Advance Auto (AAP) Beats on Q3 Earnings & Sales, Ups '21 View

Advance Auto Parts, Inc. AAP reported adjusted earnings of $3.21 per share for third-quarter 2021 (ended Oct 9, 2021), increasing 21.6% from the prior-year figure. The reported figure also beat the Zacks Consensus Estimate of $2.78 on higher-than-expected comps growth. For the third quarter, comparable store sales witnessed 3.1% growth, outpacing the consensus mark of 0.2%. Advance Auto generated net revenues of $2,621.2 million, topping the Zacks Consensus Estimate of $2,564 million and rising 3.1% from the year-ago reported figure.

Adjusted operating income was up 6.9% year over year to $273.8 million. Adjusted selling, general and administrative expenses totaled $953.3 million compared with $871.6 million witnessed in the year-ago period.

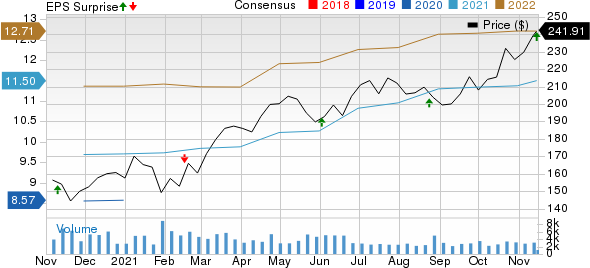

Advance Auto Parts, Inc. Price, Consensus and EPS Surprise

Advance Auto Parts, Inc. price-consensus-eps-surprise-chart | Advance Auto Parts, Inc. Quote

Financial Position

Advance Auto had cash and cash equivalents of $604.6 million as of Oct 9, 2021 compared with $834.9 million on Jan 2, 2021. Total long-term debt was $1,034 million as of Oct 9, 2021, slightly up from $1,033 million on Jan 2, 2021.

From the beginning of the year till the third quarter (ending Oct 9), operating cash flow was $924.9 million, up 14.3% from the corresponding period of 2020. Free cash flow (FCF) through the third quarter came in at $734 million compared with the year-ago quarter’s $616.6 million.

Dividend & Share Repurchase

On Nov 9, Advance Auto Parts’ board approved a cash dividend of $1 per share. The dividend would be payable on Jan 3, 2022 to all common shareholders of record as of Dec 17, 2021. During the quarter, the company repurchased around 1.1 million shares for $228.3 million at an average price of $205.65 per share. At the end of third-quarter 2021, AAP had $640.5 million remaining under the share-repurchase program.

Store Update

As of Oct 9, it operated 4,727 stores and 234 Worldpac branches in the United States, Canada, Puerto Rico and U.S. Virgin Islands. It also served 1,325 independently-owned Carquest-branded stores across these locations, in addition to Mexico, the Bahamas, Grand Cayman, Turks and Caicos, and the British Virgin Islands.

Guidance for 2021

Advance Auto has raised its full-year 2021 view. It now estimates full-year net sales in the band of $10.9-$10.95 billion, up from the previous projection of $10.6-$10.8 billion. Comparable store sales growth and adjusted operating income margin are now envisioned in the range of 9.5-10% and 9.4-9.5%, higher than the previous projection of 6-8% and 9.2-9.4%, respectively. Advance Auto expects FCF of a minimum of $725 million, up from the previous forecast of a minimum of $700 million.

Peer Comparison

Advance Auto currently carries a Zacks Rank #3 (Hold). It has an expected earnings growth rate of 35.1% for the current year. The Zacks Consensus Estimate for the current year has been revised upward by a penny over the past seven days.

AAP beat the Zacks Consensus Estimate for earnings in three of the last four quarters and missed once. Shares of the firm have rallied around 48.1% year to date.

Advance Auto’s key peers include O’Reilly Automotive ORLY, AutoZone AZO and CarMax KMX, each carrying a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

O’Reilly has an expected earnings growth rate of 24.1% for the current year. The Zacks Consensus Estimate for the current year has been revised 5.6% upward over the past 30 days.

ORLY beat the Zacks Consensus Estimate for earnings in the last four quarters, with an average surprise of 16.7%. Shares of O’Reilly have jumped around 43.5% year to date.

AutoZone has an expected earnings growth rate of 2.6% for fiscal 2022. The Zacks Consensus Estimate for fiscal 2022 has been revised upward by 6 cents over the past seven days.

AZO beat the Zacks Consensus Estimate for earnings in each of the last four quarters, with an average surprise of 18.6%. Shares of AutoZone have skyrocketed around 61.3% year to date.

CarMax has an expected earnings growth rate of 62.2% for fiscal 2022. The Zacks Consensus Estimate for fiscal 2022 has been revised upward by 4 cents over the past 60 days.

KMX beat the Zacks Consensus Estimate for earnings in three of the last four quarters and missed once, with an average surprise of 20.5%. Shares of CarMax have shot up around 58% year to date.

Year-to-Date Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

O'Reilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

Advance Auto Parts, Inc. (AAP) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

CarMax, Inc. (KMX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance