Agilent Technologies Q3 Preview: Can the Earnings Streak Continue?

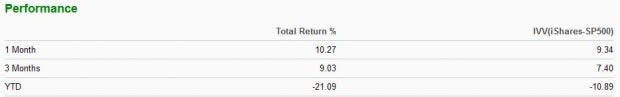

The Zacks Computer and Technology sector has been notably strong over the last month, increasing more than 10% in value and outperforming the S&P 500. Still, the sector is deep in the red year-to-date.

Below is a table illustrating the sector’s performance vs. the S&P 500 over several timeframes.

Image Source: Zacks Investment Research

A company residing in the sector that sports the highly-coveted single letter ticker, Agilent Technologies A, is on deck to reveal Q3 results after market close on Tuesday, August 16th.

Agilent Technologies is an original equipment manufacturer (OEM) of a broad-based portfolio of test and measurement products serving multiple end markets. The company was originally a spin-off from Hewlett-Packard.

How does the company stack up heading into the quarterly print? Let’s dive in and find out.

Share Performance & Valuation

Year-to-date, Agilent shares have been notably stronger than its Zacks Sector but are still down 16%.

Image Source: Zacks Investment Research

Over the last month, Agilent shares have soared, tacking on an impressive 12% double-digit gain and just barely outperforming its Zacks Sector.

Image Source: Zacks Investment Research

The recent strong price action is undoubtedly a positive, signaling that buyers have finally reappeared.

Pivoting to valuation, A’s forward earnings multiple of 27.1X is marginally above its five-year median of 26.4X and represents a somewhat steep 10% premium relative to its sector.

Image Source: Zacks Investment Research

Quarterly Estimates

Two analysts have lowered their earnings outlook for the quarter over the last 60 days, with the Consensus Estimate Trend slipping marginally. Still, the $1.20 Zacks Consensus EPS Estimate pencils in a solid 9% year-over-year uptick in earnings.

Image Source: Zacks Investment Research

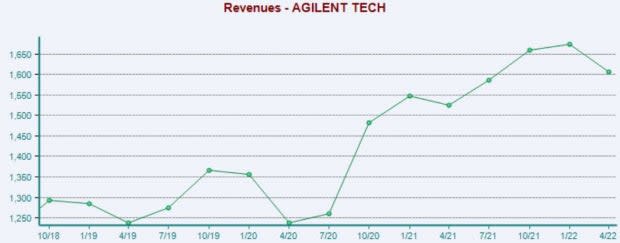

Agilent’s top-line looks to register solid growth as well – the company is projected to have generated $1.6 billion in revenue throughout the quarter, good enough for a 3% year-over-year uptick.

Quarterly Performance & Market Reactions

A’s been on a blazing-hot earnings streak, chaining together nine consecutive bottom-line beats. In just its latest quarter, the company recorded a marginal 2% EPS beat.

Top-line results have also been remarkable – A has penciled in nine revenue beats over its last ten quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, day-traders should be aware that following each of its last three quarterly prints, shares have moved downwards each time, all by at least 4.5%.

Putting Everything Together

Agilent shares have been hot as of late, outperforming its Zacks Sector over the last month and year-to-date. Valuation levels appear slightly elevated, with shares trading above their five-year median and its Zacks Sector average.

Analysts have been bearish for the quarter, but the company is projected to register solid top and bottom-line growth.

Furthermore, A has consistently reported quarterly results above expectations, but the market hasn’t reacted well following the releases as of late.

Heading into the print, Agilent Technologies A carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -1.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance