AES Completes Acquisition of 612 MW-Wind Energy Portfolio

The AES Corporation AES recently completed the acquisition of Valcour Wind Energy, a portfolio of six wind farms based in New York, with a total generation capacity of 612 megawatts (MW) worth of energy. This transaction should support AES Corp. to achieve its goal of adding 5 gigawatts (GW) of renewables to its backlog by 2021-end.

Details of the Deal

AES Corp. has bought the aforementioned wind portfolio from Carlyle Group CG, a global investment firm that manages assets worth $293 billion. Carlyle acquired the Valcour portfolio from Noble Environment Power in 2018, thereby making its first wind investment.

Post this acquisition, AES Corp. will take over the tasks of operating, maintaining and managing the wind portfolio from Cogentrix Energy, which is a Carlyle portfolio company. With Carlyle aiming to consistently be a key contributor toward New York’s clean energy transition and AES Corp. targeting to add more renewables in its portfolio, we expect to witness more such transactions between these two companies.

Benefits of the Acquisition

With the entire United States progressing rapidly toward a cleaner environment, New York has pledged to produce 70% of its electricity from renewable resources by 2030. Considering the fact that the Valcour wind portfolio produces approximately 25% of New York’s wind power, this portfolio’s takeover will strengthen AES Corp.’s position in New York’s renewable market.

To rapidly expand its renewable footprint, both on the domestic front and the overseas markets, the company is investing aggressively. The latest takeover of Valcour is a further testament to that. As of Sep 2021, the company had 38 GW of renewable energy in its global pipeline, which is among the largest in the world. The latest acquisition will further boost this pipeline of AES Corp.

Peer Moves

Realizing the growing market for renewables, with wind constituting a significant part, other utilities are also expanding their wind energy portfolio.

For instance, DTE Energy DTE recently announced that it will complete a 40% increase in its renewable energy capacity this year. The company aims to add 535 MW of new wind and solar in 2021.

Notably, DTE’s generation portfolio now includes 1,862 MW of wind and solar, which is enough clean energy to power nearly 700,000 homes. By 2025, the company aims to invest an additional $2.8 billion in new renewable energy projects, doubling its clean energy generation capacity.

NextEra Energy NEE has repowered nearly 1,500 MW of wind energy in 2020, increasing its facilities' efficiency. The company now has 136 wind projects in operation across 19 U.S. states and four Canadian provinces, which provide home-grown affordable energy and economic benefits to local communities.

This must have made NextEra Energy the largest producer of wind energy across the globe. Looking ahead, the company plans to add 5,950-7,900 MW of wind assets to its generation portfolio in the 2021-2024 time period.

Zacks Rank & Price Performance

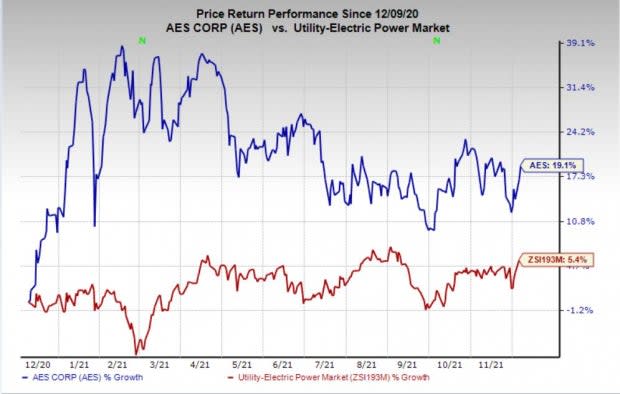

AES currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past year, shares of the company have gained 19.1% compared with the industry's 5.4% rise.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

The AES Corporation (AES) : Free Stock Analysis Report

Carlyle Group Inc. (CG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance