5 Healthy Financial Habits for Young Professionals

Just like diet and exercise, we all have different financial habits. As you begin your career it is important to develop good financial discipline. These practices can help you save and earn money throughout your life.

Develop a Personal Budget

It is important to know how much you can afford to spend on each of your expenses. Creating a budget based on your income and expenses allows you to set weekly, monthly and annual spending and saving goals.

The "50-30-20 Rule" is a common budgeting method with broad guidelines. The rule states that 50% of your post-tax income should be used for essential spending categories. Essential expenses include groceries, housing, utilities and transportation. The next 30% of your income should be used for discretionary spending such as entertainment, vacations or new clothes. Finally, the 50-30-20 rule advises that 20% of your income should be used for savings and debt repayments.

It is important to note that the 50-30-20 rule should be used as a guideline to help you start your own budget, but that your own expenses may not fit neatly within these categories. Feel free to create categories that make sense for your typical expenses. Finally, make sure that your budget includes every expense so that you don't have any unpleasant surprises at the end of the month.

Pay off Debt

If you've accumulated student loans or other types of debt, it is important to begin paying off this debt. Compounding interest works the same way for your debt as it does for your investments. This means that over time, your loan balances will continue to grow and there is urgency to repay your loans. If you have a lot of debt, it is prudent to make a plan to make regular repayments with a total repayment date in mind. This will keep you organized and motivated as you pay down your debt.

Open a Savings Account and Contribute Regularly

Opening a savings account allows you to track and segment your savings. It is important to regularly save money, even if your contributions start small. This helps you build an emergency fund for unexpected expenses, or save for a large future purchase. It also helps you get in the habit of spending less than you earn and saving money throughout your career.

Start Investing Early

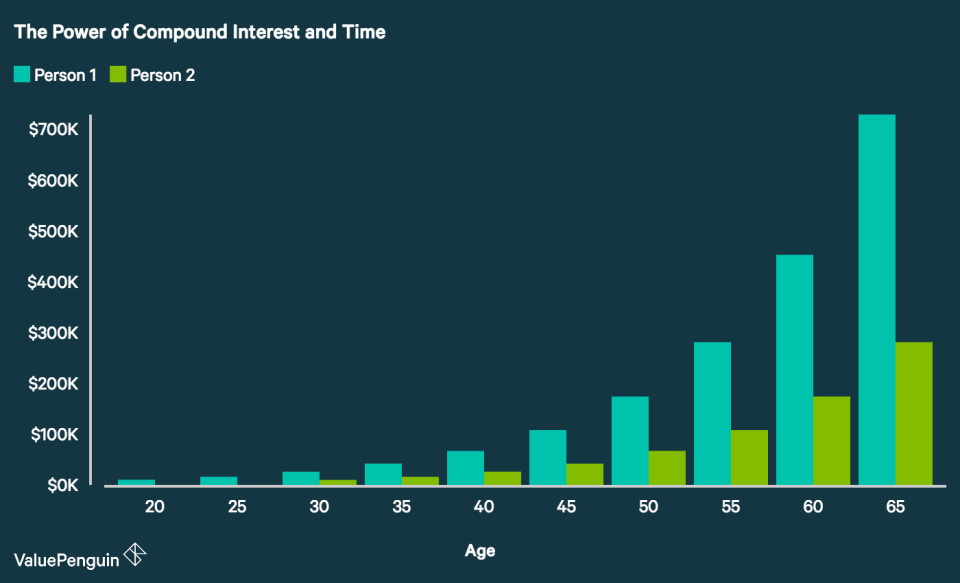

It’s also important to start investing early in your career. This habit can yield great returns over a long period of time due to the power of compounding interest. Compounding interest is the concept that describes the interest earned on interest. As an illustrative example, an individual that starts investing 10 years earlier than another person may earn more than twice as much during their career, assuming that the individuals invest the same amount and receive the same annual return rates.

There are many different ways to begin investing. These range from brokerage accounts, which offer traditional investments, such as stocks, bonds or ETFs, to crowdfunding investing platforms, which offer investment opportunities in local SMEs.

Use a Credit Card, But Avoid Credit Card Debt

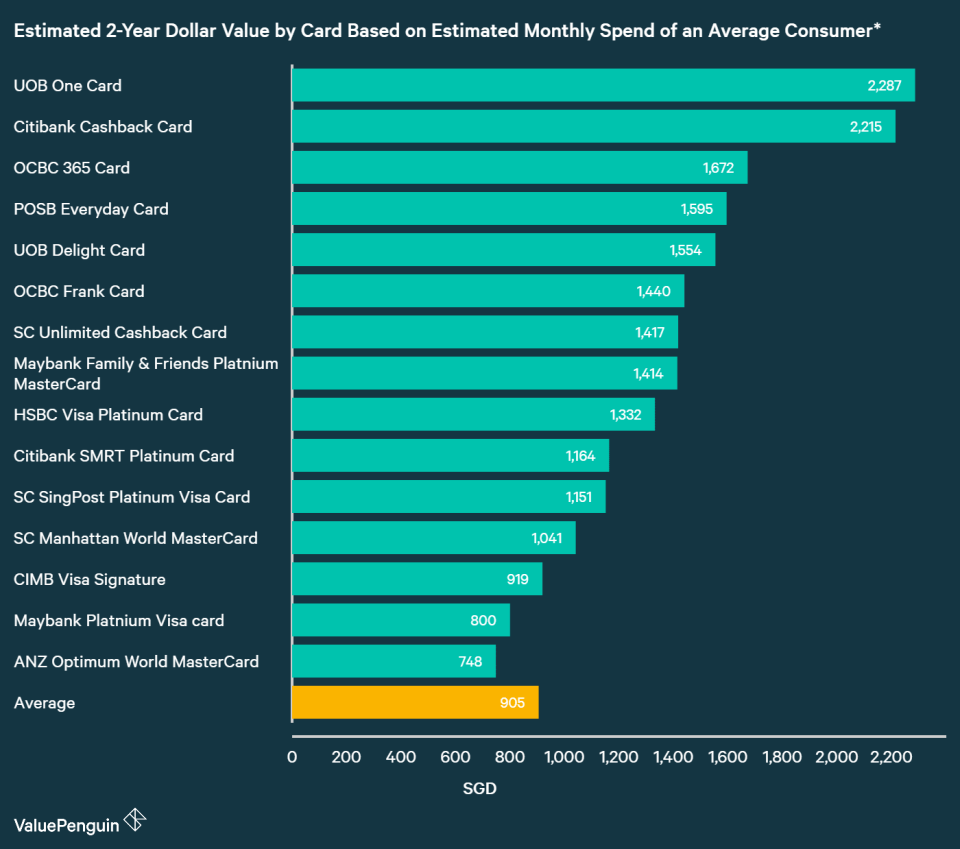

Taking advantage of credit card rewards programs can save the average consumer hundreds of dollars annually. In addition to these savings, using a credit card helps individuals build their personal credit histories and credit scores.

Credit cards typically charge interest rates of about 25% based on the unpaid balance each month. Therefore, credit cards should be used for expenses that can be paid back quickly to avoid quickly accumulating debt. Most credit cards allow you to make automatic payments each month to avoid accumulating debt. These can be helpful, but it is crucial that you have money in your account to cover your entire credit card bill.

The article Healthy Financial Habits for Young Professionals originally appeared on ValuePenguin.

ValuePenguin helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValuePenguin:

Yahoo Finance

Yahoo Finance