5 Surprising Things Your Integrated Shield Plan Doesn't Cover

With 3 in 4 Singaporeans covered not only by MediShield Life but also by supplemental insurance, it may be hard to imagine that there are still lapses in your medical coverage. However, there are a few major exclusions in your Integrated Shield Plan that may lead to you paying thousands of dollars out of pocket if you are not careful. Below, we discuss the top 5 most surprising things your Integrated Shield Plan (ISP) doesn't cover.

Dental Treatment or Surgery

While dental treatment is covered if it is due to an accident, it is highly unlikely that your root canal or wisdom tooth removal will be covered under your ISP plan. The average root canal cost in Singapore is S$606 per tooth, getting quite pricey for those who need multiple root canals. Braces and crown implants are even more expensive, both costing an average of just under S$4,500. However, you may be eligible for a government subsidy called the Community Health Assist Scheme (CHAS) if you fall within the low to middle income group. This scheme can give you a subsidy of up to S$256.50 and— if you are a senior citizen— the Pioneer CHAS card can give you a subsidy of up to S$266.50. Furthermore, these subsidies can be used anything from X-rays to root canals and fillings, giving some financial respite to those who can't afford dental care.

Maternity and Pregnancy-Related Events

As if starting a family wasn't expensive enough, you'll be responsible for most out of pocket costs relating to your pregnancy (aside from accidental miscarriages or pregnancy complications leading to ectopic pregnancy, eclampsia, coagulation or miscarriage). This means that childbirth (Caesarian or natural), abortions, pre and post-natal care and other pregnancy-related costs will either be paid out of pocket or through your Medisave Maternity package. The Medisave Maternity package can cover S$3,000 for a normal delivery and S$4,850 for a Caesarean birth, which can reduce your out of pocket costs by up to 35%. Alternatively, international health insurance plans tend to provide more comprehensive maternity coverage, even in Singapore, with riders covering pre and post-natal examinations and childbirth. However, along with a 12 month waiting period, these riders can get very expensive with costs up to S$4,000 extra in addition to your premium. Nonetheless, the riders may be well worth the cost considering that a traditional birth can cost up to S$16,000 at a private hospital.

Injuries and Illness Related to Drug/Alcohol Abuse

If you get into a car accident because you were drink-driving, chances are not only will your car insurance policy be violated, but your health insurance will refuse to cover you for any inpatient treatment as well. Furthermore, heavy drinkers will not be covered for any diseases that are caused by heavy drinking, including but not limited to, alcohol-induced pancreatitis, liver disease, alcoholic gastritis (stomach inflammation), alcoholic heart disease and alcoholic myopathy (muscle tissue disease). These conditions are not only serious and costly, but can end up being chronic leading to thousands of dollars in continual inpatient and outpatient care. Lastly, you will also not be covered for rehabilitation for drug or alcohol abuse. If you need outside help in controlling your habit, you will be responsible for paying for rehabilitation, which can cost as much as S$19,000.

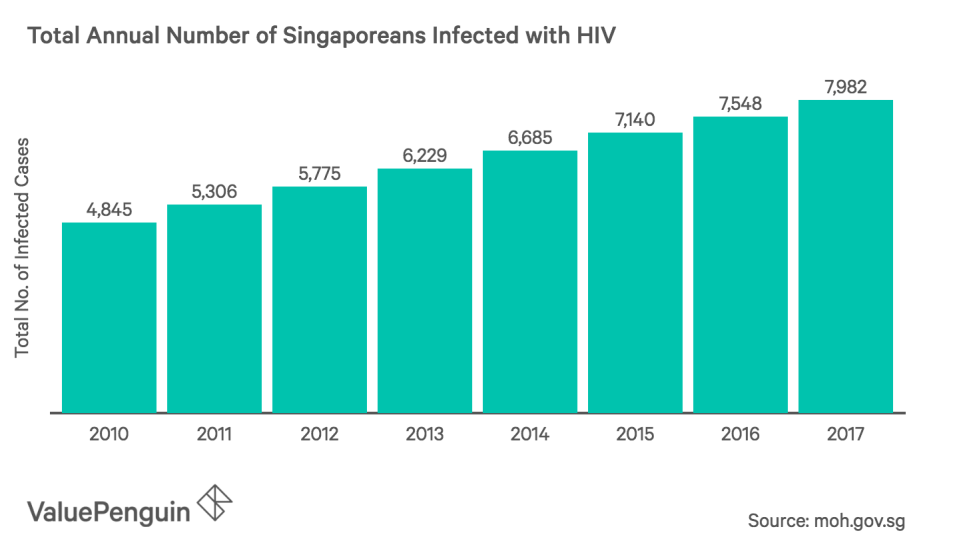

HIV/AIDS Not Due to Blood Transfusion

HIV affects around 8,000 Singaporeans and can be expensive to treat because ISPs and Medishield Life do not cover HIV acquired through sexual intercourse. With 97% of recently analysed HIV cases acquired through this method, it means most Singaporeans who have HIV will not be able to claim for HIV and AIDS related medication and treatment. In fact, the only time AIDS/HIV will be covered by your insurance is if you contracted it through a blood transfusion or through your occupation (i.e. you are a doctor). Unsubsidised anti-retroviral drugs can cost between S$1,000 and S$2,000 per month, with medication like Truvada costing around S$30 per pill. However, though your insurance will not cover costs associated with HIV, you may be able to get subsidies through Medifund and you can also use up to S$550 of your medisave funds to cover approved HIV/AIDs medication.

Treatment Due to Self-Inflicted Injuries

Unfortunately, those who hurt themselves on purpose or attempt to commit suicide and survive will be responsible for paying their own hospital bills. While health insurance covers inpatient psychiatric treatment, it does not cover treatment for self-inflicted injuries or, attempted suicides and suicide. This means that the associated costs can reach up toS$688 per night at a private hospital or S$461 per night for a public hospital if your injuries were severe enough to land you in inpatient care. Furthermore, you will also be responsible for paying for any reports such as a specialist Psychiatrist Report (around S$400) or Investigation Results report (around S$5 per service). If you find yourself having troubling thoughts or you believe you suffer from unmedicated mood disorders, it is advisable that you take the time to get outside help. There are several centers in Singapore dedicated to helping people through difficult times.

Hotlines for suicide prevention:

Samaritans of Singapore (24-hour hotline): 1800-221-4444

Care Corner Counselling Centre (Mandarin): 1800-353-5800

For Emergencies: 995

The article 5 Surprising Things Your Integrated Shield Plan Doesn't Cover originally appeared on ValuePenguin.

ValuePenguin helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValuePenguin:

Yahoo Finance

Yahoo Finance