5 Stocks in Focus on Recent Dividend Hike Amid Market Mayhem

Wall Street witnessed its worst first half in 50 years this year. Thereafter, a two-month long impressive summer rally raised optimism among market participants that the market might have bottomed out. However, the Fed’s tougher-than-expected hawkish monetary stance in the Jackson Hole Symposium last month and its September FOMC meeting destroyed all hopes.

Threats of a Recession

As the interest rate is surging in the United States, global investors are trying to hold U.S.-dollar denominated assets to get higher returns. Consequently, the ICE U.S. Dollar Index (DXY), which measures the greenback’s strength against a basket of six major currencies, has skyrocketed to a 20-year high in 2022.

With respect to the U.S. dollar, – the British has pound plunged to an all-time low, the Japanese yen is at a 20-year low, the euro is at a 20-year low and the Chinese yuan has fallen to its 14-year low. Currencies of several major emerging economies have fallen to their historic-low levels against the U.S. dollar.

Economists and financial researchers are concerned that a rising dollar will hurt the sales of U.S. multinational companies as their products will be more expensive in the international markets. Further, the volume of international trade is likely to be impacted as most of these trades are settled in U.S. dollar terms.

The yields of U.S. government bonds have soared. On Sep 27, the yield on the benchmark 10-Year U.S. Treasury Note touched 4%, its highest since 2010. The yield on the short-term 2-year U.S. Treasury Note climbed 4.3%, its highest since 2007. The yield on the long-term 30-Year U.S. Treasury Note closed at 3.88%.

The yields of 2-year and 10-Year Notes have inverted for the last two months. After the last round of rate hike in September, the yields on 10-Year and 30-Year Notes have also inverted. Economists generally consider this situation as a sign of an imminent recession.

Stocks in Focus

At this juncture, dividend-paying stocks will be in huge demand to safeguard one’s portfolio. We believe one should consider stocks that have recently raised their dividend payments. Five such companies are — Accenture plc ACN, CVB Financial Corp. CVBF, Investar Holding Corp. ISTR, Microsoft Corp. MSFT and Texas Instruments Inc. TXN.

Accenture has been steadily gaining traction in its outsourcing and consulting businesses backed by high demand for services that can improve operating efficiencies and save costs. ACN has been strategically enhancing its cloud and digital marketing suite through buyouts and partnerships.

Accenture’s strong operating cash flow has helped it reward shareholders in the form of dividend payments and share repurchases, and pursue opportunities in areas that show true potential. ACN carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

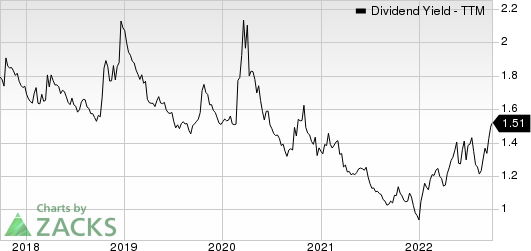

On Sep 22, 2022, Accenture declared that its shareholders would receive a dividend of $1.12 per share on Nov 15, 2022. ACN has a dividend yield of 1.7%. Over the past 5 years, Accenture has increased its dividend five times, and its payout ratio presently stays at 36% of earnings. Check ACN’s dividend history here.

Accenture PLC Dividend Yield (TTM)

Accenture PLC dividend-yield-ttm | Accenture PLC Quote

CVB Financial is a bank holding company. CVBF's principal business is to serve as a holding company for the bank, community, ventures, and for other banking or banking-related subsidiaries that it may establish or acquire.

Through its network of banking offices, the CVB Financial emphasizes personalized service combined with offering a full range of banking and trust services to businesses, professionals and individuals located in the service areas of its offices. CVBF carries a Zacks Rank #3.

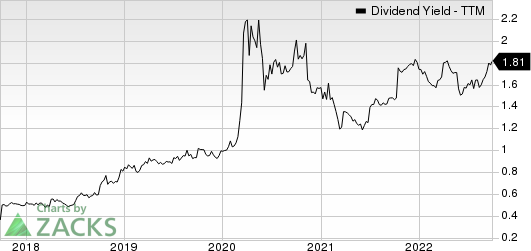

On Sep 21, 2022, CVB Financial declared that its shareholders would receive a dividend of $0.20 per share on Oct 20, 2022. CVBF has a dividend yield of 3%. Over the past 5 years, CVB Financial has increased its dividend three times, and its payout ratio presently stays at 52% of earnings. Check CVBF’s dividend history here.

CVB Financial Corporation Dividend Yield (TTM)

CVB Financial Corporation dividend-yield-ttm | CVB Financial Corporation Quote

Investar Holding is a bank holding company for Investar Bank. ISTR offers a range of commercial and retail lending products throughout its market areas, including business loans to small to medium-sized businesses and professional concerns, as well as loans to individuals.

Investar Holding also provides cash management products and services, such as remote deposit capture, electronic statements, positive pay, ACH origination and wire transfer, investment sweep accounts, and business Internet banking, as well as debit cards and mobile banking services. ISTR carries a Zacks Rank #3.

On Sep 21, 2022, Investar Holding declared that its shareholders would receive a dividend of $0.095 per share on Oct 31, 2022. ISTR has a dividend yield of 1.9%. Over the past 5 years, Investar Holding has increased its dividend 15 times, and its payout ratio presently stays at 45% of earnings. Check ISTR’s dividend history here.

Investar Holding Corporation Dividend Yield (TTM)

Investar Holding Corporation dividend-yield-ttm | Investar Holding Corporation Quote

Microsoft’s performance is benefiting from strength in its Azure cloud platform amid accelerated global digital transformation. Teams’ user growth is gaining from the continuation of remote work and mainstream adoption of the hybrid/flexible work model. Recovery in advertising and job market has boosted LinkedIn and Search revenues.

Solid uptake of new Xbox consoles is aiding the gaming segment performance. MSFT is witnessing growth in user base of its different applications including Microsoft 365 suite, Dynamics and Power Platform. Microsoft expects Surface revenues to grow in the mid-teens range, driven by strong demand for premium devices. MSFT carries a Zacks Rank #3.

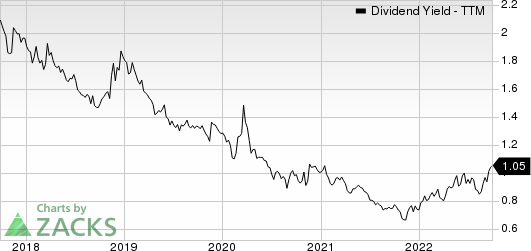

On Sep 20, 2022, Microsoft declared that its shareholders would receive a dividend of $0.68 per share on Dec 8, 2022. MSFT has a dividend yield of 1.1%. Over the past 5 years, Microsoft has increased its dividend six times, and its payout ratio presently stays at 27% of earnings. Check MSFT’s dividend history here.

Microsoft Corporation Dividend Yield (TTM)

Microsoft Corporation dividend-yield-ttm | Microsoft Corporation Quote

Texas Instruments is benefiting from a solid rebound in the automotive market. Further, a solid demand environment in the industrial, communication equipment and enterprise systems markets is a major positive for TXN. Additionally, solid momentum across the Analog segment owing to robust signal chain and power product lines, is contributing well to the top line.

The Embedded Processing segment also remains robust. Solid investments in new growth avenues and competitive advantages are acting as a tailwind. Texas Instruments’ portfolio of long-lived products and efficient manufacturing strategies are the other positives. TXN carries a Zacks Rank #3.

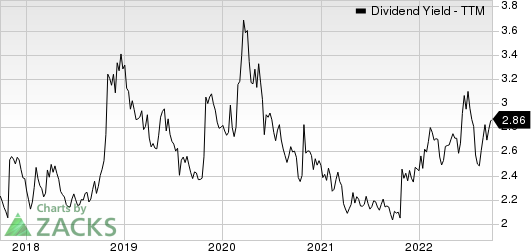

On Sep 15, 2022, Texas Instruments declared that its shareholders would receive a dividend of $1.24 per share on Nov 15, 2022. TXN has a dividend yield of 3.1%. Over the past 5 years, Texas Instruments has increased its dividend six times, and its payout ratio presently stays at 50% of earnings. Check TXN’s dividend history here.

Texas Instruments Incorporated Dividend Yield (TTM)

Texas Instruments Incorporated dividend-yield-ttm | Texas Instruments Incorporated Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Accenture PLC (ACN) : Free Stock Analysis Report

CVB Financial Corporation (CVBF) : Free Stock Analysis Report

Investar Holding Corporation (ISTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance