6 Investment Themes To Ride On The M&A Wave (Part 1)

With 14 companies in the midst of privatisation, it is safe to say that the M&A and privatisation wave is gaining momentum. Based on data from DBS, the number of M&A deals have exceeded the whole of 2018 and 2017 respectively. In privatisation deals over the last three years, shareholders could gain around 15 percent premium over the last transacted share price. DBS thinks that such opportunity continues to exist for investors to capitalize on.

Screening Criteria For M&A Plays By DBS

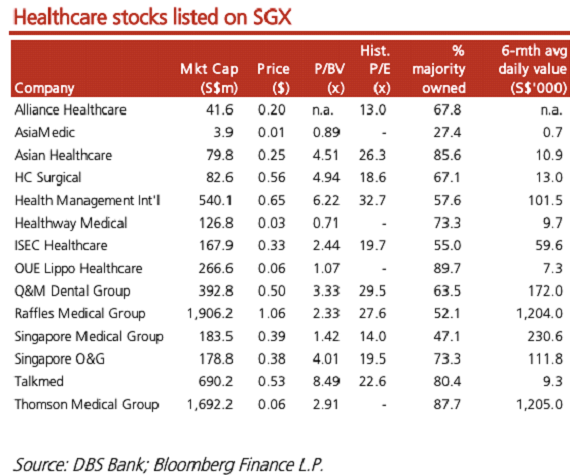

To screen for privatisation candidates, DBS uses three criteria: (1) Cash rich; (2) Low liquidity; and (3) Majority shareholder has more than 50 percent ownership. In this 3-part M&A series, we summarise six M&A investment themes from DBS for investors to consider as an alpha generating investment strategy.

In this article, we focus on two M&A investment themes that DBS highlighted in its recent thematic research: ‘Mergers In The REIT Space’ and ‘Consolidating For Better Health’.

Investors Takeaway: ‘Mergers In The REIT Space’ & ‘Consolidating For Better Health’

⦁ Mergers In The REIT Space

According to DBS, this is the year for M&A activity and “indexation” among listed S-REITs. Most REIT managers are taking strategic steps towards increasing their own assets under management (AUM) and market cap to gain investor visibility. The year started with the proposed combination of the two OUE-sponsored REITs while smaller REITs found new sponsors. For example, IREIT Global found a new sponsor in City Development while Sabana REIT gained a new sponsor with Vibrant Group selling its stake.

Moving forward, DBS believes that the industry will continue to see further consolidation within the REIT space. In particular, mid-cap industrial REITs such as AIMS APAC REIT, Cache Logistics Trust and Soilbuild REIT could be targets for M&A. DBS notes that these REITS are trading at attractive yields in excess of 7-8.5 percent. They are attractively priced for Sponsors to consider them for M&A in the long term.

AIMS APAC REIT

AIMS APAC REIT is one of the REITs that are predominantly focused on the Singapore market. AIMS APAC REIT has a diversified asset portfolio and attractive exposure to in-demand properties such as business parks and modern ramp-up facilities. Its master leases also come with built-in rental escalations, which gives investors a higher degree of income certainty ahead of the sub-sector’s anticipated recovery in 2020.

One interesting acquisition thesis that DBS spots in AIMS APAC REIT is its untapped gross floor area. AIMS APAC REIT has ~600,000 sqft of untapped gross floor area, which is one of the highest among S-REITs. Given the prime location of the untapped gross floor area, the Manager can potentially redevelop these sites into future-proof assets such as data centres. This could lift its FY19 revenue and NAV by 14.7 percent and 10.3 percent respectively by DBS’ estimates. The fragmented shareholding structure in AIMS APAC REIT also makes it a potential target.

⦁ Healthcare – Consolidate For Better Health

Unlike other industries, the healthcare industry in Singapore’s stock market is fragmented, i.e. made up of multiple small players. Besides Raffles Medical which owns Raffles Hospital and provides a suite of specialised services, the rest of the healthcare plays are small in size and tends to focus only in their own specialised field. Consolidation in the field could create bigger medical players with a greater suite of medical services while providing cross referrals for patients, share resources, attract talents and compete more effectively with bigger players. A bigger entity post-merger will also put the healthcare plays on investors’ radar.

Yahoo Finance

Yahoo Finance