6 Basic Things Everyone Needs To Know Before Investing In Their First Stock

When it comes to the world of investment, there is an infinite amount of knowledge that a person can acquire to help make them a better investor. With the financial markets constantly evolving, it might be daunting for a first-time investor to learn all the various investing knowledge at once.

Thankfully, there are certain investing principals that would never change. What works for investing legends such as Benjamin Graham, Peter Lynch and Warren Buffett in the past can still work for us today.

If you are new to investing, we like to share with you 6 investing terms that can help you in your investment decisions.

(1) Price-To-Earnings Ratio

One of the first things most investors would look is the Price-To-Earnings ratio, more commonly known as the P/E ratio. The P/E ratio refers to how much you are paying to buy a stock for every $1 that it is able to earn. For example, a P/E ratio of 10 would imply that an investor would need to pay $10 for every $1 that the company earns.

P/E ratio is important because it helps you measure just how expensive or cheap a company is compared to other companies in the same sector.

For example, based on the current price as of the time of writing, we can see from SGX StockFacts that the P/E ratio for the three telecommunication companies in Singapore range from 13.2 to 15.9, with M1 having the lowest P/E at 13.2, and SingTel having the highest P/E at 15.9. That means investors pay about $2.70 more for SingTel stocks as compared to M1 stocks to earn each dollar.

Source: StockFacts

The lower the P/E ratio is, the cheaper the stock costs to own. At the same time, it is worth asking why the stock might be cheaper than its peers in the industry. Could the company be taking on more debt to earn the return, hence making it exposed to higher risk? Or perhaps the company had a good one-off year with high profits brought in, leading to a very low P/E that will eventually revert back to the mean in the following years to come. These are all questions that an investor, even a new one, needs to ask.

(2) Price-To-Book Ratio

One main limitations of the P/E ratio is that it can only be used for companies that are actually earning a profit. At the same time, just because a company did not make a profit for the year does not mean it is suddenly worth nothing. Assets that a company owns that are on its balance sheet have a tangible value to it.

The Price-To-Book ratio, also known as the P/B ratio, is used to measure the company’s market value (i.e. its share prices) against its tangible book value (i.e. assets that it owns minus liabilities). A P/B ratio of 1 means that the company market value is the same as its book value.

A P/B ratio that is greater than 1 means that the company’s market value is higher than its existing book value. For example, the company could be worth $200 million while its assets are worth $100 million.

A P/B ratio that is lesser than 1 means that company’s market value is actually lower than its existing book value. For example, the market value of the company might be $100 million while the assets on its books are worth $150 million.

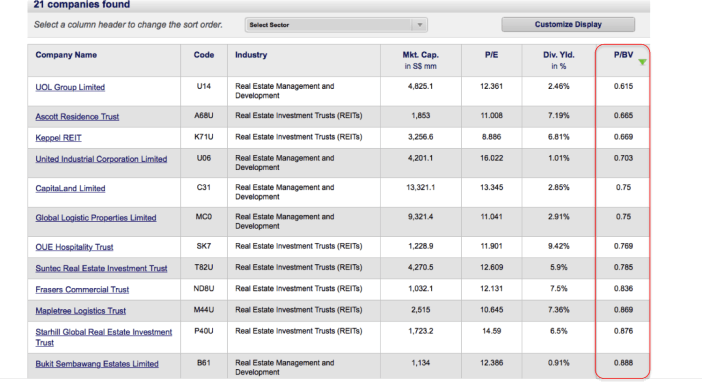

Based on a search that we did on SGX StockFacts for real estate companies, we can see that it is common to find companies that have a P/B ratio which is lesser than 1. That is because real estate companies tend to hold quite a fair bit of assets on their books in the form of the properties that they have own and have yet to sell.

Source: StockFacts

One way of understanding the differences between P/E and P/B ratio is to think of the P/E ratio as the salary from your job and the P/B ratio as the properties that you own. Some people may have high salaries but little assets. Others may have a lot of assets but little earnings.

(3) Dividends Yield

If your objective to invest is to enjoy passive income, then knowing which stocks pay out regular dividends to its shareholders will be important. Dividends refer to a sum of money that is paid regularly from the company to its shareholders out of its profits or reserves.

It is important to note that not all companies pay out dividends. There are companies that do not have a habit of paying out dividends even when they are doing exceedingly well. One such company is Google, who prefers to retain all profits in the company to cater for future growth.

Another aspect to take note of is whether or not the company has a dividend policy in place, or a consistent track record of giving out dividends. It would be foolish for an investor to invest in a company that gives the highest dividend yield without taking into consideration the company’s ability to continue sustaining this high dividend payout.

Telecommunication companies tend to provide stable dividends pay out to its shareholders due to their stable cashflow. Based on the information we found from StockFacts, dividends yields are range from 4.5% to 6% per annum, for the three telcos in Singapore.

Source: StockFacts

(4) Volume Weighted Average Price

When you think of buying a stock, the first thing that usually comes to mind would be how much the stock costs today.

While that by itself isn’t wrong, it may not necessarily be the most accurate way to look at the price of the stock, especially if your intention is to invest into the stock over a period of time, rather than to put in all your money at one go.

Since our investment into the stock is to be made over time, we think it makes more sense to be looking at the volume weighted average price of the stock, rather than to base it on what the price of the stock is today. Volume weighted average price takes the total value of the stock that has been transacted over a certain period (e.g. 6 months) divided by the total volume traded. It gives us a better picture of how much the stock is over the past period.

For example, a stock might be worth $1 today but may have a volume weighted average price of $0.95 over the past 3 months when you were busy accumulating it. Hence the price you paid for the stock is closer to $0.95, and not the $1 that it costs today.

The same logic applies when selling a stock. Unless your intention is to sell all your stocks in one single day, it would more accurate to be looking at the volume weighted average price of the stock over a period of time.

(5) Market Capitalisation

Market capitalisation is the term used to describe the total value of the company. In simple terms, it tells you how much a certain company is worth in total based on the current stock price.

To calculate market capitalisation, simply take the stock price and multiple it by the number of shares that the company has issued.

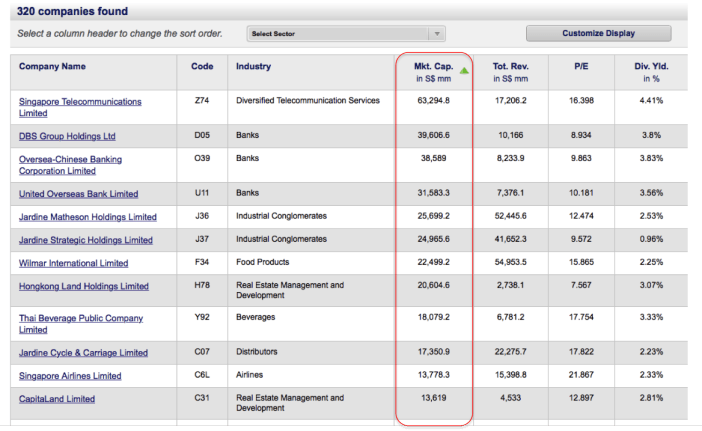

For example, DBS have about 2.5 billion shares issued. Since each share costs about $15.68 as of the time of writing, the market capitalisation of DBS would be about $39.2 billion dollars.

Generally speaking, most people would prefer to invest in companies that have a higher market capitalisation (i.e. bigger companies). That is because companies with higher market capitalisation would tend to have higher liquidity. Some investment funds may even have an investing mandate that allows their fund manager to only invest in companies that have a certain minimum market capitalisation.

Source: StockFacts

(6) Beta

Probably the least familiar of all the 6 things we covered today, Beta is a measure of volatility of a stock compared to the rest of the market.

A beta that is lesser than 1 implies that stock is less volatile than the market. A beta that is greater than 1 implies that the stock is more volatile than the rest of the market.

For example, a stock with a beta of 1.1 is likely to be 10% more volatile than the market. Investors who are less inclined to take risks may prefer to invest in stocks that have a lower.

Whenever you buy a stock, it is worth finding out what is the stock’s beta is, especially if you are new to investing. This gives you an idea on just how volatile a stock is, compared to the rest of the market.

Using StockFacts To Screen Companies

If you are new to investing, SGX has a stock-screening platform that would be ready made for you to get started on shortlisting stocks that are worth looking at based on your requirements. StockFacts is a free platform that allows users to find suitable stocks based on criteria that they have set in place. You can easily use this platform to compare between different types of stocks that you are looking at within your shortlist. Best of all, you don’t even need to sign up to use the platform. Just head over to the StockFacts page and start using.

These could be criteria that we have mentioned above, or other criteria that you think are important which you want to screen for in your search.

To be an informed investor, you will also want to stay up to date with the latest news happening in the stock market. Do follow the SGX My Gateway Facebook Page so that you will receive important updates pertaining to the market.

If you wish to find out more about SGX StockFacts, or want to learn more about investing in general, do head down to the My First Stock Carnival organised by SGX at Civic Plaza in Ngee Ann City on 7 & 8 May. The event runs from 11am to 9pm. Who knows, you might just learn what you need to get started on your investing journey.

This article was written in collaboration with SGX. All views expressed in the article are the independent opinion of DollarsAndsense.sg

Photo credit: Lendingmemo

The post 6 Basic Things Everyone Needs To Know Before Investing In Their First Stock appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance