5 Retail Stocks That Could Rally on Lower Inflation

Much of the fate surrounding the stock market and the broader economy as a whole continues to dwell upon the Fed’s tightening cycle but another month of better-than-expected inflation data is beneficial for stocks.

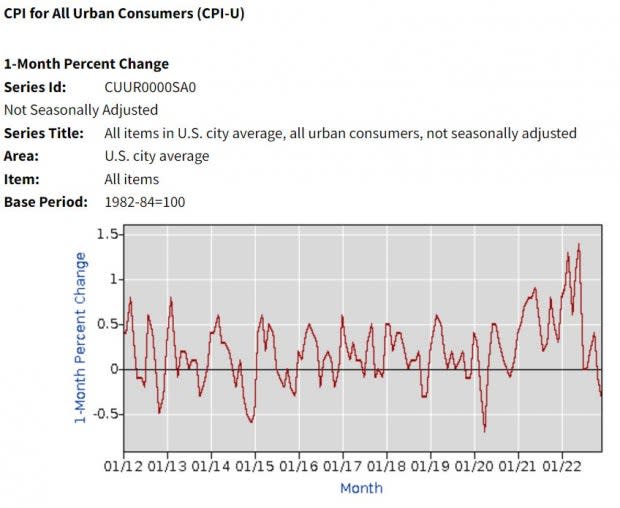

The Consumer Price Index (CPI) for all items rose 6.5% year over year but showed deflation on a month-to-month basis decreasing -0.1% in December.

To that note, here are five retail stocks that could benefit if inflation continues to be less stressful on consumers.

Image Source: U.S. Bureau of Labor Statistics

CVS Health CVS: Starting off in the pharmaceutical retail space, CVS could see its stock trend higher with inflation regressing. CVS stock has been in a slight downtrend after news broke that the company could acquire Oak Street Health OSH for $10 billion.

Still, the top line growth for CVS has been solid, and Oak Street Health could be a nice addition to CVS’s revenue with OSH sales expected to jump 43% in FY23 to $3.06 billion.

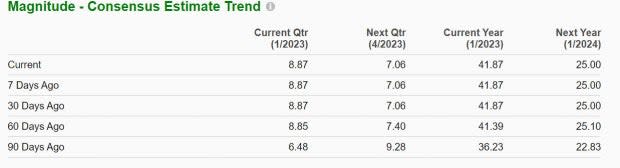

Image Source: Zacks Investment Research

Dillard’s DDS: One retail company that particularly sticks out from a valuation standpoint is Dillard’s. Improved consumer data could get DDS stock rallying again trading at just 8.5X forward earnings.

Despite a dip expected in the company’s fiscal 2024 earnings, Dillard’s bottom line is still massive and earnings estimate revisions have remained higher over the last quarter.

Image Source: Zacks Investment Research

Macy’s M: Another retail company that sticks out from a valuation standpoint is omnichannel retailer Macy’s, which trades at just 5.3X forward earnings. Macy’s earnings had slowly but surely begun to stabilize as the company adjusts to the new age of retail shopping. And a stronger consumer would be helpful as the company’s fiscal 2024 earnings are expected to dip below pre-pandemic levels of $4.18 per share in 2019.

Image Source: Zacks Investment Research

Overstock.com OSTK: E-commerce provider Overstock could see its stock boosted from a stronger consumer which would be greatly beneficial to the company’s continued growth. Overstock saw stellar growth during the pandemic and this could continue with fiscal 2023 sales forecasted to stabilize and rise 1% to $2.04 billion after a -27% fall from FY21 sales of $2.76 billion. Shares of OSTK are still 64% from their highs making the stock a rally prospect if deflation continues.

Image Source: Zacks Investment Research

Walgreens Boots Alliance WBA: Rounding out the list we go back to the pharmaceutical retail space with Walgreens Boots Alliance. Shares of WBA have rallied more than 20% from their October lows and this momentum could continue if inflation keeps easing. Top and bottom line growth are stabilizing again after Walgreens stock continued to cool off following the boost it received from the pandemic.

Image Source: Zacks Investment Research

Bottom Line

Consumer data showing signs of deflation on a month-to-month basis is promising for the broader stock market. This is especially significant for the Retail and Wholesale sector and a stronger consumer could lead to more upside in these five stocks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M) : Free Stock Analysis Report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

CVS Health Corporation (CVS) : Free Stock Analysis Report

Overstock.com, Inc. (OSTK) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

Oak Street Health, Inc. (OSH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance