6 Top-Ranked S&P 500 Stocks Ride Out the Coronavirus Rout

The continuing spread of the coronavirus (officially COVID 19) and the Federal Reserve’s surprising 50-basis point (bps) rate cut rattled the markets on Mar 3. The coronavirus is now estimated to have infected more than 93,000 people with cases rising rapidly in Europe.

Moreover, the World Health Organization (WHO) stated that mortality rate for the COVID-19 is 3.4% globally, higher than its previous estimate of roughly 2%.

The Dow Jones was down 786 points at close on Mar 3, wiping out more than half the 1,294 points gain on the previous trading session. Moreover, the S&P 500 Index closed 2.8% lower than with the 4.6% gain on Mar 2. The Nasdaq composite also closed nearly 3% below the gain of 4.5% in the previous trading session.

Dow Futures Rise as Joe Biden Leads

Fed’s sudden rate cut reflects the growing risk from the coronavirus outbreak to the U.S. economy. Per CNBC, which cited data from the Centers for Disease Control and Prevention, COVID-19 cases in the United States Have shot up by 17 over the past 24 hours, infecting 108 people and killing at least six.

However, the U.S. Stock futures indicate higher opening on Mar 4, buoyed by early results of Super Tuesday, which showed former Vice President Joe Biden winning key southern states including Virginia, North Carolina and Arkansas.

This anticipated rise bodes well for investors. Here we discuss six S&P 500 stocks that registered returns in the past week despite the coronavirus-led commotion and are well-poised to reap benefits from improving sentiments based on their strong fundamentals.

Key Picks

Regeneron Pharmaceuticals REGN has been one of the many biotech companies engaged in developing a treatment to tackle the coronavirus. The company is working in the same direction in agreement with the U.S. Department of Health and Human Services (HHS). CEO Leonard Schleifer expects the company’s coronavirus vaccine to be ready for human testing possibly by August. This Zacks Rank #1 (Strong Buy) stock is expected to pursue clinical trials and drug manufacturing, simultaneously.

Regeneron has returned 4.3% in the past week. The Zacks Consensus Estimate for 2020 earnings stands at $28.60 per share, having been revised 6.9% upward over the past 60 days. (Read More: Best & Worst Performing Stocks in Coronavirus Outbreak)

Regeneron Pharmaceuticals, Inc. Price, Consensus and EPS Surprise

Regeneron Pharmaceuticals, Inc. price-consensus-eps-surprise-chart | Regeneron Pharmaceuticals, Inc. Quote

Qorvo QRVO is benefiting from the robust adoption of its wireless connectivity, base station and Gallium Nitride (GaN) technology-based solutions. Moreover, this Zacks #1 Ranked company’s expanding portfolio of 5G solutions amid accelerated deployment of 5G is a key catalyst. You can see the complete list of today’s Zacks #1 Rank stocks here.

Qorvo has returned 1.8% in the past week. The Zacks Consensus Estimate for fiscal 2021 earnings stands at $7 per share, having moved 3.4% north over the past 60 days.

Qorvo, Inc. Price, Consensus and EPS Surprise

Qorvo, Inc. price-consensus-eps-surprise-chart | Qorvo, Inc. Quote

Ralph Lauren RL is gaining traction from strength across all businesses, stringent cost discipline and continued investment in brand elevation and other strategic endeavors. Further, this Zacks Rank #2 (Buy) stock continues to witness strong international and digital footprint.

With speculations being rife about lockdowns in various parts of the world, the use of the Internet and Internet-based services is increasing. Ralph Lauren’s digital business is well-poised to take advantage of any lockdown. Its presence in China and Australia, based on partnerships with Tmall and Myer, is noteworthy in this regard.

Ralph Lauren has returned 3.6% in the past week. The Zacks Consensus Estimate for its fiscal 2021 earnings has moved 2.6% up in the past 60 days to $8.67 per share.

Ralph Lauren Corporation Price, Consensus and EPS Surprise

Ralph Lauren Corporation price-consensus-eps-surprise-chart | Ralph Lauren Corporation Quote

MSCI MSCI is benefiting from robust demand for custom and factor index modules as well as the increasing uptake of the ESG solution in the investment process. This #2 Ranked company’s open architecture approach enables it to integrate content from any third-party application. This is likely to keep fueling user growth.

MSCI shares have inched up 2.8% in the past week. The consensus mark for 2020 earnings stands at $7.42 per share, having rised 3.5% over the past 60 days.

MSCI Inc Price, Consensus and EPS Surprise

MSCI Inc price-consensus-eps-surprise-chart | MSCI Inc Quote

NVIDIA NVDA is gaining from strong growth in GeForce desktop and notebook GPUs, which is aiding its gaming revenues. Moreover, an uptick in Hyperscale demand is a tailwind for this Zacks #2 Ranked stock’s data-center business. Additionally, ray-traced gaming, rendering, high-performance computing, AI and self-driving cars are key growth prospects.

NVIDIA has gained 1.5% in the past week. The Zacks Consensus Estimate for fiscal 2021 earnings has increased 9.9% to $7.80 over the past 60 days.

NVIDIA Corporation Price, Consensus and EPS Surprise

NVIDIA Corporation price-consensus-eps-surprise-chart | NVIDIA Corporation Quote

Netflix NFLX shares have gained 2.4% in the past week. This stock with a Zacks Rank of 2 is benefiting from buoyant demand for its streaming services amid growing speculations of lockdowns in various parts of the world in response to the coronavirus outbreak. Apart from a solid content portfolio, expanding international footprint is a key driver. Moreover, the launch of low-priced mobile plans in India, Indonesia and Malaysia is expected to broaden the subscriber base in the Asia-Pacific.

For the first quarter of 2020, Netflix expects to add 7 million paid subscribers. The company expects to have 174.09 million paid subscribers globally, indicating a 16.9% rise from the year-ago reported figure.

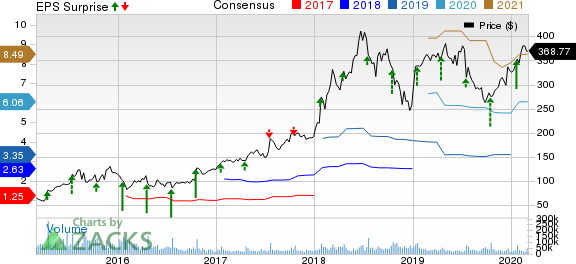

The Zacks Consensus Estimate for Netflix’s 2020 earnings has been raised 10.6% to $6.06 in the past 60 days.

Netflix, Inc. Price, Consensus and EPS Surprise

Netflix, Inc. price-consensus-eps-surprise-chart | Netflix, Inc. Quote

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

MSCI Inc (MSCI) : Free Stock Analysis Report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance