Abbott's (ABT) Q1 Earnings and Revenues Exceed Estimates

Abbott Laboratories ABT reported first-quarter 2022 adjusted earnings of $1.73 per share, which exceeded the Zacks Consensus Estimate by 17.7%. The adjusted figure also improved 31.1% from the prior-year quarter.

The quarter’s adjustments include certain non-recurring intangible amortization expenses and other expenses primarily associated with restructuring actions, acquisitions and other expenses.

Reported earnings came in at $1.37, reflecting a 37% rise year on year.

First-quarter worldwide sales of $11.89 billion were up 13.8% year over year on a reported basis. The top line exceeded the Zacks Consensus Estimate by 7.1%. On an organic basis (adjusting for the impact of foreign exchange), sales improved 17.5% year over year in the reported quarter.

Quarter in Detail

Abbott operates through four segments — Established Pharmaceuticals Division (EPD), Medical Devices, Nutrition, and Diagnostics.

In the first quarter, EPD sales improved 7.1% on a reported basis (up 13.4% on an organic basis) to $1.15 billion. Organic sales in key emerging markets improved 17.1% year over year. According to Abbott, organic sales improvement was backed by double-digit growth in several geographies and therapeutic areas, including gastroenterology, respiratory and central nervous system/pain management.

Medical Devices business sales improved 7.4% on a reported basis (up 11.5% on an organic basis) to $3.57 billion. Barring Neuromodulation, all other sub-segments in the quarter reported organic revenue growth.

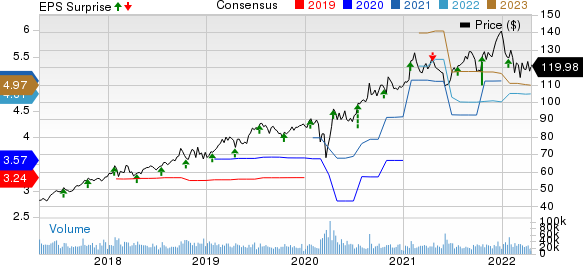

Abbott Laboratories Price, Consensus and EPS Surprise

Abbott Laboratories price-consensus-eps-surprise-chart | Abbott Laboratories Quote

Diabetes Care reported organic growth of 20.4% year over year led by FreeStyle Libre, which represented 26.2% of organic sales growth in the reported quarter. Heart Failure sales improved 16.2% organically.

Compared with the pre-pandemic figures of 2019, Medical Devices sales improved 17% on a reported basis (up 15.8% on an organic basis) in the fourth quarter. Apart from these two businesses, the company also reported double-digit organic growth in Electrophysiology and Structural Heart wings.

Nutrition sales were down 7% year over year on a reported basis (down 4.4% on an organic basis) to $1.89 billion. Pediatric Nutrition sales registered an 18.8% slump on an organic basis, impacted by a voluntary recall of certain powder formulas manufactured at one of Abbott's U.S. plants.

Adult Nutrition sales however, improved 11.5% organically. According to the company, Adult Nutrition sales benefited from improved sales performance of Abbott's complete and balanced nutrition brand Ensure and diabetes nutrition brand, Glucerna.

Diagnostics sales were up 31.7% year over year on a reported basis (up 35.1% on an organic basis) to $5.29 billion. Core Laboratory Diagnostics sales were up 4.2% organically. However, Molecular Diagnostics declined 3% on an organic basis. Rapid Diagnostics sales improved 60.8% on an organic basis. Point of Care Diagnostics sales rose 0.4% organically.

2022 Guidance

Abbott has reiterated its 2022 EPS guidance.

Full-year adjusted earnings from continuing operations (excluding specified items of $1.35 per share) are expected to be at least $4.70. The current Zacks Consensus Estimate is pegged at $4.81.

Our Take

Abbott posted better-than-expected earnings and revenue numbers for the first quarter of 2022. Overall, the year-over-year improvement in revenues looks encouraging. Barring Nutrition (where the company reported a 4.4% year-over-year decline on an organic basis), the company registered organic sales growth across all its core operating segments. Global COVID-19 testing-related sales were $3.3 billion in the quarter, led by the sales of rapid testing products.

Within the Diabetes Care business, the company has been in the limelight for developments in its flagship, sensor-based continuous glucose monitoring system, FreeStyle Libre. Within Adult Nutrition, the company gained from the strong performance of Ensure and Glucerna brands. However, Pediatric Nutrition sales were negatively impacted by a voluntary recall of certain powder formulas manufactured at one of Abbott's U.S. plants.

Zacks Rank & Key Picks

Abbott currently carries a Zacks Rank #3 (Hold).

Here are some medical stocks worth considering as these have the right combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy), or #3 to post an earnings beat this quarter.

Lucira Health LHDX has an Earnings ESP of +485.72% and a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Lucira Health’s long-term earnings growth rate is estimated at 40.2%. LHDX’s current-year P/E of 3.73x is significantly cheaper than the S&P 500 Index’s 19.36x.

NanoString Technologies, Inc. NSTG has an Earnings ESP of +15.62% and a Zacks Rank of 2. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

NanoString Technologies’ 2023 earnings growth rate is estimated at 35.1%. NSTG’s revenue growth rate for 2023 is expected to be 41.83%.

Meridian Bioscience VIVO has an Earnings ESP of +26.32% and a Zacks Rank of 2.

Meridian Bioscience’s long-term historical earnings growth rate is 16.3%. VIVO’s 2022 revenue growth rate is expected to be 6.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Meridian Bioscience Inc. (VIVO) : Free Stock Analysis Report

NanoString Technologies, Inc. (NSTG) : Free Stock Analysis Report

Lucira Health, Inc. (LHDX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance