development of products catering to electrification and fuel-cell markets for commercial vehicles augur well. The award-winning 3414 RHS has become a compelling option for customers in the Class 8 Daycab market.

Electrification Strides: Allison’s eGen family of electric products demonstrates its ability to create differentiated innovative offerings suitable for an electric future and positions the company for incremental growth opportunities. Allison’s eGen Power portfolio comprises electric axles (including 100S, 100D, 130S and 130D) for medium- and heavy-duty commercial trucks. eGen Flex portfolio caters to the development of next-gen zero emissions electric hybrid propulsion systems. Integration programs are underway with GILLIG, New Flyer and major transit original equipment manufacturers. eGen Force portfolio deals with the creation of electric hybrid propulsion system for tracked combat vehicles. This portfolio caters to a broad spectrum of applications, including the heavy Infantry Fighting Vehicle and future Main Battle Tank markets.

Defense Unit Looking Up: While sales from the Defense unit contracted year over year in 2022, Allison believes the defense market is set for sustained revenue growth in the coming years. The eGen Force portfolio is set to drive the unit’s prospects. The eGen Force electric hybrid system—designed for 50-ton track vehicles and scalable up to 70-ton tracked vehicles—will meet the U.S. Army's optionally manned fighting vehicle requirements as well as main battle tank requirements. Frequent contracts over the last six months for Abrams tank production, mobile protective firepower vehicle, U.S. Army's newest light tank and the M88 A3 Hercules recovery vehicle are expected to fuel sales growth. The contract with Larson and Tuborg for Allison's proven 3040 MX transmission for India's future infantry combat vehicle will also support the company’s international defense business.

Growing FCF & Investor-Friendly Moves: In 2021 and 2022, Allison’s FCF witnessed an increase of 3.1% and 6.5%, respectively. Adjusted FCF is estimated within $480-$530 million for 2023.In 2022, ALSN bought back $279 million of shares, representing 8% of shares outstanding and exited the year with $1 billion of authorized buyback capacity. The company has increased its annual dividend each year since 2020. It hiked its payout to 23 cents a share for the first quarter of 2023, marking the fourth straight year of dividend increases.

Favorable Projections, Valuation and Other Readings

Last year, Allison generated record sales of $2,769 million, an increase of 15.3% from 2021, driven by demand growth across its global on-highway and off-highway end markets. Encouragingly, Allison expects 2023 net sales in the band of $2,825-$2,925 million. The Zacks Consensus Estimate for sales also implies year-over-year growth of 4.5%. The company forecasts adjusted EBITDA within $965-$1,025 million for 2023, higher than 961 million.

The Zacks Consensus Estimates for 2023 and 2024 earnings implies a year-over-year increase of 9% and 4.7%, respectively. The company is seeing northbound estimate revisions in its 2023 and 2024 earnings. The consensus mark for 2023 and 2024 EPS has been upwardly revised by 11 cents and 17 cents, respectively, over the past 30 days.

Allison topped earnings estimates in three of the trailing four quarters and missed once, with the average surprise being 10.4%. The company also sports a low forward earnings multiple of 7.5X, which is well below the its industry’s 21.22X. It currently carries a Value Score of A.

Should ALSN be on Your Watchlist?

On the flip side, Allison has a stretched balance sheet. As of Dec 31, 2022, long-term debt was $2,501 million against cash and cash equivalents of $232 million, depicting financial weakness. Its total debt-to-capital ratio stands at 0.74, higher than its industry's 0.31. A high total debt-to-capital ratio, both in absolute and relative terms, restricts the firm’s financial flexibility. Also, temporary hiccups, including supply chain disruptions, high operating costs and manufacturing inefficiencies amid commodity cost and labor inflation, may limit margins. Nonetheless, the stock has a lot working in its favor and is a good investment option for a long-term horizon. ALSN currently carries a Zacks Rank #3 (Hold).

Better-Ranked Players in the Auto Space

Blue Bird Corp. BLBD: Headquartered in Cambridge, BLBD is engaged in the designing, engineering, manufacturing and sale of school buses and related parts. It also offers alternative fuel applications with its propane-powered and compressed natural gas-powered school buses.

The stock currently carries a Zacks Rank #2 (Buy) and has a VGM Score of B. The Zacks Consensus Estimate for Blue Bird’s fiscal 2023 earnings and sales suggests year-over-year growth of 140% and 23.7%, respectively.

Penske Automotive PAG: Penske engages in the operation of automotive and commercial truck dealerships in the United States, Canada and Western Europe. It has become the largest dealership group for Freightliner in North America with the Warner Truck Centers acquisition.

The stock currently carries a Zacks Rank #2 and has a VGM Score of B. PAG pulled off an earnings beat in the last four quarters, with the average being 11%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Penske Automotive Group, Inc. (PAG) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Blue Bird Corporation (BLBD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance