Airline Stock Roundup: LUV, JBLU's Rosy Q2 Revenue Views, ALK's Labor Woes & More

With air-travel demand increasing by the day as reflected in the northbound trend in bookings, Southwest Airlines LUV and JetBlue Airways JBLU raised their respective forecasts for second-quarter 2022 revenues. Also driven by strong bookings, European carrier Ryanair Holdings RYAAY anticipates load factor (percentage of seats occupied by passengers) to reach pre-pandemic levels at 94-95% in June-August. Ryanair was also recently in the news when it reported narrower-than-expected loss per share for the fourth quarter of fiscal 2022. That story was reported in details in the previous week’s write-up.

Alaska Air Group ALK also grabbed the headlines, thanks to its labor problems that saw its pilots voting to authorize a strike in case the ongoing negotiations with the management on a new contract (the deadlock persists for more than three years) ultimately fizzle out. Meanwhile, Delta Air Lines DAL decided to trim its summer schedule to dodge travel disruptions during the busy season.

Recap of the Latest Top Stories

1 On the back of upbeat air-travel demand, Ryanair expects traffic for the month of May to exceed 15 million passengers. The reading in April was14.24 million. Load factor is expected to be 92% in May, indicating growth from 91% in April. Per CEO, Michael O'Leary, "Bookings over the last number of weeks have continued to strengthen – both the numbers are strengthening and average fares being paid through the summer are rising." O'Leary added that bookings are especially strong for travel to the beaches of Portugal, Spain, Italy and Greece.

2.. Highlighting the labor trouble, which has been hurting the U.S. Airline industry of late, Alaska Air’s pilots voted overwhelmingly to authorize a strike if an agreement on a new employment contract fails to materialize. This development was confirmed by the Air Line Pilots Association (ALPA). ALPA represents the 3,000 plus pilots at Alaska Air, currently carrying a Zacks Rank #3 (Hold). 96% of pilots participated in the voting procedure with 99% supporting the call of a strike by union leaders if the talks with the airline, which have been prolonged for more than three years, eventually falls through. However, the vote to authorize a strike does not imply that passengers of Alaska Air will be inconvenienced. The pilots can halt work and go on a strike only if the National Mediation Board allows them to take this drastic step. So, ALK’s operations are currently in no way impacted

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

3. Driven by the continued strength witnessed with respect to passenger yield, Southwest Airlines’ management expects second-quarter 2022 operating revenues to increase in the 12-15% band from the earlier estimate of an 8-12% increase. The same is compared with the second-quarter 2019 actuals. Capacity is still expected to decline around 7% in the current quarter from the second-quarter 2019 level. Economic fuel costs per gallon are now forecast in the $3.30-$3.40 range (earlier forecast was in the $3.05-$3.15 band). Management said that the yield strength, driven by upbeat demand, more than offset the fuel price increase. LUV still expects cost per available seat miles or CASM, excluding fuel, oil and profit-sharing expenses, and special items, to increase 14-18% in the ongoing quarter from the comparable period’s level in 2019.

4. Driven by a strong demand environment, JetBlue Airways’ management expects revenues for second-quarter 2022 to be “at or above high-end” of the earlier expectation of an 11-16% increase. The metric is also compared with the second-quarter 2019 actuals. On the back of a healthy completion factor so far this quarter, capacity is now expected to increase in the 2-3% band (earlier expectation for the second-quarter 2022 capacity was either flat or an increase up to 3% from the second-quarter 2019 actuals). JBLU still expects CASM, excluding fuel, oil and profit-sharing expenses, and special items, to increase 15-17% in the ongoing quarter from the comparable period’s level in 2019. Fuel price per gallon is now expected to be $4.08 compared with the earlier estimate of $3.79.

5. To improve operational reliability as air-travel demand bounces back from the pandemic lows, Delta’s management confirmed that in the Jul 1-Aug 7 time frame, it will reduce services by roughly 100 daily departures. The cuts will be primarily in the US and Latin America markets. Highlighting the buoyant air-travel demand scenario, DAL anticipates to carry 2.5 million customers this Memorial Day weekend. The projection, if comes true, would mean a 25% increase from the year-ago reported figure.

Performance

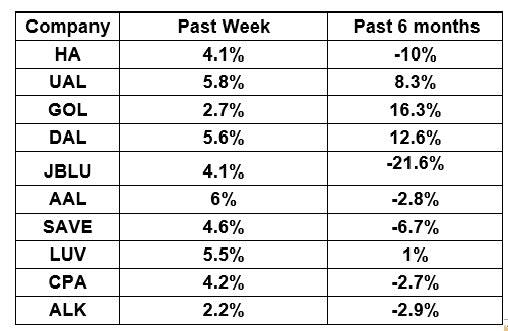

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that the airline stocks have traded in the green over the past week, driven by the optimistic revenue forecasts for the June quarter as air-travel demand soars. The NYSE ARCA Airline Index has gained 3.8% to $70.98. Over the past six months, the NYSE ARCA Airline Index has declined 11%.

What's Next in the Airline Space?

With Delta scheduled to be present at the Bernstein Strategic Decisions Conference on Jun 1, all eyes will be on whether DAL ups its second-quarter 2022 revenue forecast like LUV and JBLU.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance