5 Stocks to Watch on Dividend Hikes Amid Market Uncertainty

Volatility in the U.S. stock market continues due to inflation worries. The consumer price index (CPI) rose 0.5% in January 2023 compared to a slower gain of 0.1% in December 2022. With contribution mostly from the rise in prices of shelter, food and energy, prices of goods and services rose by 6.4% over the past 12 months. Reacting to this situation, the Dow, the S&P 500 and the Nasdaq have posted a negative return of 3.81%, 4.27% and 4.82% over the past month.

Domestic inflation continues to remain the biggest worry for investors and the Fed. The change in the rate of fall of inflation for January 2023 compared to December 2022 suggests that inflation remains in the system and getting control over it is more complex than what markets and the Fed have anticipated. In the month of January, more than half a million jobs were added.

Growth in wage rates turned out faster than what they were a decade ago, the labor market continues to be hot, and inflation is not coming down as fast as the Fed had thought. Retail sales in the said period grew at 3.0%, suggesting that consumer spending is not slowing as anticipated. Since getting control over inflation is the Fed’s primary target, and its ambition for 2% inflation over time looks distant, it is expected the Fed will continue with its hawkish stance.

Also, the global energy crisis and supply-chain distributions remain major threats to business. Thus, investors looking for regular income and capital preservation can invest in mature businesses, which pay out regular dividends. Amid adverse economic conditions, these stocks remain profitable due to their proven business models.

Companies, which tend to reward investors with a high dividend payout, outperform non-dividend-paying stocks during market volatility. Investors can expect a regular flow of income in volatile market conditions.

On that note, let us look at companies like Sun Communities SUI, Dell Technologies DELL, Synovus Financial SNV, Wyndham Hotels & Resorts WH and The Toronto Dominion Bank TD that lately hiked their dividend payments.

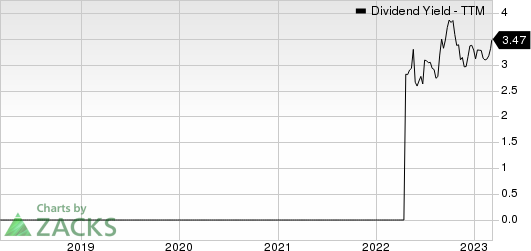

Sun Communities is a fully integrated real estate company. This Zacks Rank #3 (Hold) company owns, operates & finances manufactured housing communities concentrated on the midwestern & southeastern United States. You can see the complete list of today’s Zacks #1 Rank stocks here.

On Mar 3, SUI declared that its shareholders would receive a dividend of 93 cents a share on Apr 17. SUI has a dividend yield of 2.42%.

Over the past five years, SUI has increased its dividend six times and its payout ratio at present sits at 48% of earnings. Check Sun Communities’ dividend history here.

Sun Communities, Inc. Dividend Yield (TTM)

Sun Communities, Inc. dividend-yield-ttm | Sun Communities, Inc. Quote

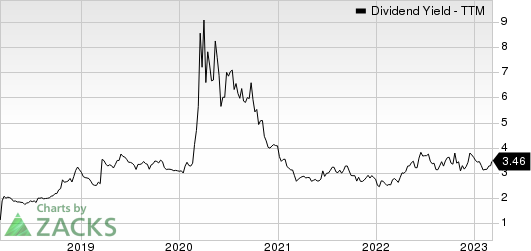

Dell Technologies is a provider of information technology solutions. This Zacks Rank #3 company designs, develops, manufactures, markets, sells and supports various comprehensive and integrated solutions, products and services in the Americas, Europe, the Middle East, Asia, and internationally.

On Mar 2, DELL declared that its shareholders would receive a dividend of 37 cents a share on May 5, 2023. DELL has a dividend yield of 3.38%.

Over the past five years, DELL has increased its dividend twice and its payout ratio presently sits at 20% of earnings. Check Dell Technologies’ dividend history here.

Dell Technologies Inc. Dividend Yield (TTM)

Dell Technologies Inc. dividend-yield-ttm | Dell Technologies Inc. Quote

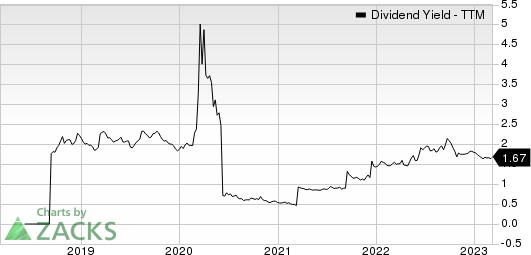

Synovus Financial is a diverse financial services company. This Zacks Rank #3 company provides integrated financial services, including commercial and retail banking, investment, and mortgage services, to its customers through locally branded divisions of its wholly-owned subsidiary, Synovus Bank, which has 257 branches in Alabama, Florida, Georgia, South Carolina and Tennessee.

On Mar 2, SNV declared that its shareholders would receive a dividend of 38 cents a share on Apr 3, 2023. SNV has a dividend yield of 3.32%.

Over the past five years, SNV has increased its dividend five times and its payout ratio presently sits at 28% of earnings. Check Synovus Financial’s dividend history here.

Synovus Financial Corp. Dividend Yield (TTM)

Synovus Financial Corp. dividend-yield-ttm | Synovus Financial Corp. Quote

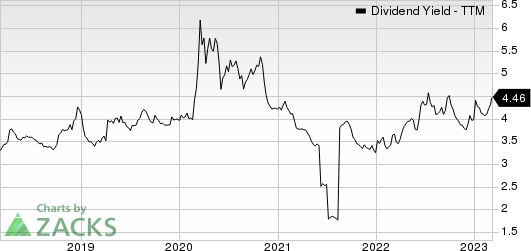

Wyndham Hotels & Resorts is a hotel and resort chain. This Zacks Rank #3 company operates as a hotel franchisor and provides related services to third-party hotel owners and others worldwide.

On Mar 2, WH declared that its shareholders would receive a dividend of 35 cents a share on Mar 29, 2023. WH has a dividend yield of 1.63%.

In the past five-year period, WH has increased its dividend six times. Its payout ratio at present sits at 32% of earnings. Check Wyndham Hotels and Resorts’ dividend history.

Wyndham Hotels & Resorts Dividend Yield (TTM)

Wyndham Hotels & Resorts dividend-yield-ttm | Wyndham Hotels & Resorts Quote

The Toronto Dominion Bank is a Canadian chartered banking company. This Zacks Rank #3 company offers a wide range of business and consumer services that include checking and savings accounts, credit cards, mortgage and student loans, trusts, wills, estate planning, investment management services and financial and advisory services.

On Mar 2, TD announced that its shareholders would receive a dividend of 70 cents a share on Apr 30, 2023. TD has a dividend yield of 4.34%.

Over the past five years, TD has increased its dividend 13 times. Its payout ratio now sits at 44% of earnings. Check Toronto Dominion Bank’s dividend history here.

Toronto Dominion Bank (The) Dividend Yield (TTM)

Toronto Dominion Bank (The) dividend-yield-ttm | Toronto Dominion Bank (The) Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synovus Financial Corp. (SNV) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Toronto Dominion Bank (The) (TD) : Free Stock Analysis Report

Sun Communities, Inc. (SUI) : Free Stock Analysis Report

Wyndham Hotels & Resorts (WH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance