5 Stocks That Just Increased Their Dividends

The Federal Reserve, lately, increased its benchmark interest rate by a widely expected 0.75 percentage point to quell sky-high inflation. After all, inflation had already jumped 9.1% last month from a year earlier, marking an alarming 41-year high, according to the Labor Department.

The key interest rate has now been raised to its highest level since 2018. In fact, the central bank has hiked interest rates for the fourth time this year, with Fed Chair Jerome Powell keeping the door open for another “unusually large increase” in interest rates at the central bank’s next meeting in September.

Such an increase in interest rates undoubtedly makes borrowing more expensive and increases the odds of a slowdown in economic growth, something that doesn’t bode well for the stock market. Anyhow, the major indexes have already been subjected to bouts of volatility all through the year.

Thus, for an astute investor, keeping an eye on dividend-paying stocks at the moment seems prudent. This is because dividend stocks have a long track of profitability and a solid business model that helps them stay afloat amid market turmoil. They not only provide a steady flow of income but also have fewer chances of experiencing wild swings in their price. In reality, dividend-paying stocks have more or less outperformed non-dividend-paying stocks in periods of market volatility.

On that note, let us look at stocks like Wells Fargo & Company WFC, Matador Resources Company MTDR, Cintas Corporation CTAS, Truist Financial Corporation TFC and MSCI Inc. MSCI that have lately hiked their dividend payments.

Wells Fargo is one of the largest financial service providers in the United States. The Zacks Rank #3 (Hold) company provides banking, insurance and investment-related services. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

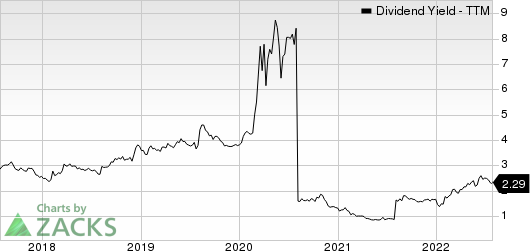

On Jul 26, 2022, WFC declared that its shareholders would receive a dividend of $0.30 a share on Sep 1, 2022. WFC has a dividend yield of 2.33%.

Over the past 5 years, WFC has increased its dividend six times, and its payout ratio presently sits at 24% of earnings. Check Wells Fargo’s dividend history here.

Wells Fargo & Company Dividend Yield (TTM)

Wells Fargo & Company dividend-yield-ttm | Wells Fargo & Company Quote

Matador Resources is predominantly involved in oil and gas exploration in the United States. The Zacks Rank #3 company’s upstream operations are primarily concentrated in the in the Delaware and Midland basins.

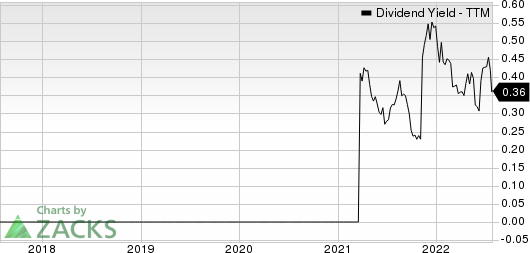

On Jul 26, 2022, MTDR declared that its shareholders would receive a dividend of $0.10 a share on Sep 1, 2022. MTDR has a dividend yield of 0.39%.

Over the past 5 years, MTDR has increased its dividend twice, and its payout ratio presently sits at 3% of earnings. Check Matador Resources’ dividend history here.

Matador Resources Company Dividend Yield (TTM)

Matador Resources Company dividend-yield-ttm | Matador Resources Company Quote

Cintas offers specialized services to businesses of all types throughout North America. The Zacks Rank #3 company is known for providing corporate identity uniforms.

On Jul 26, 2022, CTAS declared that its shareholders would receive a dividend of $1.15 a share on Sep 15, 2022. CTAS has a dividend yield of 0.96%.

In the past 5-year period, CTAS has increased its dividend five times, and its payout ratio at present sits at 33% of earnings. Check Cintas’ dividend history here.

Cintas Corporation Dividend Yield (TTM)

Cintas Corporation dividend-yield-ttm | Cintas Corporation Quote

Truist Financial is the sixth largest commercial bank in the United States. The Zacks Rank #3 company is headquartered in Charlotte, NC.

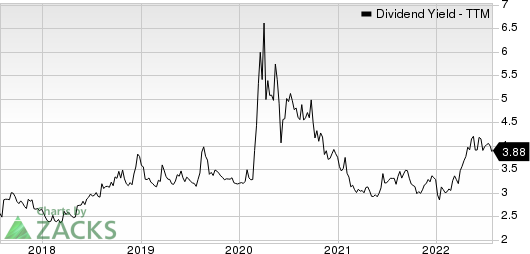

On Jul 26, 2022, TFC announced that its shareholders would receive a dividend of $0.52 a share on Sep 1, 2022. TFC has a dividend yield of 3.96%.

Over the past 5 years, TFC has increased its dividend five times, and its payout ratio now sits at 37% of earnings. Check Truist Financial’s dividend history here.

Truist Financial Corporation Dividend Yield (TTM)

Truist Financial Corporation dividend-yield-ttm | Truist Financial Corporation Quote

MSCI provides investment decision support tools. The Zacks Rank #3 company provides risk management products and services.

On Jul 26, 2022, MSCI declared that its shareholders would receive a dividend of $1.25 a share on Aug 31, 2022. MSCI has a dividend yield of 0.94%.

Over the past 5 years, MSCI has increased its dividend six times, and its payout ratio at the present time sits at 40% of earnings. Check MSCI’s dividend history here.

MSCI Inc Dividend Yield (TTM)

MSCI Inc dividend-yield-ttm | MSCI Inc Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

Cintas Corporation (CTAS) : Free Stock Analysis Report

MSCI Inc (MSCI) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Truist Financial Corporation (TFC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance