AES Corp (AES) Boosts Renewables Portfolio, Buys Commune Energy

The AES Corporation AES announced the acquisition of Community Energy Solar, LLC, thus boosting its renewables asset portfolio. The move marks one step for AES Corp. to achieve its net-zero energy future target.

Community Energy developed more than three gigawatt (GW) of solar and storage projects across the United States. Hence, the acquisition of the company by AES Corp. would certainly provide an edge to expand in the renewables arena.

Benefits of the Acquisition

AES Corp. is leading the utility industry's transition to clean energy by investing in sustainable growth and innovative solutions. To reap the benefits of the growth prospects in the renewables market, AES Corp. has been undertaking significant initiatives. The company aims to achieve 2,000 GW of utility-scale wind and solar additions by 2030. In this context, it is worth mentioning that the acquisition of Community Energy augments AES Corp.’s growth strategy in renewables in the United States and is a testament to its efforts to achieve the long-term target.

Moreover, the acquisition comes with an additional 10 GW pipeline, which strengthens AES Corp's pipeline growth strategy, bringing the total to 40 GW across the country. Furthermore, the company has signed four GW of renewables long-term power purchase agreements (PPAs) to date and the acquisition takes the total to 5.7 GW of signed PPAs. The buyout also provides an edge to achieve the goal of having 50% of its earnings from renewables and utilities.

Brief Note on AES’Renewables Target

Through its presence in key growth markets, AES Corp. is positioned to benefit from the global transition toward a more sustainable power generation mix. Hence, it is imperative to mention that the company has completed the construction or acquisition of 643 megawatts (MW) of renewables and energy storage to date. Additionally, the company had 38 GW of renewable energy in its global pipeline, among the largest pipelines in the world.

Further, to rapidly expand its renewable footprint, both in the domestic and overseas markets, the company is investing aggressively. Its subsidiary, AES Indiana, aims to invest $1.5 billion over the next five years as part of its grid modernization program and transition to a more renewables-based generation.

Growth Prospects in Renewables

Companies worldwide are transitioning to renewables, primarily to achieve the carbon-neutral target. Hence, this favorable trend in green energy space has boosted investments in renewables. Per the IEA report, the amount of renewable electricity capacity added in 2020 rose 45% in 2020 to 280 GW.

Further, the new capacity additions are expected to reach 270 GW in 2021 and 280 GW in 2022 per the report. Hence, the growth projections provide ample opportunities for companies like The AES Corp. to expand in the renewables space and boost their top line. To reap the benefits of the lucrative renewables market, companies that have been investing in renewables are:

Duke Energy DUK has taken initiatives to expand the renewable asset base and aims to reach the target of net-zero carbon emissions from electricity generation by 2050. It has already lowered its carbon emissions in 2020 by more than 40% since 2005.

Duke Energy delivered an average earnings surprise of 2.3% in the last four quarters. DUK’s long-term (three to five years) earnings growth is projected at 5.3%. Shares of Duke Energy have returned 15.8% in the past year.

Xcel Energy Inc. XEL continues to invest substantially in its utility assets and renewable projects, which will increase the reliability of its services and help meet the rising electricity demand effectively. These investments are aimed to strengthen its renewable projects. Xcel Energy aims to achieve 85% carbon reduction and completely reduce coal usage by 2030. Overall, the company plans to generate 100% carbon-free electricity by 2050.

Xcel Energy’s long-term (three to five years) earnings growth is pegged at 6.36%. Shares of XEL have rallied 3.5% in the past year.

DTE Energy DTE is investing steadily to enhance its renewable generation assets. Over the next 15 years, DTE Electric plans to withdraw a portion of its coal-fired generation and boost the natural gas-fired generation and renewables mix. DTE Energy is committed to reducing carbon emissions of its electric utility operations by 32% by 2023, 50% by 2030 and 80% by 2040 from 2005 carbon emission levels. DTE Energy expanded this commitment by announcing its net-zero carbon emission goal for DTE Electric and DTE Gas by 2050.

DTE Energy’s long-term earnings growth is pegged at 6%. Shares of DTE have surged 2.8% in the past three months.

Price Movement

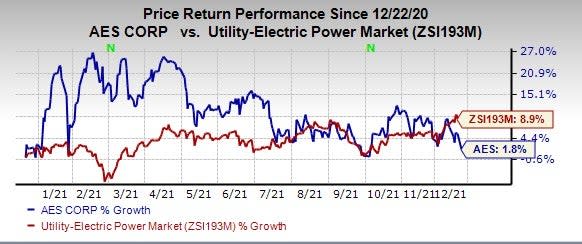

In the past year, shares of AES Corp have rallied 1.8% compared with the industry’s rise of 8.9%.

Image Source: Zacks Investment Research

Zacks Rank

AES Corp currently carriesa Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

The AES Corporation (AES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance