5 Top-Ranked Tech Stocks Trading Under $10 With Room To Run

Technology sector has been money-spinning space for investors for some time now. This is evident from the fact that the Technology Select Sector SPDR ETF XLK has returned 18.2% so far this year.

The rapid adoption of cloud, Internet of Things (“IoT”), autonomous cars, advanced driver assisted systems (“ADAS”), gaming, wearables, drones, virtual reality/ augmented reality (“VR/AR”) devices, artificial intelligence (“AI”), cryptocurrencies, and other emerging technologies are fueling huge growth in the sector.

Here’s Why Tech Sector is Ideal for Investment

Technology sector is enjoying a significant dominance owing to its deep involvement with other sectors in this meaningful data-insights driven age. In fact, the growing clout of modern technology benefits almost all the sectors. The individuality of each company in the tech sector on the back of their dynamic efforts to produce something original is truly remarkable.

From digitizing retail outlets with automated check-out tech, modernizing payment systems with robust cybersecurity measures, revolutionizing health care mechanisms and education with credible data-driven insights, we can well and truly say the age of technology is here to stay.

The accelerated deployment of 5G technology — the next wireless revolution — is likely to create further growth opportunities. Additionally, positive trends in overall IT spending and improving PC shipments are encouraging.

The Winning Strategy

The big and small, all players alike are striving to deliver cutting-edge innovative technologies, which is delivering solid returns. Hence, we believe this is the right time to buy a few technology stocks that not only have growth potential but also hold promise on the momentum front.

In order to shortlist the stocks from the vast universe of tech companies, we have zeroed in on stocks that carry a Zacks Rank #1 (Strong Buy) or 2 (Buy).

Further, we have selected those that have Growth Score as well as a Momentum Score of A or B. Our research shows that stocks with a Growth & Momentum Score of A or B when combined with a Zacks Rank #1 or 2 offer the best upside potential.

At the same time, we have taken into consideration stocks which closed below $10, ensuring the best bargain for you.

Our Picks

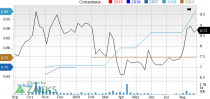

Lattice Semiconductor LSCC sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here. The company has a Momentum Score and Growth Score of A and B, respectively. The stock, currently priced at $8.02, has returned 37.4% in the past six months.

Lattice Semiconductor Corporation Price and Consensus

Lattice Semiconductor Corporation Price and Consensus | Lattice Semiconductor Corporation Quote

Portland, OR-based programmable logic devices provider has beaten the Zacks Consensus Estimate in two of the preceding four quarters delivering an average positive surprise of 83.3%.

RadiSys RSYS carries a Zacks Rank #2. The company has a Momentum Score of B. It also has Growth Score of B. The stock, currently priced at $1.57, has returned 83.5% in the past six months.

RadiSys Corporation Price and Consensus

RadiSys Corporation Price and Consensus | RadiSys Corporation Quote

Hillsboro, OR-based company specializes in computer based building blocks. The company has outpaced the Zacks Consensus Estimate in three of the trailing four quarters, delivering an average beat of 27.3%.

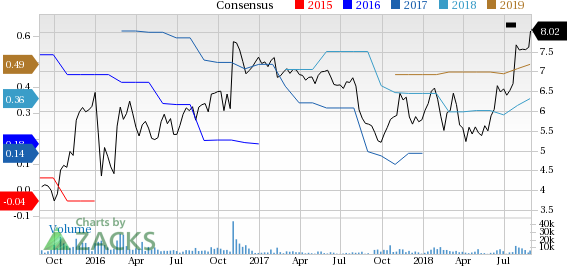

Pixelworks PXLW, carrying a Zacks Rank #2, has a Momentum Score of B. The company also has Growth Score of B. The stock, currently priced at $4.99, has returned 13.1% in the past six months.

Pixelworks, Inc. Price and Consensus

Pixelworks, Inc. Price and Consensus | Pixelworks, Inc. Quote

San Jose, CA-based company designs semiconductors and develops software that enables the visual display of broadband content. Pixelworks has surpassed the Zacks Consensus Estimate in three of the trailing four quarters, registering an average positive surprise of a whopping 112.5%.

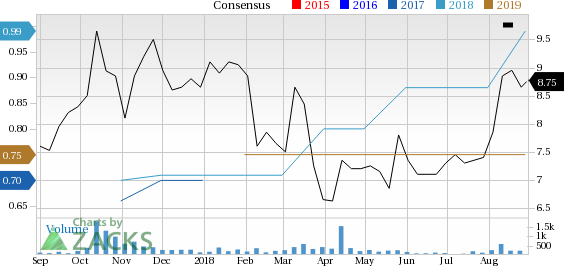

inTEST INTT carries a Zacks Rank #2. The company has a Momentum Score of A. It also has Growth Score of A. The stock, currently priced at $8.75, has returned 15.1% in the past six months.

inTest Corporation Price and Consensus

inTest Corporation Price and Consensus | inTest Corporation Quote

Mount Laurel, NJ-based company develops ATE interface solutions and temperature management products. inTest has beaten the Zacks Consensus Estimate in the trailing four quarters, delivering an average beat of 54.1%.

Magic Software Enterprises MGIC carries a Zacks Rank #2. The company has a Momentum Score and Growth Score of A and B, respectively. The stock, currently priced at $9.07 has returned 17.9% in the past six months.

Magic Software Enterprises Ltd. Price and Consensus

Magic Software Enterprises Ltd. Price and Consensus | Magic Software Enterprises Ltd. Quote

Or Yehuda, Israel-based company develops products to accelerate the process of deploying applications within existing systems. Magic Software has beaten the Zacks Consensus Estimate considering the trailing two quarters delivering an average beat of 7.2%.

Bottom Line

Investors looking for lucrative options at lower prices should go for the aforementioned companies as these as these have encouraging financials and are reasonably good choices to start.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Magic Software Enterprises Ltd. (MGIC) : Free Stock Analysis Report

Lattice Semiconductor Corporation (LSCC) : Free Stock Analysis Report

Pixelworks, Inc. (PXLW) : Free Stock Analysis Report

RadiSys Corporation (RSYS) : Free Stock Analysis Report

inTest Corporation (INTT) : Free Stock Analysis Report

SPDR-TECH SELS (XLK): ETF Research Reports

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance