Agriculture Operations Outlook: High Food Demand Drives Resilience

The agriculture industry has been experiencing growth since mid-February 2018. There is adequate optimism for the industry through 2018 as the USDA projects agricultural exports of $142.5 billion for 2018, up $3 million from the February forecast, mainly due to a rise in corn and cotton exports. Further, the USDA expects soybean exports to increase on higher demand for soybean meal and oil and lower competition from Argentina.

Moreover, the industry is riding high on the benefits of the organic movement, where agriculturists are adapting to organic production techniques to satisfy consumers’ increasing demand for healthier foods and ingredients. Further, innovations in food processing, improved grain handling techniques, larger storage spaces, diversification and strong emerging market demand are conducive to the industry.

However, the rising rift in trade relations with China may pose a barrier to the growth of the U.S. agricultural segment. Adversities arising from China’s retaliatory tariffs on American agricultural products like soybeans, corn, pork and poultry, is turning to be a major concern for the U.S. farming segment. Among these, soybean is likely to be impacted the most as China is the largest importer.

Recent data reveals a sharp decline in China’s purchases of American soybeans due for delivery later on in 2018, in anticipation of higher tariffs. Further, China may turn to Brazil and Argentina, the world’s second and third largest soybean producers, respectively, to cover the shortfall in soybeans supplies.

Notwithstanding these headwinds, players in the U.S. agri-business are poised to gain from their efforts to adopt organic production methods, with reduced use of chemicals and pesticides to grow crops. On the whole, the shift in consumers’ preference to healthier food options, including lower consumption of meat, is likely to result in higher demand for agri-based products.

Additionally, companies are undertaking measures to lower operating costs and improve efficiency with the use of modern technology and equipment.

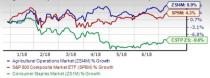

Industry Performance Edges Over S&P 500

The U.S.-China trade conflict is likely to leave a meaningful impact on the performance of the American agriculture space. However, pronounced effects of tariffs on American agriculture products are expected show up near the end of 2018 due to the advance purchase agreements for soybeans and other products. Moreover, the stocks in the industry are getting much support from strategies to shift to healthier food options, an expanding animal feed business, innovation, cost curtailment and more.

The Zacks Agriculture – Operations Industry within the broader Zacks Consumer Staples Sector has outperformed both the S&P 500 and its own sector year to date.

While the stocks in this industry have collectively gained 8.9%, the Zacks S&P 500 Composite has rallied 4.3% and Zacks Consumer Staples Sector declined 9.6%.

Year-to-Date Price Performance

However, it’s worth noting that there was a significant lack of synchronization in the performance of individual stocks within the group. While some agricultural stocks are suffering from strained margins due to increased costs to catch up with the changing industry trends, others with solid financial backing and effective execution of strategic plans are outperforming.

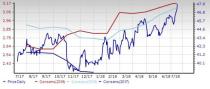

Agriculture Stocks Trading Cheap

One might get a good sense of the industry’s relative valuation by looking at its price-to-earnings ratio (P/E), which is the most appropriate multiple for valuing Consumer Staples stocks because their earnings are effective in gauging performance. The industry's valuation picture looks attractive.

This ratio essentially measures a stock’s current market value relative to its earnings performance. Investors believe that the lower the P/E, the higher the value of the stock will be.

Generally, the price of a stock rallies on a rise in earnings. As earnings forecasts move higher, demand for the stock should drive its price. If the P/E of a stock is rising steadily, it means that investors are pinning their hopes on the company’s inherent strength.

The industry currently has a trailing 12-month P/E ratio of 16.8X, which is in sync with the median level over the past year and below the one-year median level of 19.4X.

The space also attractive when compared with the market at large, as the trailing 12-month P/E ratio for the S&P 500 is 20.5X and the median over the past year is 20.3.

Price-to-Earnings Ratio (TTM)

Outperformance May Continue on Solid Earnings Outlook

Despite the threat of adverse consequences from the trade war, the agriculture operations segment has been displaying strength due to the adoption of latest technology and techniques, a shift to organic and healthier options, research & development, better grain handling and storage, diversification, effective cost control and strong emerging market demand. These factors are likely to help the stocks in the industry to generate positive shareholder returns in the near future.

But what really matters to investors is whether this group has the potential to perform better than the broader market in the quarters ahead. The above ratio analysis shows that there is a solid value-oriented path ahead. However, one should look for good entry points based on solid fundamentals and other near-term factors.

One reliable measure that can help investors understand the industry’s prospects for a solid price performance is the earnings outlook for its member companies. Empirical research shows that a company’s earnings outlook significantly influences the performance of its stock.

One could get a good sense of a company’s earnings outlook by comparing the consensus earnings expectation for the current financial year with the last year’s reported number, but an effective measure could be the magnitude and direction of the recent change in earnings estimates.

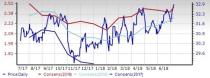

The consensus earnings estimate for the Zacks Agriculture – Operations industry is reflecting an improvement since February 2018. Moreover, the trend in earnings estimate revisions depicts a positive graph.

Price and Consensus: Zacks Agriculture – Operations Industry

Looking at the aggregate estimate revisions, it appears that analysts are hopeful of this group’s earnings potential.

Zacks Industry Rank Indicates Bright Prospects

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates continued outperformance in the near term.

The Zacks Agriculture – Operations industry currently carries a Zacks Industry Rank #108, which places it at the top 42% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Our proprietary Heat Map shows that the industry’s rank has improved considerably over the past eight weeks.

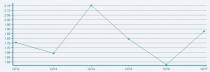

Agriculture – Operations: Earnings & Revenue Trends

The past earnings trend of the Agriculture – Operations space reveals that although the group has witnessed a steep in decline in the period between 2014 and 2016, there is an uptrend thereafter.

Agriculture – Operations EPS

Though the Zacks Agriculture – Operations industry has witnessed steep decline in revenues historically, we note that top lines have stabilized since March 2017.

Agriculture – Operations Revenues

Bottom Line

U.S. farmers and food processors are in the crossroads of a global trade conflict. Tariffs were already imposed by Canada on beef and by Mexico on pork and ham imports. Another round of tariff from China on soybeans and pork has also shored in response to Trump’s latest tariff implementation. The consequences of the trade-war are likely to be devastating, not only for these economies but for the entire world.

However, the agricultural segment should remain resilient given the increased demand for food stemming from the drastic rise in global population and the changing dietary preferences of people around the globe, particularly in emerging markets. Estimates reveal that global demand for food is expected to rise by 70% by 2050. Further, a stable economic backdrop with a tightened job market and rising income present a favorable scenario for the growth of this consumer-driven industry.

Though the industry’s valuations are cheap for the one-year horizon (as discussed above), the solid run by the stocks in the last few months might have made some stocks pricey. So, it is appropriate that investors closely evaluate the long-term expectations and look for some good entry points in the stocks that will help them to make the most of the momentum in the industry.

While none of the stocks in our Agriculture – Operations industry currently sport a Zacks Rank #1 (Strong Buy), there are two stocks that carry Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Archer Daniels Midland Company (ADM): The consensus EPS estimate for this Chicago, IL-based company, which is one of the world’s largest grain traders and a major food processor, has moved up nearly 1% for the current fiscal in the last seven days. The company has gained 17.3% in the past year.

Price and Consensus: ADM

Calyxt, Inc. (CLXT): The stock of this New Brighton, MN-based company has rallied 60.9% in the past year. The Zacks Consensus Estimate for current year witnessed positive estimate revisions of 9 cents in the last 30 days.

Price and Consensus: CLXT

Given the robust prospects of the Agriculture - Operations industry, investors may hold on to some stocks that can fetch great returns in the near future. Here is one such stock:

Adecoagro S.A. (AGRO): This Luxembourg-based agricultural company carries a Zacks Rank #3 (Hold) and has gained 5.7% in the past three months. The Zacks Consensus Estimate for the company’s current fiscal EPS has moved up by 2.6% in the last 60 days.

Price and Consensus: AGRO

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Calyxt, Inc. (CLXT) : Free Stock Analysis Report

Adecoagro S.A. (AGRO) : Free Stock Analysis Report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance