Air Products (APD) Seals NASA Deals to Supply Liquid Hydrogen

Air Products and Chemicals, Inc. APD recently announced that it has secured multiple supply contracts from NASA, which are worth more than $130 million. These contracts involve delivering liquid hydrogen to various NASA locations, including the Kennedy Space Center, Cape Canaveral Space Force Station and other NASA facilities.

One public contract will enable Air Products to provide liquid hydrogen to NASA to support operations at the Kennedy Space Center and the Cape Canaveral Space Force Station. The multi-year contract, with a maximum value of around $75 million, is already in effect.

Additionally, the company has been awarded a more than $57 million public contract by NASA that requires it to provide liquid hydrogen to numerous NASA facilities, including the Marshall Space Flight Center in Huntsville, AL, and the Stennis Space Center in Bay St. Louis, MS.

The company said that it has been collaborating with NASA for a significant period, dating back to the early stages of the U.S. space program, the Apollo 11 mission, and continuing through recent missions aimed at exploring Mars. The company also provides necessary industrial gases to support NASA’s critical missions and anticipates continuing its longstanding partnership with the U.S. space program for many more decades.

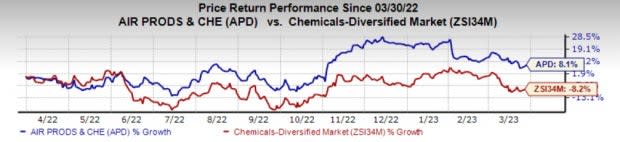

Shares of Air Products have gained 8.1% over a year against an 8.2% fall recorded by its industry.

Image Source: Zacks Investment Research

Air Products, on its first-quarter call, said that it expects its adjusted earnings to be in the range of $11.20-$11.50 per share for fiscal 2023. The company sees its adjusted earnings for the fiscal second quarter to be between $2.50 and $2.70. For fiscal 2023, the company expects its capital expenditures to be in the range of $5-$5.5 billion.

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. price-consensus-chart | Air Products and Chemicals, Inc. Quote

Zacks Rank & Key Picks

Air Products currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are Olympic Steel, Inc. ZEUS, Steel Dynamics, Inc. STLD and Linde plc LIN. LIN currently carries a Zacks Rank #2 (Buy), while ZEUS and STLD sport a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Olympic Steel’s shares have gained 37.4% in the past year. The Zacks Consensus Estimate for ZEUS’ current-year earnings has been revised 61% upward in the past 60 days. It topped the Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 26.2% on average.

Steel Dynamic’s shares have gained 30.5% in the past year. The Zacks Consensus Estimate for STLD’s current-year earnings has been revised 37.2% upward in the past 60 days. It topped the Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 11.3% on average.

Linde’s shares have gained 6.6% in the past year. The company has an earnings growth rate of 8.1% for the current year. The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 25% upward in the past 60 days.

LIN topped the Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 6% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance