Alibaba (BABA) Surpasses Q1 Earnings & Revenue Estimates

Alibaba Group Holding Limited BABA reported first-quarter fiscal 2020 earnings of $1.83 per share, surpassing the Zacks Consensus Estimate of $1.50. Also, the bottom line increased 56% year over year.

It reported revenues of RMB114.9 billion (US$16.74 billion), up 42% from the prior-year quarter. Also, revenues surpassed the Zacks Consensus Estimate of US$16.58 billion.

The revenue increase was driven by strength in the company’s China commerce retail business, Ele.me and strong sales growth of Alibaba Cloud.

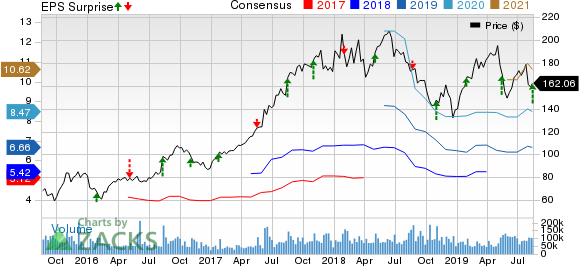

Alibaba Group Holding Limited Price, Consensus and EPS Surprise

Alibaba Group Holding Limited price-consensus-eps-surprise-chart | Alibaba Group Holding Limited Quote

Revenues by Segments

Alibaba has four reportable segments — Core Commerce, Cloud Computing, Digital Media and Entertainment, and Innovation Initiatives. The details of these segments are discussed below.

Core Commerce: This segment comprises marketplaces operating in retail and wholesale commerce in China, and international commerce. The segment’s revenues in the quarter totaled RMB99.5 billion (US$14.5 billion), reflecting an increase of 44% on a year-over-year basis.

China commerce retail business (66% of total revenues) — The business vertical’s revenues in the quarter were RMB75.6 billion (US$11 billion), reflecting an increase of 40% year over year. The increase was driven by contributions from direct sale businesses, including Tmall Supermarket and Freshippo. Combined customer management and commission revenues attributed to strong growth in the quarter.

China commerce wholesale business (3% of total revenues) — This business generated revenues of RMB2.9 billion (US$436 million), reflecting a 33% increase from the year-ago quarter. The increase was due to a rise in average revenues from paying members on 1688.com.

International commerce retail business (5% of total revenues) — Revenues in the quarter were RMB5.6 billion (US$811 million), increasing 29% year over year. The increase was driven by consolidation of Trendyol, Turkey’s leading e-commerce platform, and an increase in revenues from AliExpress.

International commerce wholesale business (2% of total revenues) — This business generated revenues of RMB2.2 billion (US$327 million), increasing 22% from the prior-year quarter. The growth was due to an increase in the number of paying members on alibaba.com platform.

Cainiao logistics services (4% of total revenues) — This business generated revenues of RMB5 billion (US$729 million). The segment represents revenues from domestic and cross-border fulfilment services provided by Cainiao Network, after elimination of inter-company transactions.

Consumer services (5% of total revenues) — This business generated revenues of RMB6.2 billion (US$900 million), increasing 137% year over year.

Others business (2% of total revenues) — The business generated revenues of RMB1.95 billion (US$284 million), reflecting a 123% year-over-year increase.

Cloud Computing: This segment comprises Alibaba Cloud that offers a complete suite of cloud services. Revenues in the quarter were RMB7.8 billion (US$1.1 billion), up 66% from the year-ago quarter, driven by an increase in average spending per customer.

Digital Media and Entertainment: The segment operates businesses through media properties that include UCWeb, Youku Tudou, OTT TV service, Alibaba Music and Alibaba Sports. Revenues from the segment were RMB6.3 billion (US$920 million), reflecting an increase of 6% on a year-over-year basis. The segment’s top-line growth was driven by consolidation of Alibaba Pictures.

Innovation Initiatives and Others: This segment includes businesses such as the YunOS operating system, AutoNavi, DingTalk enterprise messaging and others. Revenues in the quarter were RMB1.28 billion (US$187 million), up 21% year over year, driven by an increase in revenues from Amap.

Key Metrics

Mobile Monthly Active Users (MAUs) — Mobile MAUs were 755 million, improving 19.1% from the prior-year quarter and 4.7% sequentially. This improvement was caused by an increase in the adoption of mobile devices by consumers, as the primary method of accessing Alibaba’s platforms.

Annual Active Buyers — China retail marketplaces had 674 million annual active buyers, reflecting 17% year-over-year growth and 3.1% sequential improvement.

Operating Results

Alibaba’s operating expenses (product development + sales and marketing + general and administrative) of RMB27.5 billion increased 1% from a year ago.

Operating margin was 21%, up 1100 basis points year over year.

Adjusted EBITDA also increased 30% year over year to RMB34.6 billion (US$5 billion).

Balance Sheet

Alibaba exited the fiscal first quarter with cash and cash equivalents, as well as short-term investments of approximately RMB212.2 billion (US$30.9 billion) compared with RMB193.2 billion in fourth-quarter fiscal 2019.

Cash Flow/Share Repurchase

Net cash flow from operations was RMB34.6 billion (US$5 billion) while free cash flow was RMB26.4 billion (US$3.8 billion) in the fiscal first quarter.

Zacks Rank and Stocks to Consider

Currently, Alibaba has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector include AMETEK, Inc. AME, Booking Holdings Inc. BKNG and eBay Inc. EBAY, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for AMETEK, Booking Holdings and eBay is currently projected at 9.47%, 13.4% and 9.4%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance