Advantage Solutions And Two More Undervalued Small Caps With Insider Actions In The United States

As the S&P 500 and Nasdaq reach record highs, buoyed by strong performances in tech stocks like Nvidia, the broader market sentiment appears optimistic. This climate sets a compelling stage for exploring undervalued small-cap stocks, which might offer unique opportunities in light of current economic indicators and upcoming financial events such as the Federal Reserve's commentary and inflation reports.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

PCB Bancorp | 8.9x | 2.4x | 44.44% | ★★★★★☆ |

Thryv Holdings | NA | 0.7x | 31.00% | ★★★★★☆ |

AtriCure | NA | 2.7x | 47.85% | ★★★★★☆ |

Titan Machinery | 3.9x | 0.1x | 25.84% | ★★★★★☆ |

Columbus McKinnon | 21.2x | 1.0x | 48.19% | ★★★★☆☆ |

Franklin Financial Services | 8.9x | 1.8x | 36.76% | ★★★★☆☆ |

Citizens & Northern | 12.4x | 2.8x | 39.17% | ★★★☆☆☆ |

Ramaco Resources | 13.9x | 1.1x | 12.03% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Delek US Holdings | NA | 0.1x | -134.46% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

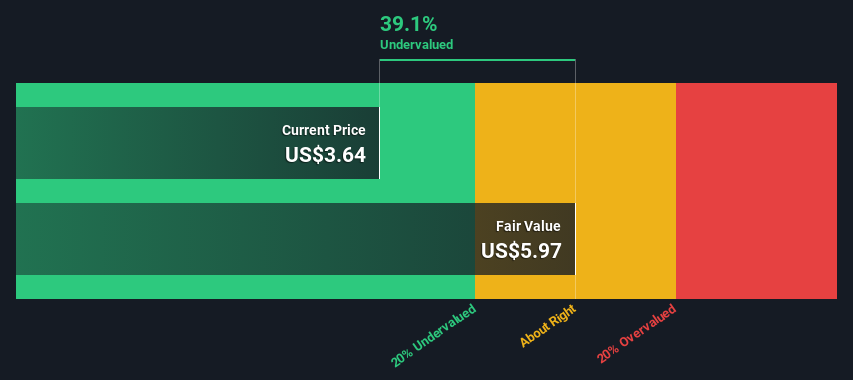

Advantage Solutions

Simply Wall St Value Rating: ★★★★★☆

Overview: Advantage Solutions is a business solutions provider specializing in sales and marketing services primarily for the consumer goods industry, with a market capitalization of approximately $1.29 billion.

Operations: Over the years, the company has experienced fluctuations in gross profit margin, ranging from 13.76% to 23.28%. Notably, in recent periods up to 2024, there's been a downward trend with margins tightening to approximately 13.51%, reflecting potential pressures on cost management or pricing strategies within its operations.

PE: -14.6x

Despite recent setbacks, including being dropped from several Russell indexes on July 1, 2024, Advantage Solutions has shown promising strategic moves. Recently, they announced a joint venture with L.A. Libations to enhance their national retail capabilities—a positive step for expanding their influence in the consumer packaged goods sector. Furthermore, the company repurchased 5 million shares for US$20 million between January and April 2024, demonstrating insider confidence and commitment to shareholder value. This activity aligns with their reaffirmed earnings guidance for modest revenue growth in 2024.

Take a closer look at Advantage Solutions' potential here in our valuation report.

Gain insights into Advantage Solutions' past trends and performance with our Past report.

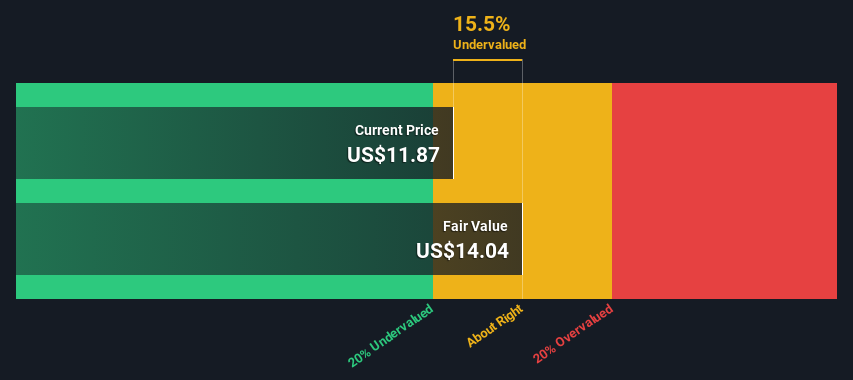

Chimera Investment

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Chimera Investment operates by investing, on a leveraged basis, in a diversified portfolio of mortgage assets.

Operations: The entity generates substantial revenue from its diversified portfolio of mortgage assets, achieving a gross profit margin of 89.09% with a net income of $124.44 million in the most recent quarter reported. Operating expenses for the same period were $54.35 million, underscoring significant operational costs relative to its financial performance.

PE: 9.4x

Chimera Investment's recent strategic maneuvers, including a reverse stock split and a fixed-income offering of $65 million in senior unsecured notes, underscore its proactive approach to financial structuring. Amidst these changes, the company has also increased its quarterly dividend to $0.35 per share, signaling confidence in its financial health. Insider confidence is evident as they recently purchased shares, reflecting a belief in the firm’s potential despite forecasts suggesting a slight earnings decline over the next three years. This combination of insider activity and dividend growth presents Chimera as an intriguing prospect within the underappreciated small-cap sector.

Leggett & Platt

Simply Wall St Value Rating: ★★★★☆☆

Overview: Leggett & Platt is a diversified manufacturer specializing in bedding products, specialized products, and furniture, flooring, and textile products with a market capitalization of approximately $4.68 billion.

Operations: The business generates revenue primarily through three segments: Bedding Products ($1.91 billion), Specialized Products ($1.28 billion), and Furniture, Flooring & Textile Products ($1.46 billion). Gross profit margins have shown fluctuations, with a recent figure at approximately 17.83% in the latest quarter of 2024, indicating the cost of goods sold relative to sales revenue within these operational areas.

PE: -10.3x

Recently, Leggett & Platt has shown resilience despite market shifts, evidenced by insider confidence with recent share purchases. With a leadership change reinstating Karl Glassman as CEO, the firm is poised to leverage his deep industry knowledge. Despite a dip in quarterly earnings and reduced dividends reflecting strategic adjustments, their proactive search for acquisitions signals growth ambitions. This aligns with their reaffirmed annual guidance projecting steady sales amidst challenging conditions, underscoring potential overlooked by the market.

Summing It All Up

Reveal the 68 hidden gems among our Undervalued US Small Caps With Insider Buying screener with a single click here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:ADV NYSE:CIM and NYSE:LEG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com