6 Profitable Companies Trading at a Discount

Companies that have positive and steady net margin and operating margin are often good investments because they can return a solid profit to investors.

According to the GuruFocus discounted cash flow calculator as of April 8, the following undervalued companies have a high margin of safety and have grown their margins over a ten-year period.

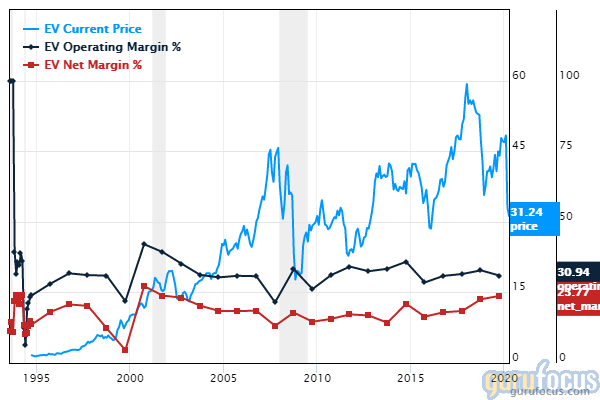

Eaton Vance

Eaton Vance Corp.'s (EV) net and operating margin have grown 17.59% and 32.01% per annum, respectively, over the past 10 years.

According to the DCF calculator, the stock is undervalued with a 37.8% margin of safety at $34.24 per share. The price-earnings ratio is 9.26. The share price has been as high as $51.79 and as low as $23.59 in the last 52 weeks; it is currently 33.89% below its 52-week high and 45.15% above its 52-week low.

The provider of asset-management services has a market cap of $3.89 billion and an enterprise value of $5.48 billion.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.04% of outstanding shares, followed by Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.02% and Ray Dalio (Trades, Portfolio)'s Bridgewater Associates with 0.02%.

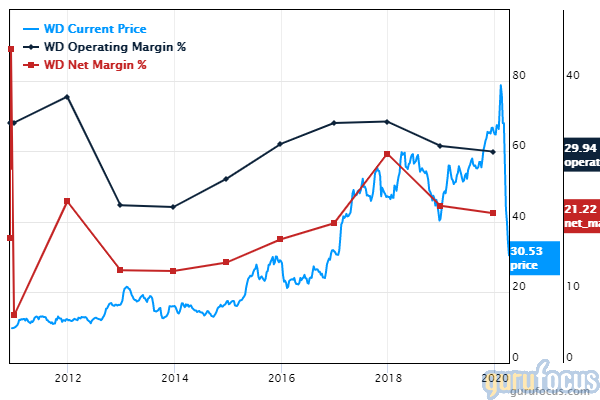

Walker & Dunlop

The net margin of Walker & Dunlop Inc. (WD) has grown 18.67% per annum over the past ten years. The operating margin have grown 30.89%

According to the DCF calculator, the stock is undervalued with an 76.58% margin of safety at $34.24 per share. The price-earnings ratio is 6.08. The share price has been as high as $79.74 and as low as $24.55 in the last 52 weeks; it is currently 57.06% below its 52-week high and 39.47% above its 52-week low.

The U.S. real estate finance company has a market cap of $1.07 billion and an enterprise value of $2.15 billion.

The company's largest guru shareholder is Chuck Royce (Trades, Portfolio) with 0.90% of outstanding shares, followed by Jeremy Grantham (Trades, Portfolio)'s GMO with 0.71% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.10%.

Aircastle

Aircastle Ltd. (AYR) has grown its net margin and operating margins by 15.96% and 52.17% annually over the past 10 years, respectively.

According to the DCF calculator, the stock is undervalued with a 6.32% margin of safety at $32.01 per share. The price-earnings ratio is 15.54. The share price has been as high as $32.47 and as low as $18.63 in the last 52 weeks; it is currently 1.42% below its 52-week high and 71.82% above its 52-week low.

The seller of commercial jet aircrafts has a market cap of $2.40 billion and an enterprise value of $7.34 billion.

The company's largest guru shareholder is Diamond Hill Capital (Trades, Portfolio) with 2.01% of outstanding shares, followed by Simons' firm with 0.16%.

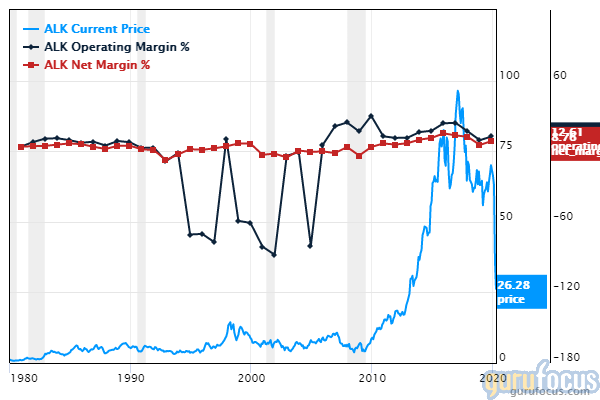

Alaska Air Group

The net margin of Alaska Air Group Inc. (ALK) has grown 9.31% per annum over the past ten years. The operating margin has grown 14.44 annually over a 10-year period.

According to the DCF calculator, the stock is undervalued with an 82.96% margin of safety at $30.08 per share. The price-earnings ratio is 4.8. The share price has been as high as $72.22 and as low as $20.02 in the last 52 weeks; it is currently 58.35% below its 52-week high and 50.25% above its 52-week low.

The airline operator has a market cap of $3.68 billion and an enterprise value of $5.36 billion.

The company's largest guru shareholder is PRIMECAP Management (Trades, Portfolio) with 4.93% of outstanding shares, followed by T Rowe Price Equity Income Fund (Trades, Portfolio) with 1.94% and Diamond Hill Capital (Trades, Portfolio) with 1.68%.

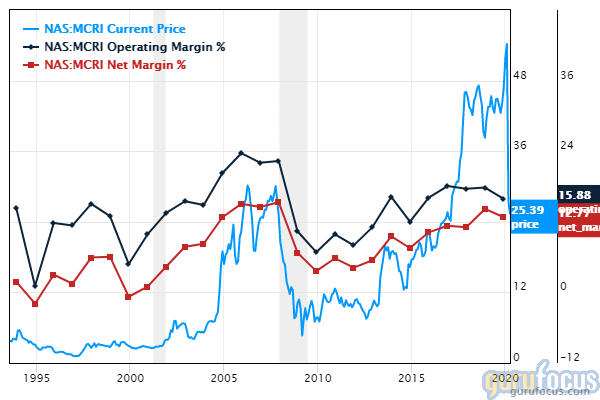

Monarch Casino & Resort

Monarch Casino & Resort Inc.'s (MCRI) net margin and operating margin have grown 9.87% and 15.99% annually over the past ten years, respectively.

According to the DCF calculator, the stock is undervalued with a 42.42% margin of safety at $27.66 per share. The price-earnings ratio is 15.72. The share price has been as high as $57.57 and as low as $12.83 in the last 52 weeks; it is currently 51.95% below its 52-week high and 115.59% above its 52-week low.

The resort and casino operator has a market cap of $507.96 million and an enterprise value of $658.42 million.

With 1.13% of outstanding shares, Simons' firm is the company's largest guru shareholder, followed by Grantham's firm with 0.08%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Retailers Beating the Market

5 Undervalued Companies With 5-Star Predictability

5 Peter Lynch Stocks With a Margain of Safety

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance