Agios (AGIO) Files MAA in EU for Rare Genetic Disease Drug

Agios Pharmaceuticals, Inc. AGIO announced that it has submitted a marketing authorisation application (“MAA”) to European Medicines Agency for the most advanced drug in its pipeline, mitapivat, to treat adults with pyruvate kinase (“PK”) deficiency, a rare genetic disease.

PK deficiency is a rare, inherited disease that presents as chronic hemolytic anemia, which is the accelerated destruction of red blood cells. The deficiency is characterized by serious complications affecting multiple organs and causes quality of life problems, including challenges with work life, social life as well as emotional health.

The MAA is based on results from two pivotal phase III studies, ACTIVATE and ACTIVATE-T, which evaluated mitapivat for the treatment of PK deficiency in adult patients who were not regularly transfused and regularly transfused, respectively.

Currently, there is no approved therapy for PK deficiency. Some treatment options include red blood cell transfusion and splenectomy, which carry both short-term and long-term risks.

It is to be noted by investors that the company has already filed a new drug application with the FDA in the United States for mitapivat to treat adults with PK deficiency. With its potential approval in the United States & European Union, mitapivat will be the first pyruvate kinase R activator to be approved for this disease.

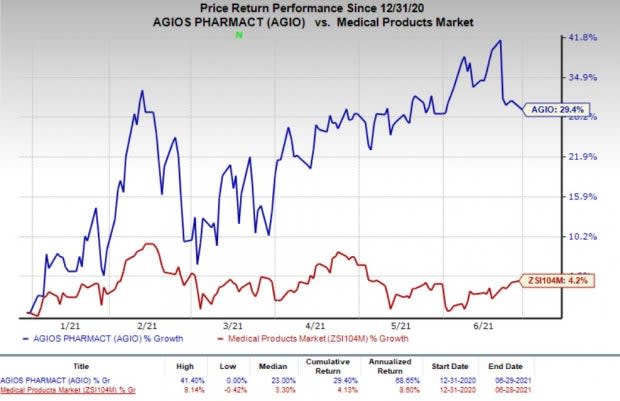

In the year so far, the stock price of Agios has risen 29.4% compared with the industry’s 4.2% growth.

Image Source: Zacks Investment Research

Mitapivat is also being developed for sickle cell disease (“SCD”), a blood disorder, and thalassemia. The company has already received an orphan drug designation from the FDA for mitapivat to treat thalassemia and SCD. A phase II/III SCD study and two phase III thalassemia studies are expected to start later in 2021.

Following the oncology business sale in April 2021, the company is completely dependent on successful development and potential approval of mitapivat.

Agios has also partnered with PerkinElmer Genomics to offer no-cost genetic testing to eligible patients in the United States with suspected hereditary anemias including PK deficiency.

Agios currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Agios Pharmaceuticals, Inc. Price

Agios Pharmaceuticals, Inc. price | Agios Pharmaceuticals, Inc. Quote

Some better-ranked stocks in the medical sector include BioNTechBNTX, Bayer BAYRY and Repligen RGEN. While BioNTech carries a Zacks Rank #1, both Bayer and Repligen currently carry Zacks Rank #2 (Buy).

BioNTech’s earnings estimates for 2021 have increased from $18.39 to $30.85 per share in the past 60 days while that of 2022 has risen from $7.55 to $25.20 over the same period. The stock has surged 182.2% this year so far.

Bayer’s earnings estimates for 2021 have increased from $1.74 to $1.81 per share in the past 60 days while that of 2022 has risen from $1.89 to $2.00 over the same period. The stock has risen 8.1% in the year so far.

Repligen’s earnings estimates for 2021 have increased from $1. 91 to $2.26 in the past 60 days while that of 2022 has risen from $2.23 to $2.56 per share over the same period.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

Repligen Corporation (RGEN) : Free Stock Analysis Report

Agios Pharmaceuticals, Inc. (AGIO) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance