Airline Stock Roundup: Q3 Earnings Beat at LUV & SKYW, Miss at JBLU & More

In the past week, the likes of JetBlue Airways JBLU, Southwest Airlines LUV, SkyWest SKYW and Hawaiian Holdings HA reported earnings for third-quarter 2022. Even though robust air-travel demand boosted the top lines of these airline operators, high fuel costs limited bottom-line growth. Alaska Airlines, the wholly-owned subsidiary of Alaska Air Group ALK, decided to exercise its option of purchasing 52 more 737 MAX jets from Boeing.

More updates on airlines’ third-quarter earnings are available in the past-week’s write-up.

Recap of the Latest Top Stories

1 JetBlue Airways’ third-quarter 2022 earnings (excluding 3 cents from non-recurring items) of 21 cents per share fell short of the Zacks Consensus Estimate of 24 cents. Higher operating expenses hurt the bottom line. Strength in air-travel demand, however, helped JBLU reap a quarterly profit for the first time since the onset of the pandemic. In the year-ago quarter, JBLU incurred a loss of 12 cents per share. Operating revenues of $2,562 million climbed 29.9% year over year and beat the Zacks Consensus Estimate of $2,559.7 million. The double-digit year-over-year jump reflects improving air-travel demand. JetBlue currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

2. Southwest Airlines’ third-quarter 2022 earnings of 50 cents per share outpaced the Zacks Consensus Estimate of 41 cents. Moreover, the bottom line improved by more than 100% year over year. Revenues of $6,220 million lagged the Zacks Consensus Estimate of $6,228.1 million but improved 32.9% year over year on the back of improvement in leisure demand and close-in bookings in September 2022. LUV’s top line also benefited from its loyalty program. However, LUV had to bear an unfavorable impact of nearly $18 million due to the flight disruptions caused by Hurricane Ian in late September 2022.

LUV expects the December-quarter revenues to increase in the 13-17% band from fourth-quarter 2019 levels.

.3. SkyWest reported third-quarter 2022 earnings of 96 cents per share, surpassing the Zacks Consensus Estimate of 72 cents. In the year-ago quarter, SKYW reported earnings of $1.45 per share. The 33.8% year-over-year decline in earnings was due to the 2.6% rise in total costs. Revenues of $789.4 million, however, missed the Zacks Consensus Estimate of $829.5 million. The top line increased 6% year over year, with block hours (a measure of aircraft utilization) declining 12.6%.

Revenues from flying agreements (contributing 96.7% to the top line) rose 6.2% from the year-ago quarter’s figure. Expenses pertaining to salary, wages and benefits increased 15.8% in the quarter. Passenger load factor (percentage of seats filled by passengers) increased 5.5 percentage points to 84.6% in the September quarter, owing to the uptick in air-travel demand.

4. Hawaiian Holdings’ third-quarter 2022 loss (excluding 3 cents from non-recurring items) of 15 cents per share was narrower than the Zacks Consensus Estimate of a loss of 19 cents. HA reported a loss of 95 cents in the year-ago quarter. Moreover, quarterly revenues of $741.2 million surged 45.6% year over year but missed the Zacks Consensus Estimate of $750.8 million.

Passenger revenues (contributing 89.5% to the top line) surged 46% year over year to $663.1 million. Scheduled airline traffic, measured in revenue passenger miles, rose 29.3% year over year to 4,113,172 million in the quarter under review. Scheduled capacity (measured in available seat miles) increased 18.3% to 4,957,011 million. Scheduled load factor (percentage of seats filled by passengers) improved 7.1 percentage points to 83% in the reported quarter as traffic surge outweighed capacity expansion. Passenger revenue per ASM (PRASM) rose 23.4% to 13.38 cents. Yield (scheduled) increased 13%.

Operating revenue per available seat mile (RASM: a key measure of unit revenues) for total operations in the quarter rose 24.1% year over year to 14.93 cents. Average fuel cost per gallon (economic) increased 109% to $3.54 in the third quarter. Gallons of jet fuel consumed increased 21.4% in the September quarter with more flights in operation.

As of Sep 30, 2022, Hawaiian Holdings’ unrestricted cash, cash equivalents and short-term investments totaled $1.4 billion. Outstanding debt and finance lease obligations were $1.7 billion.

For the fourth quarter of 2022, capacity (or ASMs) is projected to decline 4-7% from the fourth-quarter 2019 levels. Total revenues are anticipated to increase 1.5-5.5% from the fourth-quarter 2019 levels. Costs per ASM (excluding fuel & non-recurring items) are expected to rise 13-16% from the fourth-quarter 2019 numbers. Gallons of jet fuel consumed are expected to fall 5.5-8.5% from the fourth-quarter 2019 actuals. Adjusted EBITDA is expected between minus $5 and plus $35 million. Fuel price per gallon is expected to be $3.49.

For 2022, gallons of jet fuel consumed are expected to fall 10-13% from the 2019 actuals. Fuel price per gallon is expected to be $3.47 for the full year. The effective tax rate is expected in the 18-19% range. Capital expenditure is expected between $120 million and $135 million.

5. Alaska Airlines decided to exercise options to purchase 52 more 737 MAX jets from Boeing. The planes will be delivered between 2024 and 2027. This huge order for Boeing jets, will expand its MAX fleet to 146 from 94.

Performance

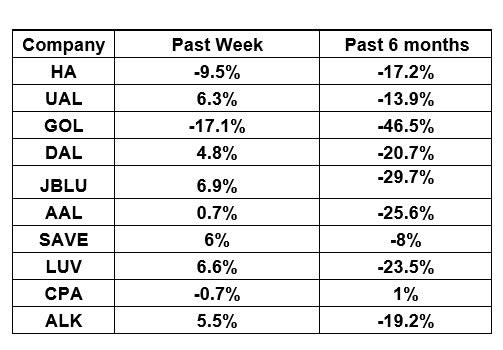

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that most airline stocks have traded in the green over the five trading days. The NYSE ARCA Airline Index has increased 2.9% to $56.95. Over the course of the past six months, the NYSE ARCA Airline Index has plummeted 25.2%.

What's Next in the Airline Space?

The third-quarter earnings reports from other carriers are scheduled to be out in the coming days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Hawaiian Holdings, Inc. (HA) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance