Airline Stock Roundup: LTM Posts Q1 Loss on Coronavirus Woes, UAL, AAL in Focus

In the past week, Latin American carrier LATAM Airlines Group LTM reported loss in first-quarter 2020 results. The drastic drop in passenger revenues due to the coronavirus-induced bleak air-travel caused this underperformance. Notably, the airline was also in news in the previous week when it filed for U.S. bankruptcy protection.

United Airlines UAL also grabbed headlines in the past week for reportedly announced plans to eliminate 13 officer roles as part of its cost-cutting initiatives to deal with the pandemic-led slump in air-travel demand.

With airlines fighting for survival due to this unprecedented crisis, updates on the unpleasant subject of layoffs were also being circulated by other carriers including American Airlines AAL.

Recap of the Past Week’s Most Important Stories

1. LATAM Airlines’ first-quarter 2020 loss (excluding $2.85 from non-recurring items) of 65 cents per share was wider than the Zacks Consensus Estimate of a loss of 15 cents and first-quarter 2019’s reported loss of 10 cents. Total revenues of $2,266.1 million too decreased 6.8% year over year and also missed the Zacks Consensus Estimate of $2,453.3 million. The year-over-year deterioration was due to a 7.1% decline in passenger revenues, which accounted for 85.6% of the top line. The carrier transported 2.9% less passengers in the quarter on a year-over-year basis. Moreover, cargo revenues declined 4.2% in the March quarter. Further, capacity contracted 6.6% while traffic fell 10.1%. With traffic decline exceeding the decrease in capacity, load factor (% of seats filled by passengers) fell 3.1 percentage points to 81% in the period. Additionally, consolidated passenger unit revenues dipped 0.6 percentage points in the quarter under discussion. Meanwhile, total unit costs slipped 0.6% and fuel gallons consumed decreased 11.1% in the reported quarter.

2. American Airlines is planning to cut jobs in the management and support staff (MSS) team by 30%, per a letter to the employees addressed by Elise Eberwein, the company’s executive vice president of People and Global Engagement. The airline is opening a voluntary early-out program for MSS team members to volunteer through Jun 10. In case there aren’t enough volunteers, the company will resort to involuntary layoffs. Those dismissed will remain on payroll through Sep 30 and continue to receive full compensation per the CARES Act guidelines.

3. Per the plan to trim headcount, management at United Airlines stated that the 13 officer positions will be eliminated effective Jun 15. Eight of those removed will continue to be attached to the company through Sep 30. To avoid furloughs, the carrier is launching programs for employees to accept voluntary leave or early retirement. The company offered several of its flight attendants voluntary separation packages.

4. In a bid to protect its plots from taking involuntary furloughs, Delta Air Lines DAL is reportedly working with its pilots’ union to avoid involuntary furloughs of more than 2,300 pilots. Notably, the carrier carried out a reshuffling process to align its staff strength with the flight frequency, scheduled for summer 2021. In a "surplus" bid, Delta asked employees to apply for the available posts at one of its U.S. pilot bases. Following the results, Delta will transfer approximately 7,000 pilots to different locations or aircraft types, per the company's Master Executive Council (MEC) of the Air Line Pilots Association. However, 2,327 pilots remained unassigned.

5. With the coronavirus pandemic disrupting air-travel demand, this currently Zacks Rank #2 (Buy) European low-cost carrier Ryanair Holdings RYAAY reported a 99.5% year-over-year plunge in May traffic to merely 0.07 million guests. As wide-spread travel restrictions are still in place, the carrier’s LaudaMotion unit in Austria did not carry any passenger during the month. The carrier operated 701 scheduled flights in the period including those for rescue operations, relief and medicine supply on behalf of various EU governments. Moreover, 99% of those flights arrived on time.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

6. In a customer-friendly move, Southwest Airlines LUV extended its published flight schedule from Oct 31, 2020 to Jan 4, 2021. Through this expansion, the carrier aims to introduce additional flights and routes to cater to the anticipated spike in demand for leisure travel during autumn and winter holidays. The airline also plans to resume flights to Mexico and the Caribbean via Cancun, San Jose del Cabo/Los Cabos, Havana, Montego Bay and Nassau beginning Jul 1, 2020.

Performance

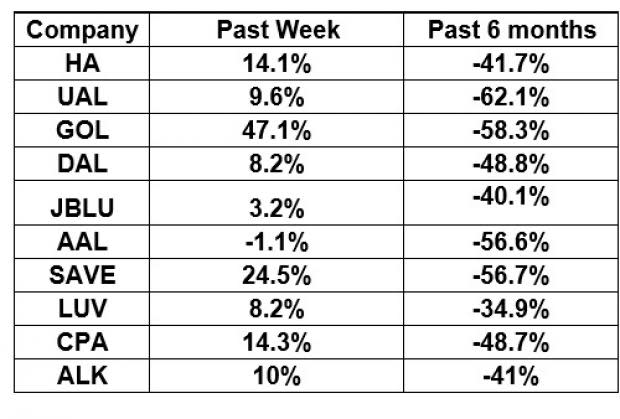

The following table shows the price movement of major airline players over the past week and during the past six months.

The table above shows that almost all airline stocks traded in the green in the past week, driven by the easing of coronavirus-triggered travel bans. The uptick led the NYSE ARCA Airline Index rally 10.2% to $57.15. Over the course of the past six months, the NYSE ARCA Airline Index has declined 46.4%.

What's Next in the Airline Space?

Investors will keenly await further coronavirus-related developments and their impact on air travel.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

LATAM Airlines Group S.A. (LTM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance